Your credit score is essentially that number that portrays your creditworthiness and financial behavioural score numerically. It can affect your ability to access loans, credit cards, mortgages, and other financial products. But how often does your credit score change? And what influences it?

In this article, we detail how credit scores are computed and updated in South Africa and answer some frequently asked questions about updating credit scores. So, right before the conclusion of this article, you will be aware of how your credit score works.

How Often Do They Update Your Credit Score

Though it is not an assurance of when your credit score report can be made, the National Credit Act requires a credit bureau to update the information on your credit report at least monthly. Of course, it doesn’t mean the credit score changes every month; your credit score comes from information in your credit report, which changes as and when your account activity gets reported by your creditors to the credit bureaus. Reporting times will vary from one creditor to another, either frequency-wise or in terms of days of the month.

This simply means that every time new information comes or updates in your credit report, like your payment history, credit utilization, account balances, inquiries, or even public records, your credit score might change. So, this change is either positive or negative, depending on how it affects your credit profile.

What Month Day Do Credit Scores Update?

Credit scores are also updated in South Africa, though no specified day of the month. As a norm, generally, credit bureaus report to update the credit information in a period of 30 to 45 days. However, this is not entirely a sure thing, as there are instances of a time-lapse in the data only if the bureaus have not updated this. This means the next update of your credit score can be unpredictable.

Improving your credit score doesn’t involve gaming the system but regularly changing your credit use. Examples include paying regularly and keeping balances low because their habitation can go a long way toward credit score improvement over time. It can be frustrating to see your score improve or lag slowly, but remember that patience and good financial habits can make it there when needed.

Does Your Credit Score Go Up Each Month?

It’s fairly difficult to predict the actual increase in your credit score each month, mostly due to how dynamic a credit report is. The report isn’t static; rather, it shows your credit behaviour. The components that contribute to your score are many things, including your credit utilization, payment history, and income to credit ratio.

For many, it could be an amazing bump in their score in just one month, even from a hundred to two hundred points. However, it’s not an average pattern. In most instances, the scores are gradually improving—especially for those with tight budgets who can’t throw huge sums at credit all at once.

After all, if your score can go up as easily as it comes down, it can fall more easily than it rises—especially after bad financial behaviour. This makes the best way to improve your credit score a pattern of healthy credit habits. In other words, do things like pay your bills on time, use a little of your credit, and follow best financial practices.

Although not immediate, the payoff from such habits regarding a better credit score is bound to happen over time. Remember, credit scores are a marathon, not a sprint, so with time, such patience coupled with sound financial habits will pay.

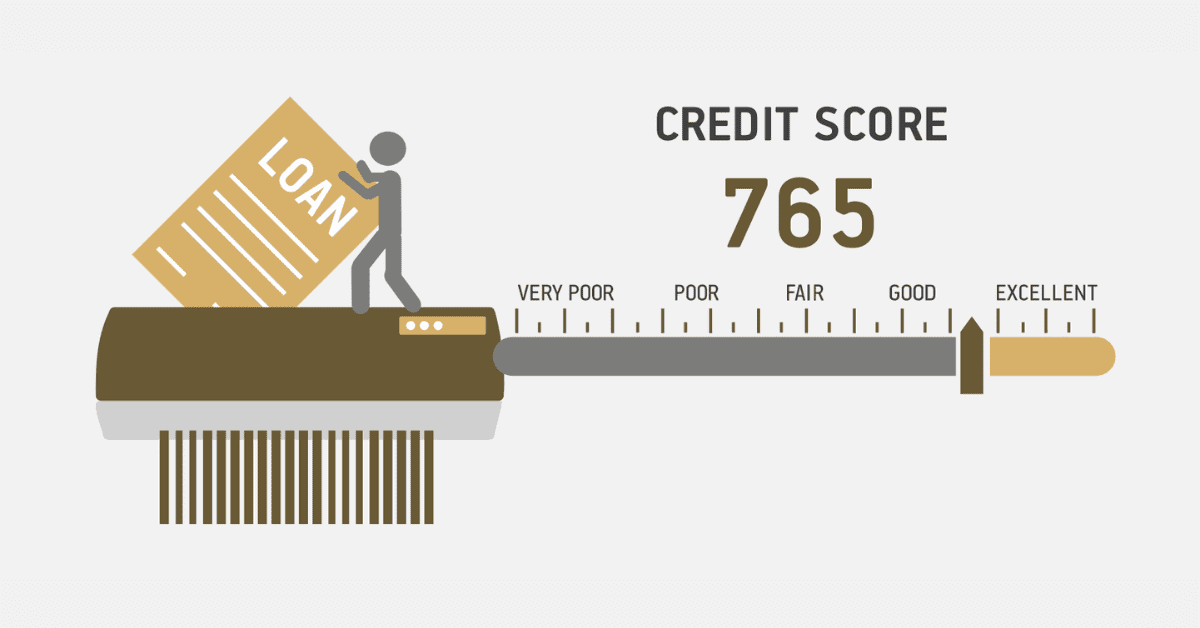

Is It True That Your Credit Becomes Clear After Seven Years?

A common opinion is that derogatory information posted on their credit reports will fall off after seven years. But that is not the SA case. It might, however, simply be a matter of what sorts of derogatory information stick around the longest and which ones tend to be purged first.

NCA requires that credit bureaus remove the following information from your credit reports after the period indicated:

- Enquiries: 2 years

- Judgments: 5 years, or until a court rescinds the judgment

- Administration orders: For five years or until the court sets it aside

- Sequestrations: For five years or until the rehabilitation order is granted

- Debt review: For five years or until the clearance certificate is issued. This is, of course, based on what the reporting institution does.

- Adverse classifications: one year for subjective classifications (e.g., slow payer or absconded) and two years for objective classifications (e.g., handed over or legal action).

- Payment profile: Three years on accounts paid up, five years for accounts not paid up

However, this is not absolute; it can be a short or long period, depending on the other circumstances. For example, you can apply to the court to set aside a judgment or administration order earlier if you settle it. On the other hand, where one has defaulted on a dormant debt for over three years, the credit provider may resurrect the debt and initiate the prescription period for another three years.

So, after seven years, your credit is clean in South Africa is a myth. The only way to ensure your credit is clean is by paying off your debts and keeping your credit in line. You should also be doing periodic checks of the credit reports and disputing errors to credit bureaus accordingly, including information no longer current. This would also put you in a better position to have a good credit score and, therefore, open better avenues for credit.