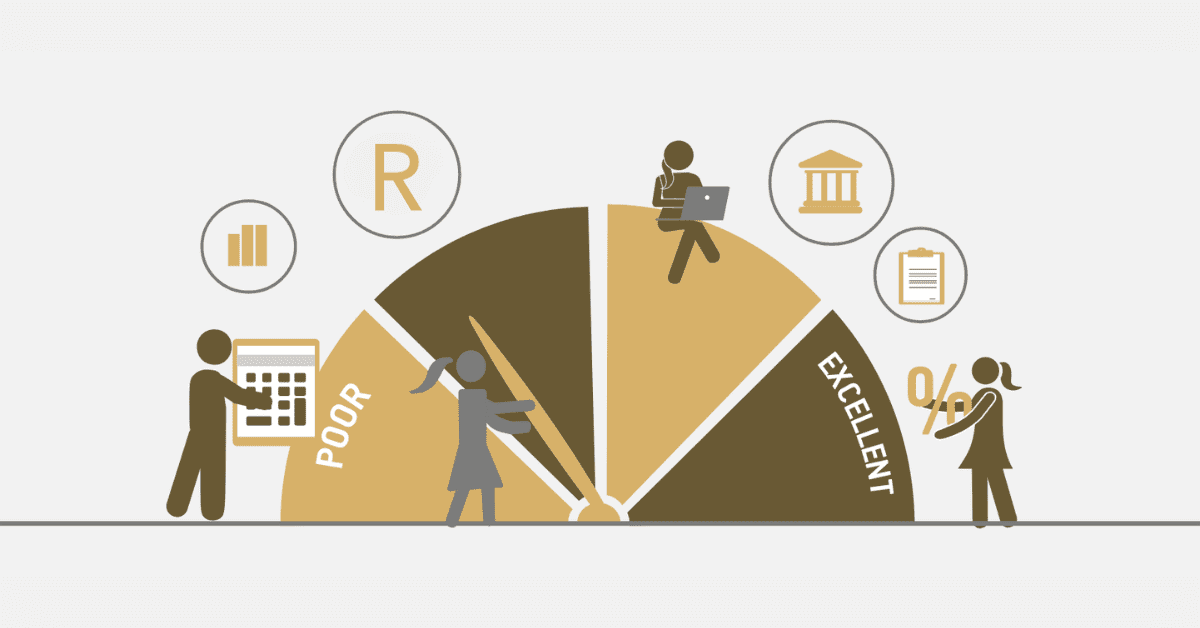

Credit and credit scores could be one of the most frustrating aspects of our modern financial world. Sometimes it seems like you can’t win unless you have a perfect score. Which very few of us do! Having both bad credit and no credit score at all will impact your ability to access credit products, although in different ways. Today, we will break some of those differences down, and help you get a better understanding of where you stand in the eyes of credit providers.

Is It Better to Have Bad Credit or No Credit?

It’s a frustrating answer, we know, but whether it is better to have bad credit or no credit is highly dependent on a variety of factors. Typically, no credit is better than bad credit. Only just, however! Both can be frustrating positions to be in.

In both cases, you will be seen as a large credit risk that is unappealing to lenders. The difference is that some lenders, depending on the full financial profile they use to assess you, may still be willing to risk lending to someone with no credit history. Especially for smaller amounts, and where other criteria make you look like you will be a responsible user.

In bad credit cases, they know you have a long record of poor financial habits. You look like a major risk. Until you can show some serious changes in that behavior, most lenders will reject you outright. By that point, you will have rehabilitated your credit score a lot, too.

Is Bad Credit the Same as No Credit?

Bad credit is not the same as no credit in any way. Let’s break down the differences between the two:

