We know how frustrating it can be to need a strong and reliable communication method and not be able to access it. And with the increasing price of flagship smartphones and their accelerated obsolescence cycle, it is becoming harder and harder to buy handsets outright as the price of everything but our salaries go up!

While taking out a cell phone contract was once the method of choice for South Africans of all ages and incomes to access top-tier handsets at a manageable monthly fee, there has been a sharp increase in the number of people being declined by cellular providers over the last 12 months. While much of this is tied to our generally poor financial habits and the increasing difficulty many households are having in servicing their debt, some of it is just network fussiness, too. It often seems arbitrary indeed. Getting a cell phone contract with no credit history is a difficult thing, but we have some tips to share that will help.

How to Get a Cell Phone Contract With No Credit History

To be brutally honest, the chances of getting a traditional South African cell phone contract with no credit history are very slim. Especially if you are hoping to stick with the big names like Telkom, MTN, Cell C, and Vodacom. All of these cellular providers will run credit checks before they give you a contract.

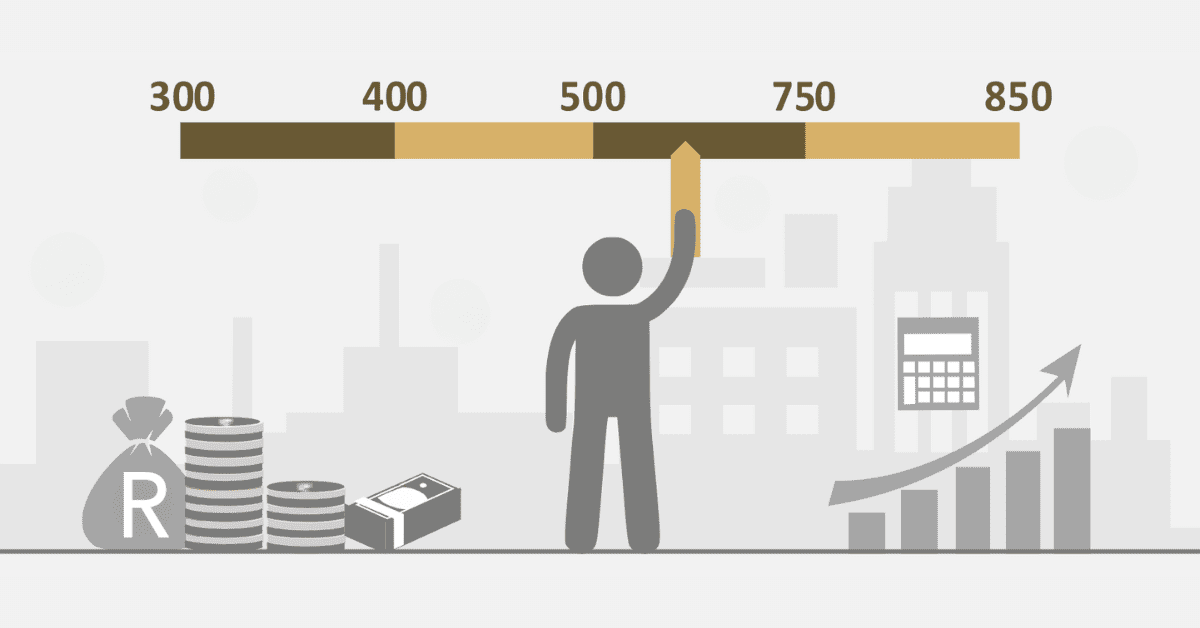

Having no credit history at all, especially if you are younger, is not as much of a red flag as a bad credit history would be. You haven’t proven you can’t manage credit well, you just have no credit record yet. However, these 4 providers have gotten increasingly fussy since the pandemic, and are declining people with average credit scores, so there isn’t a lot of hope for a non-existent one.

Your best bet for a cell phone contract with no credit history will be approaching smaller operators first. You can even consider those that advertise for ‘blacklisted’ users, although you don’t actually have a bad credit history. Many of the South African banks now offer some form of basic sim and handset option, and your bank has the advantage of having a lot of financial information about you that no one else can yet access because of that pesky credit record. Alternatively, you may be able to get someone with a good established credit record to cosign the contract with you to convince the provider to bite.

Do you Need a Credit Score for an MTN Contract?

Yes, you will need a good credit score for an MTN contract. As a cell phone contract is ‘postpaid,’ unlike prepaid data options, it is a line of credit, and they will need to do credit checks to approve you.

Does Telkom Do Credit Checks?

While Telkom does not run credit checks for their fixed line services (remember those?) they do indeed run them for cellular phone contracts. So all the usual aspects will apply.

Does Vodacom Do Credit Checks?

As with MTN, Vodacom will also do credit checks for contract phones. This is in line with all major credit sources in South Africa.

Who is the Easiest To Get A Phone Contract With?

All of the big cellular providers in South Africa (so Telkom/8ta, Cell C, MTN, and Vodacom) operate on very similar criteria. So none of them are particularly easy to get a phone contract with. Or, alternately, they are all as easy as each other- depending on how you want to look at it! In addition to using the data on your credit report, the ‘Big 4’ also keep internal credit scorecards, and we don’t have a lot of information about what is on them. This is a key reason behind the increasing number of South Africans who can’t get phone contracts.

If you are struggling to get a phone contract from the major operators, then it may be easier to approach smaller and less established networks. Some of these specifically cater to people with low credit scores and use additional criteria to assess your credit risk. This could easily work in your favor. As an example, Capitec Bank now offers a sim and data option you can apply for through your Capitec banking app. And there, you have the benefit of your banking and payment history being available to them.

However, it is also worth bearing in mind that cellular operators in South Africa have gotten much more stringent about whom they offer contracts to, and are looking for a strong, healthy credit score as a key determining factor. So if you know your credit score isn’t great, look at remedying that as much as possible before you apply again.

Getting the financial help you need with no credit record can be very frustrating. We hope these tips will help you make the most of the situation.