Could there be any relation between marriage and credit score? With marriage being the constant, does the variable credit score have an adverse on marriage or vice versa?

It is right for many who want to seek knowledge about credit scores to include the concept of marriage in their “credit” life.

This is because marriage can change the financials of your life. Once the credit score is mentioned, it is all about finances, even though your income is not recorded. What is mostly recorded is your purchases, payments, loans etc.

There is so much misconception about marriage affecting your credit. Some may have the notion that when you marry, your credit score begins to fluctuate. Others also think when you marry someone with a bad credit score, your personal credit score also changes.

These are all concerns that have been turned into rumours and misconceptions.

Today in our blog post, we are going to debunk some untrue information and share with you the reality about marriage and credit score.

What happens to credit scores when you marry

Misconception number one goes around that getting married will affect your credit score. But the truth is not nearly as exciting.

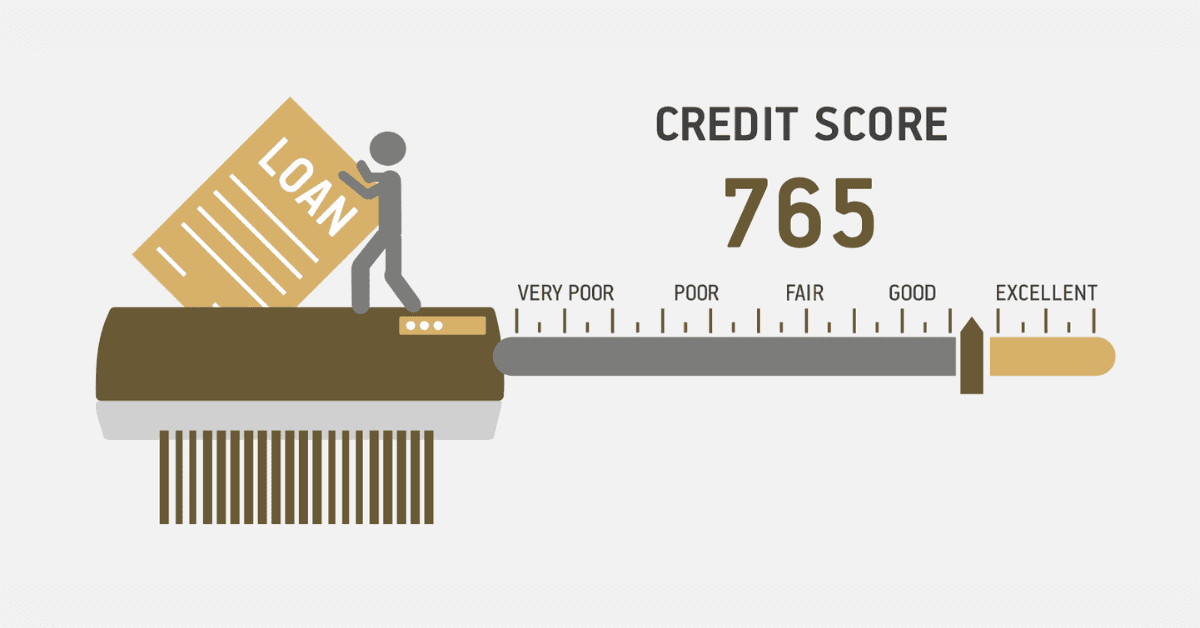

Your credit score w will not change just because you got married. Your credit score shows how responsible you are with money, not if you are married or single. Credit scores can be affected by the choices a couple makes about money while they are married.

One important thing to remember is that your credit score will not change when you get married. Your credit history, debts, and accounts do not instantly merge when you get married.

No matter if you are married or not, your credit record will still show the choices you made about money before and after you got married. This is simple; marital status is not recorded on credit history.

Even though getting married does not have a direct effect on your credit score, certain things you do with money while you are married can.

Sharing accounts or asking for loans together, for example, can hurt both people’s credit scores. Shared accounts or loans can hurt both credit scores if one person has good credit and the other has bad credit.

It is important to stress that this impact might not happen right away or for sure. If you do not handle your joint finances well, they can hurt your credit score. Making sure you pay your bills on time and using good money sense can help you keep or improve your credit score, even if you combine your funds with your partner.

In the end, marriage does not have a direct effect on your credit score, but the money decisions you make while you are married can have an effect. If you and your partner know how joint financial activities can affect your credit scores and follow good money habits as a couple, your marriage will be good for your finances too. Remember that you can improve your credit score, even if you are not married.

Does Marrying Someone with Bad Credit Affect My Credit Score?

Most of the time, getting married to someone with bad credit will not cause your own score to go down. Because everyone has their identification linked to their credit report and score, you should not expect your new spouse’s credit history to be added to yours.

For those of you who open a joint account with your partner, you both agree to pay off the amount. Any late payments will show up on both your credit records.

To handle money responsibly, you need to talk about your spending habits with others and make a plan. Even though it will not have a direct effect on your credit score, making financial decisions together can have an indirect effect on your financial health as a couple.

To keep a financial connection going, both people need to check their credit reports regularly and communicate well about their finances.

How do lenders use credit scores for married couples?

While married couples do not influence each other’s credit scores, there are certain circumstances where lenders may use the credit scores of married couples.

When there is a joint application for a mortgage, car, business or any other type of loan, lenders look through the credit score of each individual.

Although each person has a credit score, the joint application considers a median calculation of the credit score to determine if they can be approved or not.

How is a married couple’s credit score calculated?

There is nothing like a married couple’s credit score. In the world of credit scores, there is no consideration for married couples in credit applications.

Certainly, an application can be done for the married couple but that does not mean the credit bureau will calculate the credit score together.

FICO, Experian and the rest treat each individual’s credit score separately.

Credit score and credit history do not change when you get married. Your marriage has no direct influence on your credit score.

Married couple’s credit scores are non-existent, and there is no calculation metered out for them.