Bad credit. It probably sounds like a financial death sentence, especially if you have been struggling to keep up with the credit you have. There is good news on the horizon, however. A bad credit score is never for life. As soon as you make any improvement, no matter how small, in your credit behavior, you will see your credit score reflect that. Over time, you can even get a great credit score! If you are currently dealing with a low credit score in South Africa, here’s how you can start to fix it.

What is a Bad Credit Score in South Africa?

The official bad credit score range in South Africa is below 579. If it is between 580 and 669, it is fair, but not great. Don’t panic if you see a credit score under 300 and you have never had credit. In your case, it is simply that the credit bureaus have no idea who you are yet, not that you have a bad score per se.

How Do You Fix a Bad Credit Score?

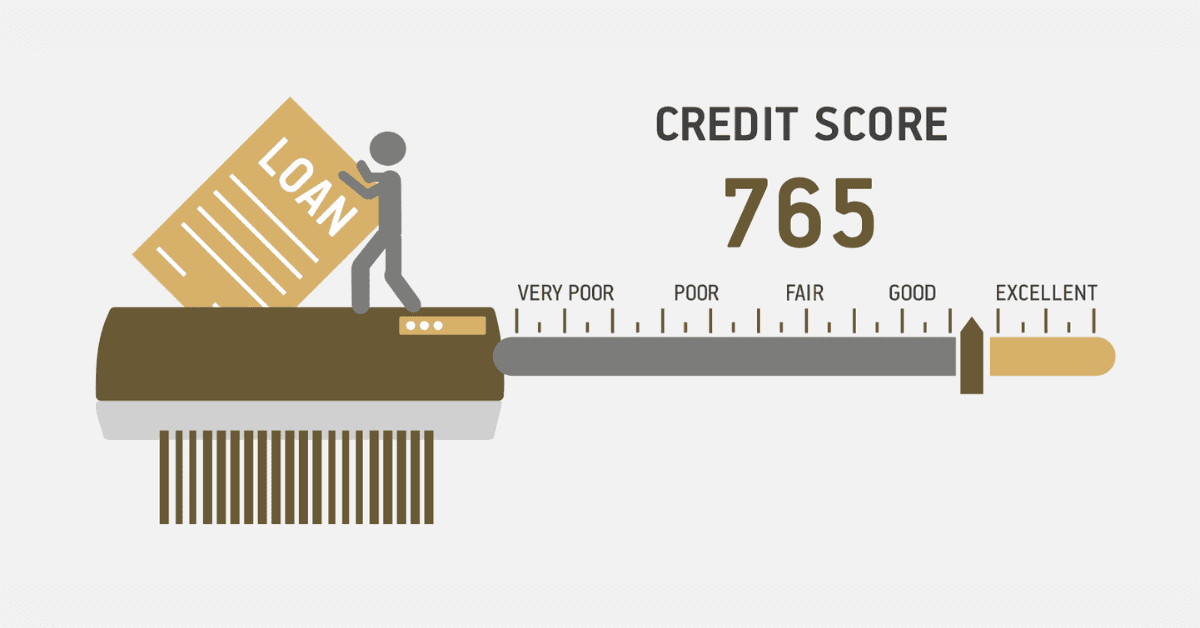

How do you fix a bad credit score? The answer is simple, if not speedy. You need to replace the bad credit usage that negatively impacted your credit score with better, smarter credit utilization. Unfortunately, you will also need to wait for the ‘bad stuff’ to fall off your credit report. Unless you can take proactive steps to get some of the worst issues resolved. This could be settling outstanding credit debt, addressing fraudulent or inaccurate information on your credit report, making a credit rehabilitation agreement with the lender, entering into a debt recovery plan, or even formal bankruptcy. It all depends on how bad the credit score is.

Once you have settled what you can of the old ‘bad stuff’, you need to demonstrate that your credit-using behavior has changed for the better. Here’s some simple steps to follow:

- Get a Credit Report: As we mentioned, start by requesting a copy of your credit report from one or more of the major credit bureaus in South Africa. Don’t worry about credit scores shown on banking apps- you need the full report to see exactly what is on record. This will let you take proactive steps to address problem loans. Remember, if your financial position is very bad and you are in over your head, solutions like debt recovery may give you the leverage you need to renegotiate with lenders and start fresh.

- Rehabilitate Credit Accounts: If you can salvage any existing credit you have, it will give the process a little boost. New lenders are unlikely to open new credit while your credit score is bad. However, you may be able to add a store account or small-balance credit card to the mix to show some fresh credit utilization with a better track record. It goes without saying you can’t run off and spend, spend, spend, however. You need to use it responsibly for it to have a positive impact on your score.

- Pay on Time: Yup, you are turning over a new leaf and now need to be a responsible credit user. That means paying at least your minimum loan balances on time, every time. Remember your payment history accounts for about 35% of your credit score, so even making this small shift will greatly improve your credit score over time.

- Don’t Overuse Your Credit: Lenders don’t want to see maxed-out credit. It tells them you will do the same to them. Using under 50% of the lines of credit you have will make you look better to lenders.

Depending on how bad your credit score may be, you won’t be able to fix it overnight. However, if you take steady steps to address the problematic credit history you have, you are on the right track. Then you simply need to show better, more responsible, use of credit going forward. You could see some big jumps in your credit score as you take care of the worst of it. And you will see a steady increase over time, too. Soon you will have the credit score of your dreams.

Can You Borrow Money With a Low Credit Score?

The lower your credit score is, the more of a risk lenders will see you as. So it is unlikely that reputable lenders will offer you much credit if you have a low credit score. You may be able to open some low-risk types of accounts, like store credit, but don’t expect to walk away with a mortgage in the bag! In South Africa, lenders prefer to see credit scores in the 600s. You may find some credit in the 500s- after all, the national average is only 560-580- but it will be harder to access and at less favorable rates.

Be very, very cautious about lenders who advertise themselves for ‘blacklisted’ clients or ‘no credit check’ loans. These are often very predatory lenders who will charge premium rates and be very unforgiving. You can easily find yourself in a dangerous, or even criminal, situation. Or trapped in the ‘payday loan’ cycle and unable to break free. This will impact your overall financial health, too. It is worth putting in the effort to rehabilitate your credit score instead. That way, you can interact with safe, approved, and reputable lenders and save yourself a lot of pain.

What is the Average Credit Score in SA?

Currently, the national average credit score in South Africa is around 560. If you were paying attention to our earlier section, you will notice that that is not the best score by any means! It doesn’t even count as ‘fair’. Unfortunately, South Africans have a long history of poor spending habits and overutilization of credit to cover the gaps between our needs and wants. There’s a lot of ‘keeping up with the Khumalos’ in the country, and it shows in our financial data.

While a bad credit score may seem discouraging, it isn’t the end of the world. And there is plenty you can do to fix it, too. You simply need to be diligent and patient, and soon that score will look a whole lot better.