Bankruptcy is a strong way to get back on track financially because it lets people start over after having too much debt. It is a legal status that people or companies can claim when they have serious money problems. It gives them a chance to start over.

Now, let us look at the interesting link between bankruptcy and credit scores. Your credit score is like a report card for your finances, and going bankrupt can affect you for a long time. Instead of being a sign of shame, it is a sign of power and determination. Bankruptcy may initially lower your credit score, but it is not a permanent problem. Being responsible with your money can help you rebuild your credit over time.

A person’s credit score changes when they file for bankruptcy and then file again. A better credit score is the result of making smart financial decisions all the time.

Now let us look at the relation between credit score and bankruptcy. In the end, we should be able to see how filing for bankruptcy affects your credit score.

How will filing bankruptcy affect my credit score

When someone can not pay back the money they owe, they file for bankruptcy. In other words, you can file for bankruptcy if you owe R50,000 and cannot pay it.

When you go bankrupt, the people you owe money to generally get a share of the value of your things. This can include everything but the most important things in your home: car, furniture, and jewellery. You may also have to pay back your loan for up to three years, depending on how much money you make.

In a word, it hurts your credit score very badly. However, this does not have to last forever. Your credit score is based on how often you have used credit cards or taken out loans to borrow money in the past.

How long it takes you to pay back your debts is recorded, and your ranking is based on how often you have done this in the past. When you file for bankruptcy, you concede that you can not pay any of your bills and will not be able to shortly, either. If your debt is very small, your bank may be able to forgive it. But if it is a big debt, this could negatively impact your credit score in a big way.

When someone asks, “How does bankruptcy affect your credit score?” most of the time, the answer is negative.

It might hurt your score for a very long time, even up to ten years. But it will not last forever, and it might only last a short time if you learn how to handle your money better in the future. The problem is that when you ask for car loans or home loans

This could mean that you have to pay more in interest or that your monthly payments will have to be bigger. But keep in mind that if you are thinking about filing for bankruptcy, your finances are probably already in a very bad spot, so it is better to do something than nothing.

How much will my credit score drop if I file for bankruptcy?

