If you are hoping to buy a home, most of us will need to take out a bond to do so. If you had the money to pay for the home cash, you wouldn’t be reading this article, after all! Homeownership is a major dream for many people. Who wouldn’t want a special sanctuary to call their own? If you are already battling with a bad credit score

Can I Get a Bond if I Am Blacklisted?

Let’s start with the worst-case scenario. You don’t just have a poor credit score. You have a terrible one. Many South Africans call this ‘blacklisting’. That’s actually an erroneous and outdated term. At one point in time, credit bureaus only kept negative information about you. Today, however, your credit score is built of both positive and negative credit information. There is no formal ‘blacklist’, and you aren’t on it.

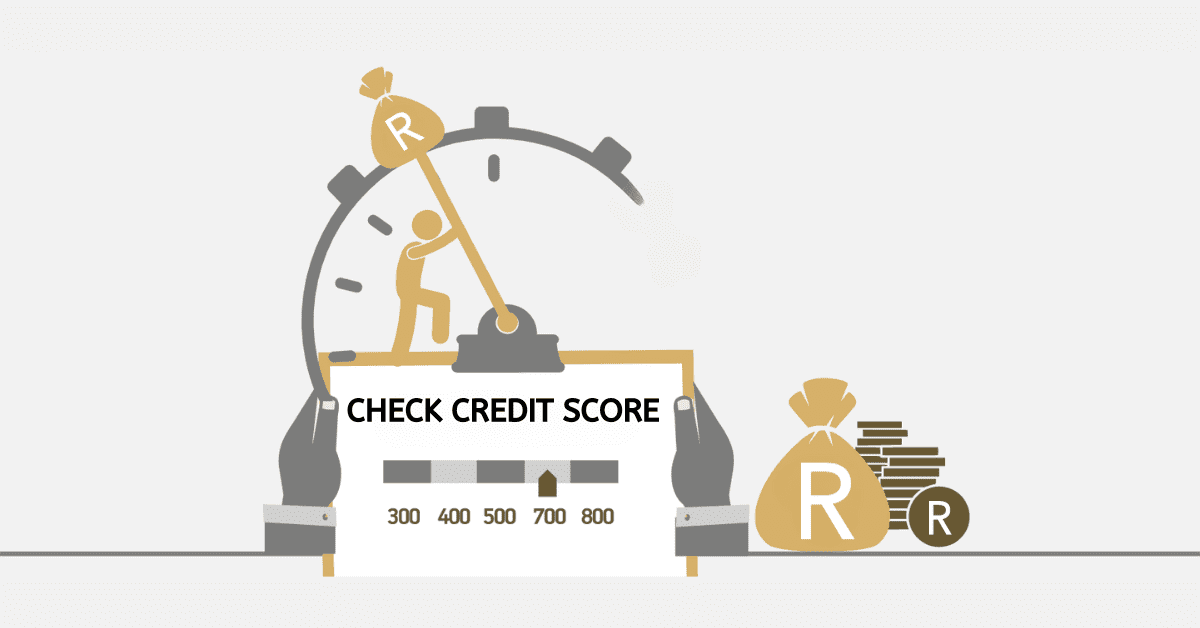

However, if you have a credit score under the 450 range, you have a particularly poor credit score and may want to consider yourself as ‘blacklisted’ anyway. The chances of getting approved for most loan types, let alone something as large and pricey as a bond, are pretty much non-existent. Right now, that is.

There is some light at the end of this blacklist tunnel. A credit score isn’t forever. There’s plenty you can do to rehabilitate your credit, and your position could look a lot different in 6 months or a year. Put your plans of home ownership on ice for a little longer, and focus on improving yourself as a credit risk so lenders will deal with you.

How To Get a Bond with a Bad Credit Score

Whether or not you have any chance of approval for a bond with bad credit depends on exactly how bad your credit score is. If it is only a little below the typical benchmark, you might be able to take steps like offering a deposit or surety to improve your risk profile enough to qualify. You could also look at purchasing with a spouse or other trusted third party, and let their better score boost your appeal. You can also approach a trusted and regulated ‘bad credit’ home loan specialist, who may be able to help where more conservative financial institutions won’t.

However, your chances aren’t very good. Remember that people who do meet the credit criteria will still be declined for bonds. They are hard to get! This is one of the largest loan types on the market, and banks want to know they will be repaid for taking the risk on you.

By far the best thing you can do right now is focus on improving your credit score instead. That is the best way to ensure you can qualify for a bond, even if it takes a little while longer than you had hoped.

What is the Lowest Credit Score to Buy a House in South Africa?

You will need at least a credit score at the 650 mark to have a realistic chance of being approved for a bond in South Africa. Some people with credit scores that just miss the mark might be fortunate enough to find a lenient lender. Especially if everything else about their application is amazing. You won’t get very favorable interest rates or terms, however. Anything less than 610 has very little chance of approval at all, even from ‘bad credit’ lenders.

How to Get a Loan When No One Will Approve You?

If no registered and reputable financial services provider will approve you for a loan, even so-called bad credit specialists, there’s a solid reason for it. Namely that bad credit record you have. Without beating about the bush, your credit score shows that you are a significant risk for not repaying the loan. Reputable financial services companies aren’t willing to take that chance. Fraudulent ones want to prey on you, so resist their siren call!

While you may have an error or fraud on your credit profile that has damaged your credit score, which you can fix pretty easily with a dispute, most of us know we are the guilty party. On the positive side, that means you can solve your problem, too, by taking ownership of the situation, addressing your outstanding debts, and improving your credit score! While it can be immensely frustrating to be in this position, you don’t want to get stuck drowning under negative judgments and defaults. Even if you feel desperate right now. Take a deep breath, relax, and get to work on improving your credit score. A brighter future (complete with a new home) could be nearer than you think. All good things are worth a little waiting.