In South Africa, it is a relatively common exercise for prospective companies to do credit assessments on potential staff members during the hiring process. A credit assessment is an exercise to become aware of an individual’s loan records, credit grades, and monetary habits. Such information may aid employers in their determination of whether that job applicant is fit, reliable, and trustworthy for a certain position. However, there exist some legal constraints as well as ethically implied repercussions whenever credit checks are conducted by employers with applicants for jobs. Thus, this article explores what employers look for when they do credit evaluations in South Africa, why they do it, how they do it, and what the rights and responsibilities of both employers and employees regarding credit checks are.

What do employers look for in credit checks

Employers’ credit checks, tailored to job requirements, consider several factors:

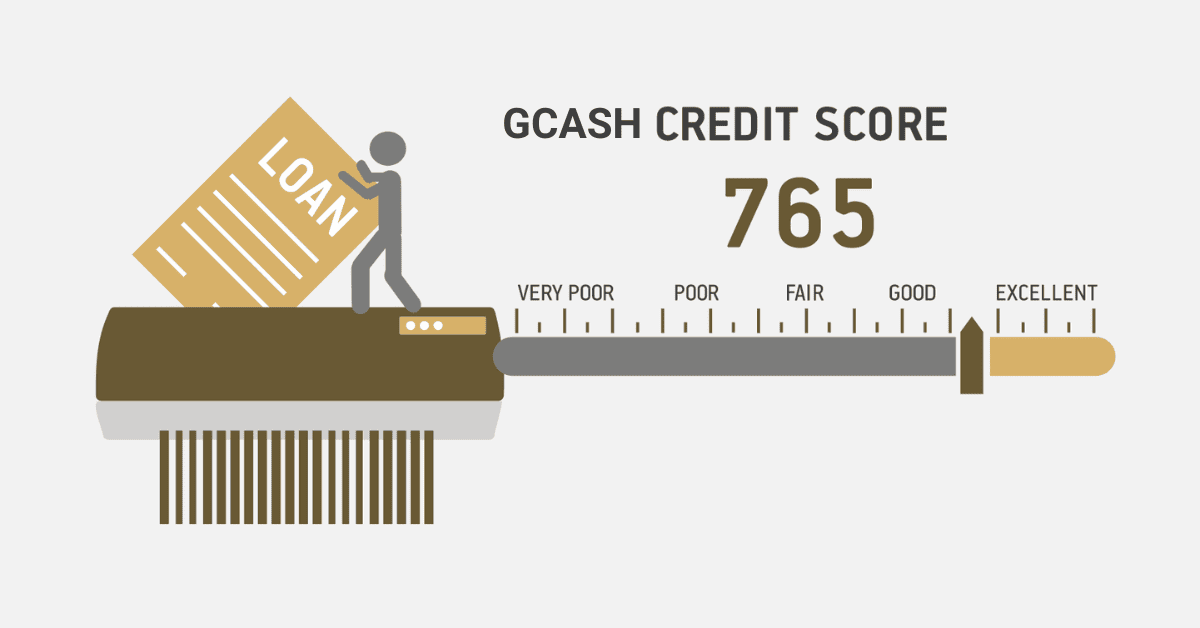

- Credit Grade: A numerical mirror of creditworthiness, scaling from 0 to 999 or 1200, based on the agency. Top-level grades suggest monetary responsibility, while bottom-level ratings may indicate cash struggles.

- Payment Records: A report of arrears, dues, and loan settlements. Consistent, prompt clearances show dependability, while ignored or late settlements raise red flags.

- Outstanding Arrears: The figure owed to lenders. Huge arrears may display monetary issues, while fewer dues show prudent cash management.

- Credit Utilisation: The percentage of available credit used. High utilization may suggest dependency on credit, while low utilization indicates independent financial management.

- Credit Enquiries: The number of past credit applications. Numerous inquiries may suggest the financial need, while fewer inquiries suggest contentment with current credit.

- Negative Information: Adverse events affecting credit status. Such information may suggest irresponsibility, while its absence indicates financial control.

Why do employers do credit checks in South Africa?

The following are some of the reasons why employers in South Africa conduct credit checks for would-be employees:

- Identity Checks: Checking identity, personal name, address, and identity number.

- Regulatory Compliance: Conspicuous credit checks on financial staff employees who handle cash or require an exceptionally high degree of honesty are within the ambit of the National Credit Act (NCA).

- Candidate Ability: Checks enable one to establish whether or not a candidate possesses the required skills, knowledge, experience, and values necessary in relation to the job at stake, particularly those involving money, assets, confidential information, or customer interaction.

- Risk Mitigation: Employers would want to avoid future liability threats on the establishment, such as fraud, theft, or even negligence. They also do this to mitigate risk against the business’s reputation by not hiring candidates, which may result in unethical or unprofessional behavior that may cause a downfall in how the business may be perceived in the public eye.

How do employers do credit checks in South Africa?

In SA, companies conducting credit assessments on potential workers must follow specific protocols:

- Candidate Consent: Firms must seek written consent from the employee before obtaining their credit statement from an approved agency. Applicants have the right to decline or withdraw consent.

- Transparency: Companies must give a legitimate reason for the assessment, highlighting how the details will be applied and kept. Arbitrary or discriminatory evaluations are not allowed.

- Relevance: Credit checks must be relevant and proportional to the job, with scope and frequency limited accordingly. Not every job or candidate warrants a credit check.

- Fair Interpretation: Credit information must be interpreted fairly and objectively. Applicants should be able to discuss or dispute any negative or incorrect info. Hiring verdicts should not only be based on credit details but also on prowess, achievements, experience, and references.

Can you be denied a job in South Africa because of bad credit?

Navigating the job market with bad credit isn’t a straightforward journey. It can limit your options, as some employers might reject your application or offer less favorable terms based on your credit information. It could also diminish your appeal as a candidate, with employers potentially favoring those with good credit. Moreover, the stress and anxiety from bad credit could impact your work performance.

However, bad credit isn’t an automatic job denial. It might not be relevant for jobs not involving finances or if the employer doesn’t conduct credit checks. It’s not the only deciding factor, as your skills, qualifications, experience, and references could outweigh your credit information. Plus, bad credit isn’t permanent. Timely bill payments, debt reduction, disputing credit report errors, and prudent credit application can improve your situation.

What is an acceptable credit score in South Africa?

One of the leading South African credit bureaus, Experian, defines an acceptable credit score as varying from 650 to 850. Scores exceeding 750 are excellent, while those below 650 are considered poor. This scale might vary among bureaus. A good score reflects timely bill payment, less debt, and different kinds of credit. It helps open deals and savings on individual credits, automobile loans, credit cards, and insurance.

How long does a South African credit assessment take?

Using instantaneous credit checks from South Africa is usually quick and takes minutes. It is a detailed credit report done electronically through registered bureaus such as Experian, TransUnion, Compuscan, or XDS. These entail the candidate’s credit score, payment history, outstanding debt, credit utilization, as well as his or her inquiries and any negative information. However, the time frame may be adjusted since it depends on the type of information to be requested, its quantity, and aspects of availability and accuracy, along with the response time and the reliability from the bureau part. Occasionally, technical glitches, system errors, or data discrepancies might cause delays.