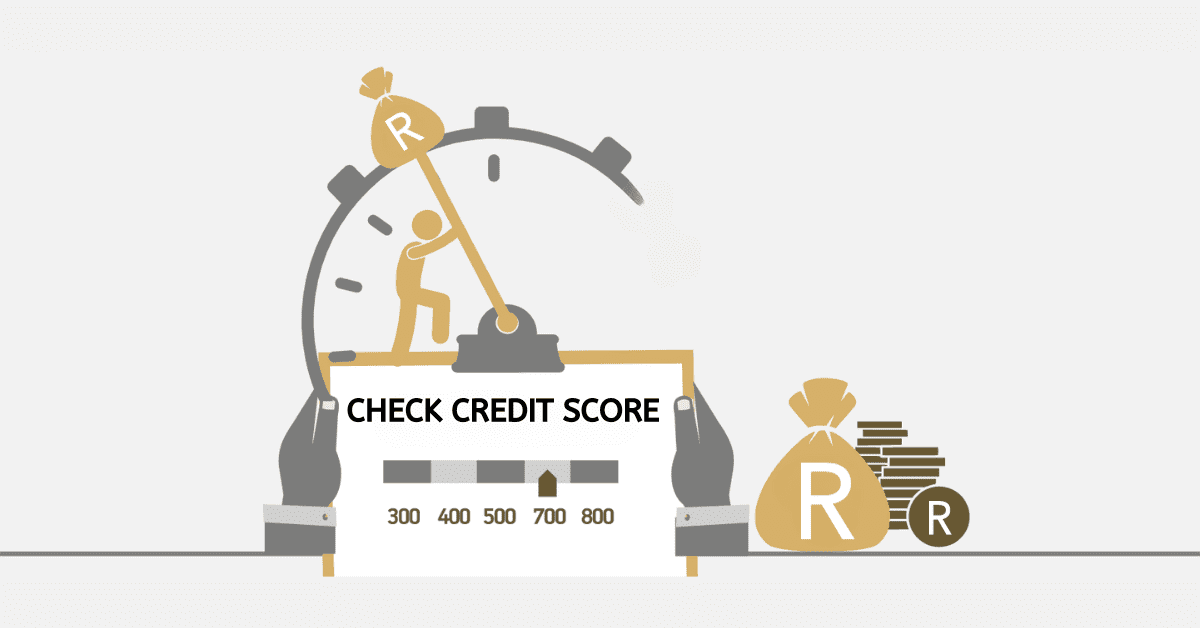

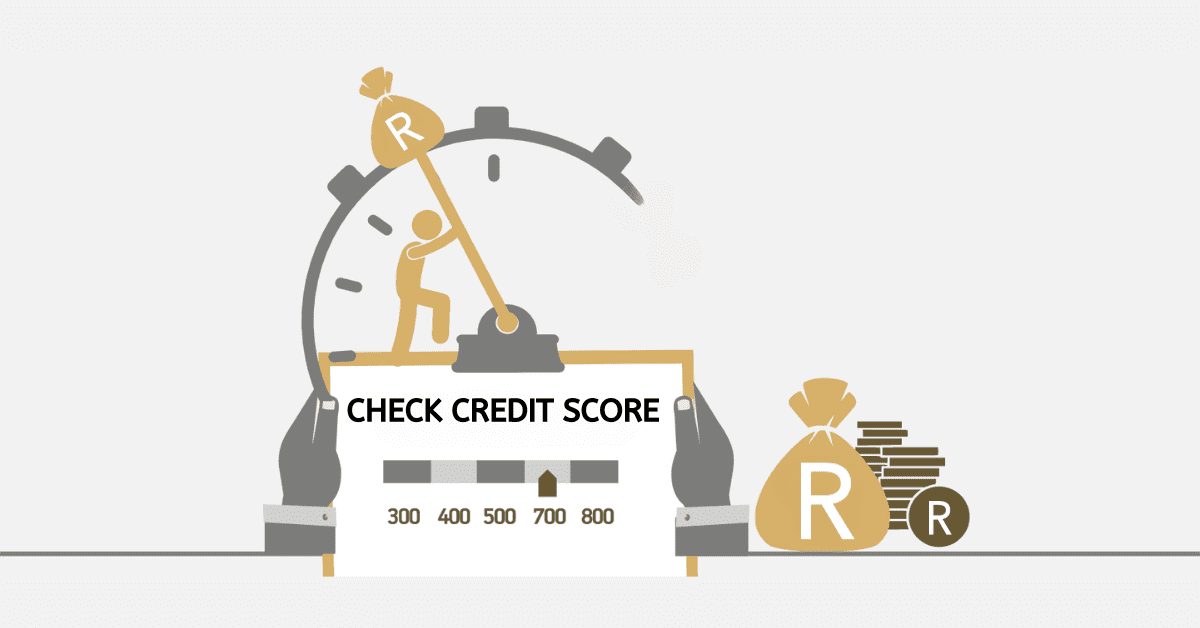

If you have filed for bankruptcy, get ready to see your credit score fall like a log. Once you are declared bankrupt, you are considered unable to repay any loan you owe.

Considering the categories of credit scores in the system, filing for bankruptcy can cause you to lose a huge amount of points. However, these points depend on the category you fall in.

Individuals with a 700 credit score can lose about 200 credit score points. If you have a credit score below 650, you could lose a point of not less than 150.

It is always necessary to seek financial advice from experts to understand the commitment you are making when you file for bankruptcy.

How long will bankruptcy affect my credit score?

It is very possible to work all over again to improve your credit score after bankruptcy. But the effect of bankruptcy towards your credit score could take years.

Once you file for bankruptcy, it stays on your credit history for at least 10 years. This means all you have to do is to work towards improving it. It could take about 1 to 2 years to improve it.

Does my credit score start again after bankruptcy?

People who can not handle their bills any other way may have to file for bankruptcy. But the process can mess up your credit scores.

There is a good chance that filing for bankruptcy will hurt your credit score, but the exact amount might be different for each person.

Your credit score does not start all over after filing for bankruptcy. But rather you could request for a new credit. However, considering how the debt on your credit history still exists, you need to start looking at how to improve your credit score.