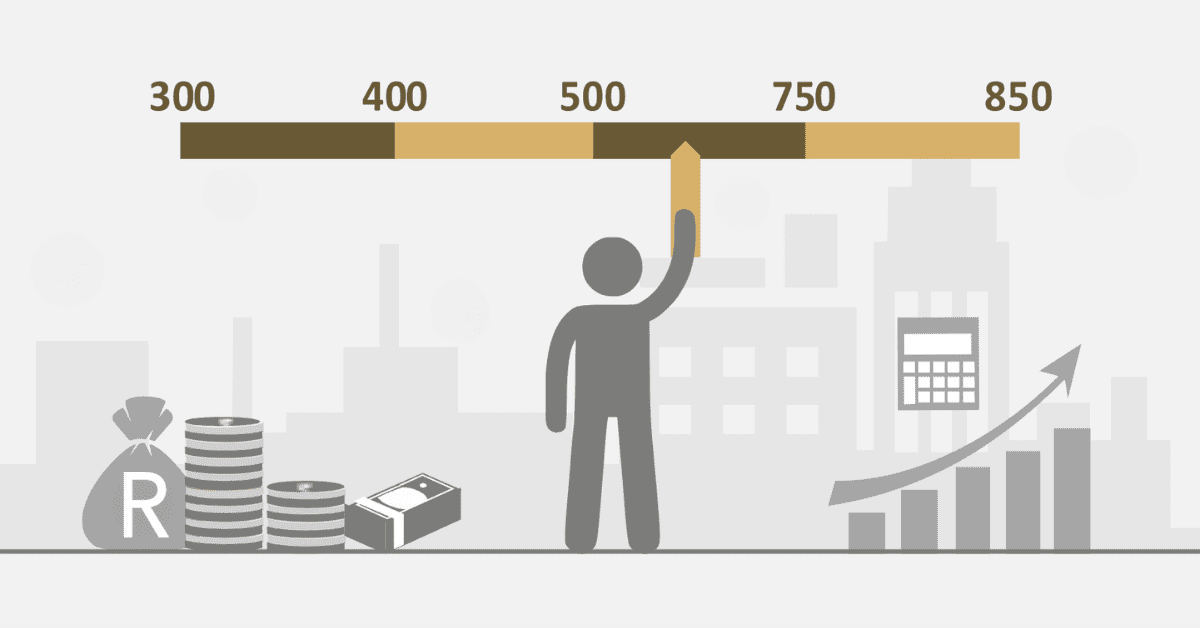

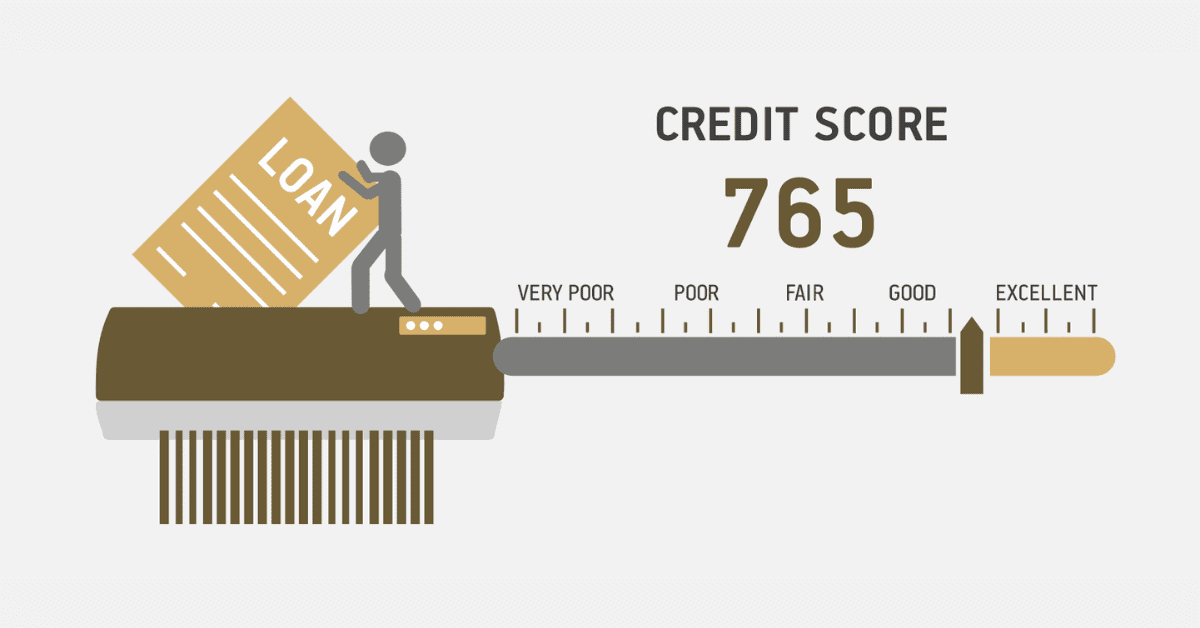

- No Credit: If you have no credit score at all, it means the credit bureaus have no data on you. This usually means you have never taken out a credit product, like a loan, store account, or credit card. Or it was so long ago it no longer counts. It’s not ‘bad’ in any way, you have done nothing wrong. However, credit providers will see you as an unknown they can’t assess for trustworthiness. This could severely limit your access to credit products initially, especially larger loans.

- Bad Credit: With bad credit, on the other hand, you have used a credit product- and used it poorly. Maybe you have missed payments, defaulted on loans, or gone over your credit limit. Credit providers will not see you as trustworthy, as your track record speaks for itself. This will be severely detrimental to your access to credit lines. However, you will be able to recover that position with good credit habits, and at least the credit providers ‘know who you are’.

What Can I Get Approved for with No Credit?

Getting approved for credit with no credit is a little easier than with bad credit, but not by much. You won’t get approved for most major loan types. You also won’t be offered high balances initially. About the only things you will be approved for are small balances on credit types with less robust checks and small risk to the lender. This means things like store accounts and some types of credit cards.

Luckily, once you get started, you will also start building your credit history and things will get easier for the next loan. If you were hoping to jump straight to a car loan or mortgage, however, think again. It won’t happen.

What is the Fastest Way to Build Credit if You Have No Credit?

To build your credit history, you need to access lines of credit and use them responsibly. The catch? Lenders are less likely to give you credit because you have no credit history. It’s a bit of a catch-22 situation. To get started, you need to get approved for your first credit line.

As we mentioned above, starting small is the best way. You are most likely to get approved for low-stakes, small-sum loans when you have no credit record. The typical advice is to try for a store account (like Truworths) first. Spend a few months using it well and paying it promptly. This will have a small impact on your score, but you can build from there.

Some lenders will offer a low-balance credit card if other factors (such as your income) look good but you lack a credit history. For some products, someone with a credit history can add you as an authorized user, but many products that allow this won’t count it towards your credit history in South Africa. You may also be able to get someone with a good credit history to cosign for you and build your credit that way.

If you have non-credit financial products, like a utility bill, this has a very minor positive impact on your credit report, but the impact won’t be great. Remember, if you open too many lines of credit at once, this will negatively impact your credit report. Instead, take a slow and steady approach over time. Don’t lose sight of the fact you don’t just need to have credit, but use it responsibly, to build a good credit score. Pay on time and don’t use too much of the credit balance.

Being stuck with no credit record or bad credit is a very frustrating place to be. However, with time, good financial habits, and patience, you will soon be able to fix the situation.