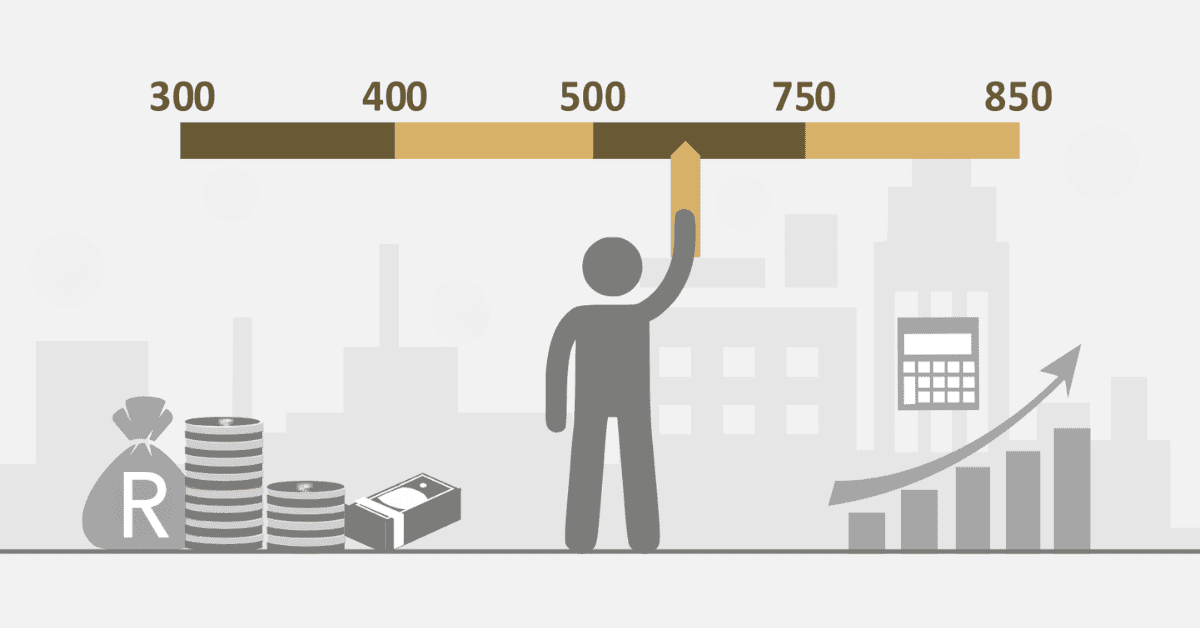

Your credit score provides insight into how you manage credit to prospective lenders, employers, and landlords. They use this information to determine your creditworthiness. Different factors affect your credit score, but the good news is that your bank account details do not impact your credit score. When you apply for credit, lenders will first check your credit history

Does Bank Account Balance Affect Credit Score?

Your checking or savings account does not affect your credit score in any way. A bank account is normally used for day-to-day transactions like depositing funds, withdrawing money, transferring money, or writing checks. These banking activities do not constitute credit, so they do not appear on credit reports. As a result, your credit is safe from any transaction you perform using your bank account.

Factors that normally affect your credit score include your payment history, duration of payment history, credit utilization ratio, application for new credit, or credit mix. Normal activity on your bank account does not affect your credit score.

Does Having Lots of Bank Accounts Affect Credit Scores?

Having two or more bank accounts does not necessarily affect your credit score. Having more current accounts comes with benefits such as overdrafts, bonuses, and cashback. However, several bank accounts can affect your credit score when you have multiple overdrafts. When you apply for several accounts within a short period, potential lenders can conduct hard checks on your credit history. Hard inquiries affect your credit score.

Several accounts with unpaid overdrafts can negatively impact your credit. Additionally, overdrafts on your accounts might reflect a bad image of how you handle your finances. If you maintain your bank accounts well, they will not affect your credit score in any way.

Does Negative Balance in Bank Account Affect Credit Score?

A negative balance in your bank does not affect your credit score. Normal day-to-day banking activities do not appear on your credit report. If you have an overdraft, make sure you pay it on time. The moment you try to open another checking account or apply for a loan, a banking account may conduct a hard credit check that may affect your credit score.

