A credit score is a number that reflects how creditworthy a person is. It plays a crucial role in making financial decisions. This report summarises an individual’s credit management and repayment behaviour, giving insights into their credit history. A higher credit score generally indicates a lower credit risk, making it easier for individuals to get loans, mortgages, or credit cards.

However, if your credit score is lower, you may face the possibility of being charged higher interest rates or being denied credit altogether.

In this blog post, we will look at the major questions about credit scores pertaining to South Africa. At the end of reading this, you should understand how to get a credit score and how it works.

What is a credit score in South Africa?

Credit scores are of utmost importance in financial transactions in South Africa. The credit scoring system takes into account several factors when evaluating creditworthiness. These factors include payment history, existing debt, how long credit has been established, the types of credit utilised, and any recent credit activity.

Banks can generate credit reports by utilising credit cards and bank accounts, with the assistance of credit bureaus.

It is extremely important to maintain a good credit score to have access to favourable financial opportunities. Lenders depend on these scores to assess the level of risk involved in lending money. Making payments on time, using credit responsibly, and having a variety of credit accounts all have a positive impact on your credit score.

The National Credit Act in South Africa is responsible for overseeing credit reporting and ensuring that consumers are safeguarded against irresponsible lending practices.

How does credit score work?

Credit scoring models typically consider factors such as the timeliness of your payments, the amount of debt you owe, and the frequency and recency of any missed payments. Your credit history will also provide information about the number of existing credit accounts you have compared to all your accounts on file.

