A credit score provides insight into an individual’s likelihood of repaying a loan. Various factors are considered, including the borrower’s payment history, credit utilisation rate, account length, credit type, and new credit additions. When lenders make lending decisions or assess creditworthiness, they rely on a three-digit number to determine the level of risk involved. If your number is higher, you have the advantage of being able to borrow money at more favourable terms and lower interest rates. You have a greater sense of financial responsibility. Conversely, a lower number could indicate potential difficulties in obtaining a loan or higher interest rates. Monitoring your accounts, ensuring timely bill payments, and exercising responsible credit usage to maintain or enhance your credit score are important.

The dynamics of credit scores may persist but what what raises a lot of questions is the relation between credit scores and other counterparts.

These relations begin with credit score and healthcare, credit score and renting an apartment, credit and sports betting etc.

To enlighten ourselves we look at how sporty betting affects credit scores and other related credit score issues.

Can sports betting affect my credit score

Participating in sports betting does not have a direct effect on a person’s credit score. Financial behaviours related to borrowing and repaying money often have an impact on credit scores. Nevertheless, there are various ways in which sports betting can impact an individual’s creditworthiness indirectly. Individuals must be aware of these factors to maintain a strong financial profile.

One possible consequence of sports betting is the potential misuse of credit cards or loans to finance gambling activities, which can have an indirect impact on credit. Using credit cards to place bets and accumulating a significant amount of debt can have a detrimental impact on one’s credit score. Accumulating too much debt and failing to make payments on time can raise concerns for lenders, resulting in a decline in your credit score and reduced ability to borrow money.

In addition, people can utilise their sports betting activities to develop financial discipline and enhance their decision-making abilities. By adopting a strategic approach to betting, conducting thorough research on odds, and responsibly managing your bankroll, you can cultivate valuable financial habits. It’s crucial to view sports betting as a means of amusement rather than a potential money-maker and to practise self-discipline to avoid any adverse financial outcomes.

Ultimately, although sports betting doesn’t have a direct impact on your credit score, the financial choices you make with these activities can still have an influence. Practising responsible gambling is crucial to avoid any negative effects on credit scores. This includes avoiding debt, setting limits, and prioritising financial responsibilities.

How long does bad credit last in South Africa?

Bad credit is the least objective of every human. In South Africa, every individual who may have a credit history may want to have it all good at all times.

But what happens when you have bad credit? What is the ultimate timeline for a bad credit to change?

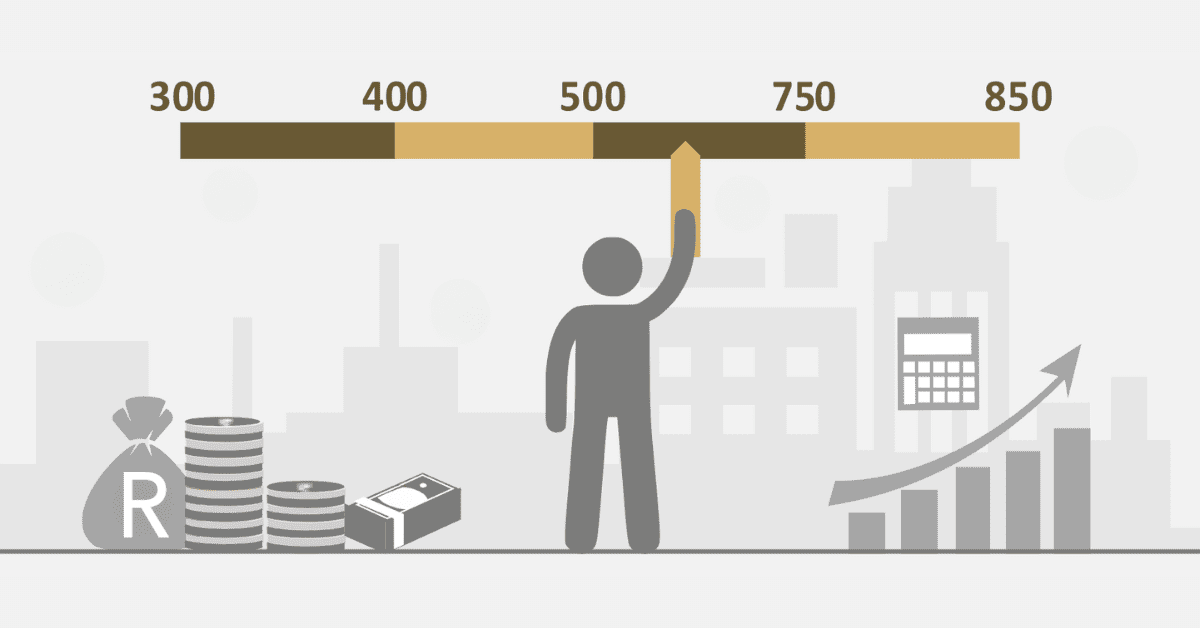

Based on records, there is no specific timeline on when bad credit should last. These credit records reflect your daily transaction and therefore the impact could run with you for a few years.

Based on the credit provider association and survey picked up in years, bad credit could last for not less than 5 years in South Africa.

However, some ways could improve your bad credit over time. Dealing with bad credit can be frustrating but applying the necessary financial plans can alter things in the right direction.

How many months does it take to fix credit score?

Fixing your credit score requires patience and it model relies on your long-term financial behaviour and account history.

There is no easy solution to improve your credit. The duration required to fix your credit history is contingent upon the severity of your credit issues and their impact on your credit history.

Typically, it takes around three to six months to repair credit. Your credit score will gradually improve as creditors agree to make changes in your favour.

Why You Shouldn’t Use A Credit Card For Sports Betting

Before we look at why you should not use a credit card for sports betting, let us address some trivial issues. Betting could be bad and could be good if managed well. The risk associated with sports betting varies and requires financial discipline.

Betting is not the issue at hand here, but the credit card used for sports betting is a bad idea.

Using a credit card for sports betting comes with additional risks beyond increased spending. Additional negative consequences of gambling could involve exceeding your intended budget.

Credit cards may seem attractive for sports betting, but they are generally not the best option.

Several factors contribute to the issuer’s concerns, including costs, security hazards, and the risk of overspending.

Using credit cards to pay for online sports betting combines financial obligations with the risks of gambling. Combining them can be quite dangerous since they both promote reckless spending.

The fees for deposits or processing may vary depending on the online sportsbook and could be a percentage of the transferred amount.

Some credit cards for sports betting treat gambling payments as cash advances instead of regular credit purchases. Using credit cards for sports betting can be quite problematic, given the expenses involved and the potential for significant debt.