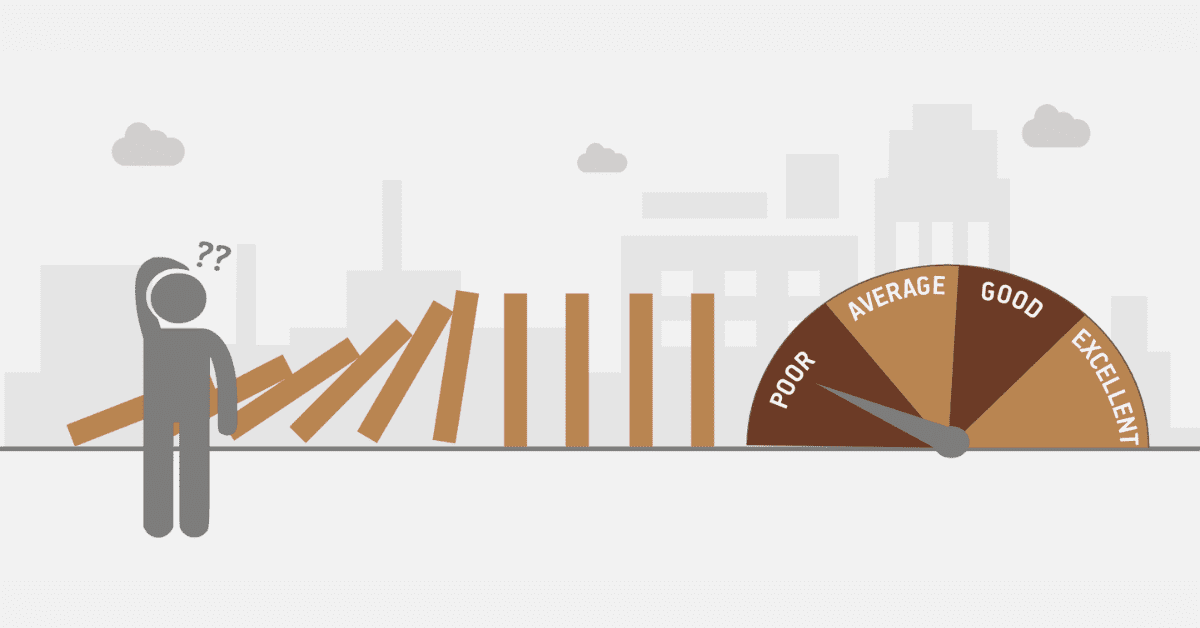

When the overdraft is unpaid for an extended time, it goes to collections and this will affect your credit score. This means the bank will enlist the services of a debt collector to recover the money you owe. Such a scenario negatively affects your credit score. Another issue that can affect your credit score is closing an overdrawn account with a negative balance. The bank can report to credit bureaus and hire collection agents to recover the money. This action will affect your credit score.

Another aspect that can affect your negative balance is obtaining overdraft protection from your bank. Once you sign this protection, it means you have applied for some form of soft loan agreement with your bank. Your bank can temporarily cover your outstanding overdraft until you pay up the amount owed. However, when you apply for a loan while you still have outstanding payments, the lender will conduct a hard inquiry on your credit history. As a result, your credit score will be impacted. Moreover, overdrawing your account without protection can affect your score. Failure to repay your balance can lead to overdraft fees, and your bank can hand over your account to debt collectors. The financial institution will report the case to credit bureaus, which affects your credit score.

What Affects Your Credit Score the Most?

Commonly, your credit score is impacted by factors like payment history, credit utilization ratio, credit mix, duration of credit history, and application for new payment. Payment history and the amount you owe contribute about 70% of your credit score. To build your credit score, make sure you pay all your bills and loans on time.

Avoid getting new credit when you have outstanding debts that should be repaid. More importantly, create a realistic budget that you can follow to live by your means instead of relying on loans. Only apply for credit when you genuinely want to cover some pressing issues.

Do Credit Cards Check Affect Your Bank Balance?

Credit cards are different from debit cards since they work in different ways. Although a credit card can be used to pay bills, withdraw cash, and purchase household goods, it does not affect your bank balance in any way. A credit card is a special type of loan provided by the credit card company, and it comes with a limit. When you exceed the limit, interest may be applied to your card. Failure to maintain your credit limit can lead to undesirable consequences on your credit score.

Unlike a debit card, a credit card is not linked to your bank account in any way. When you buy using a debit card, you are using your money in your checking account. The money is deducted directly from your account. However, this is not the case when you use your credit card. The money comes from the credit card provider or lender, and you can repay later. Therefore, your credit card usage does not affect your bank balance.

When you apply for a new credit card, the lender will conduct a hard credit check on your credit history to determine your creditworthiness. With a good credit score, it becomes easier to get loan approval with favorable repayment terms. Lenders also conduct credit checks when you apply for different types of loans. The good thing is that your bank account does not affect credit checks in any way. Even when you have a negative bank balance, your credit score is not affected by credit checks that may be conducted by potential lenders. However, you should pay all bank overdrafts to avoid debt collectors.