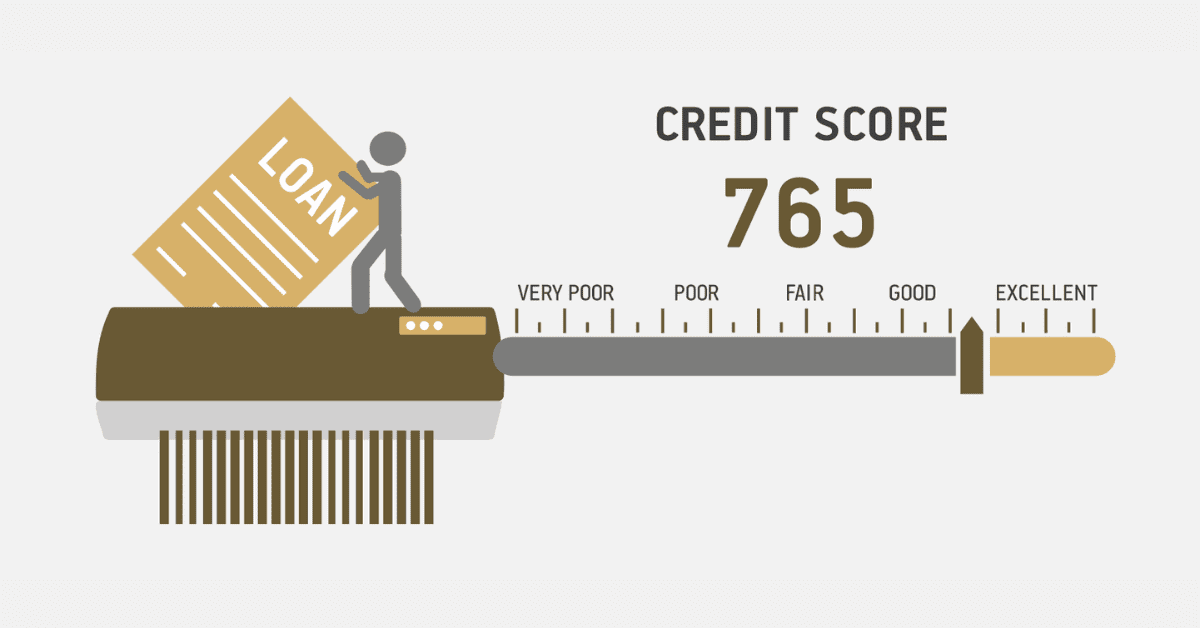

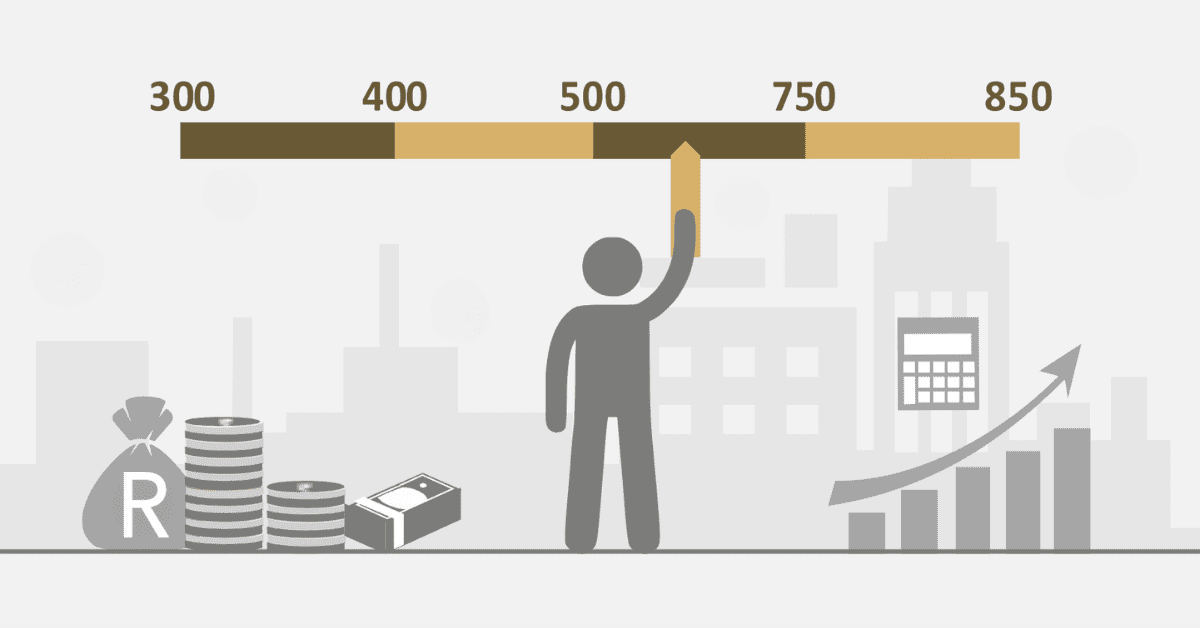

Credit scores are numerical values of three digits, typically ranging from 300 to 850. They are used to estimate the probability of an individual repaying a loan in a prompt manner.

Lenders rely on the information provided by credit reference agencies to assess your creditworthiness and make predictions about your borrowing behaviour. It may seem like you are assigned a numerical rating, ranging from 1 to 10, that determines whether you are considered a ‘poor’ borrower or a ‘strong’ borrower.

Your credit file is essentially a collection of data that provides information about your credit history. It helps lenders evaluate the level of risk associated with lending to you and, in some cases, the potential profitability of doing so.

What is a good credit score in South Africa?

In South Africa, a good credit score signifies healthy financial transactions. Credit scores are built over time once you start banking and use your credit card for transactions.

Once you have a credit card, these payments and all the necessary details contribute to your credit score.

A score above 670 is considered to be a good credit score in South Africa. This is generally based on the banking sector and credit bureaus in South Africa.

How much can you borrow with a credit score of 680?

Your credit score has an influence on the amount you can borrow. In most cases, the amount one can borrow does not only look at credit score but the bank and the associated credit bureaus.

A credit score of 680 which is considered to be good can help you borrow an amount from R50,000 and more. Since there are different types of loans, it is important to know the kind of loan you seek. A personal loan with a credit score of 680 can guarantee a great amount for someone seeking to borrow some money.

What is the lowest credit score in SA?

If your credit score is low, it can greatly affect your overall financial situation. It is crucial to be aware of the possible consequences when your credit score falls between 301 and 550. Having a low credit score indicates a greater likelihood of not being able to repay loans or fulfil credit responsibilities, which can make it more difficult to obtain approval. A credit score ranging from 301 to 550 is generally considered to be on the lower side.

How do you get a credit score?

If you want to obtain a credit score, it is advisable to reach out to your bank and inquire about opening a credit account. Once your bank forms a partnership with a credit bureau, they will create an account for you using the information you have provided.

The credit score is gradually built over time through activities such as paying bills, making purchases, and conducting bank transfers, among others. The credit score for these activities is determined by using standard formulas.