Most of us never think about credit and our credit history until we need it. That’s a little too late! Whether you’re a youngster taking your first steps in the financial world and trying to build up your credit score ahead of time, or someone who has already fallen into bad credit habits and tanked their score, many people in South Africa have no, or a very poor, credit history. That’s never good news when you are looking for a loan! Today we will walk you through some common questions we see from people in these circumstances, and what your options are.

Can You Get a Loan Without a Credit Score in South Africa?

Whether you have no credit score yet, or a really bad one, you are going to struggle to get a loan in South Africa. While some lenders specialize in ‘no credit’ or ‘bad credit’ loans, they will inevitably have more stringent checks of other data, and you will receive unfavorable loan terms and higher interest rates. Additionally, this space is full of scammers and predatory entities looking to take advantage of you, so you will need to be very selective about the lenders you choose. Make sure they are registered financial institutions operating legitimately.

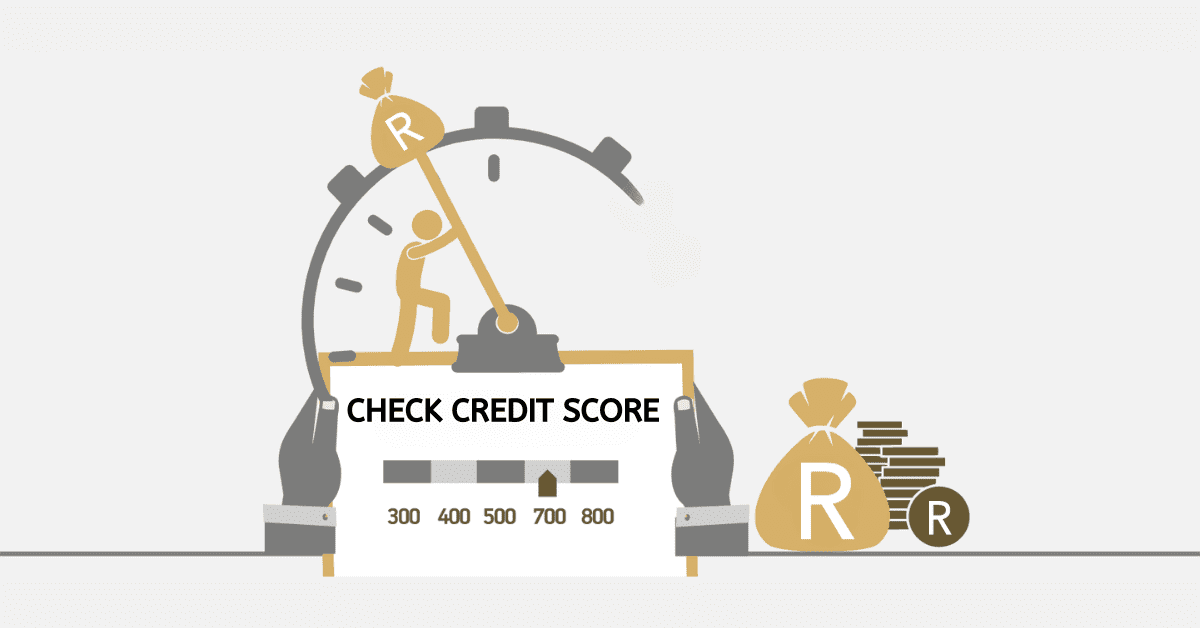

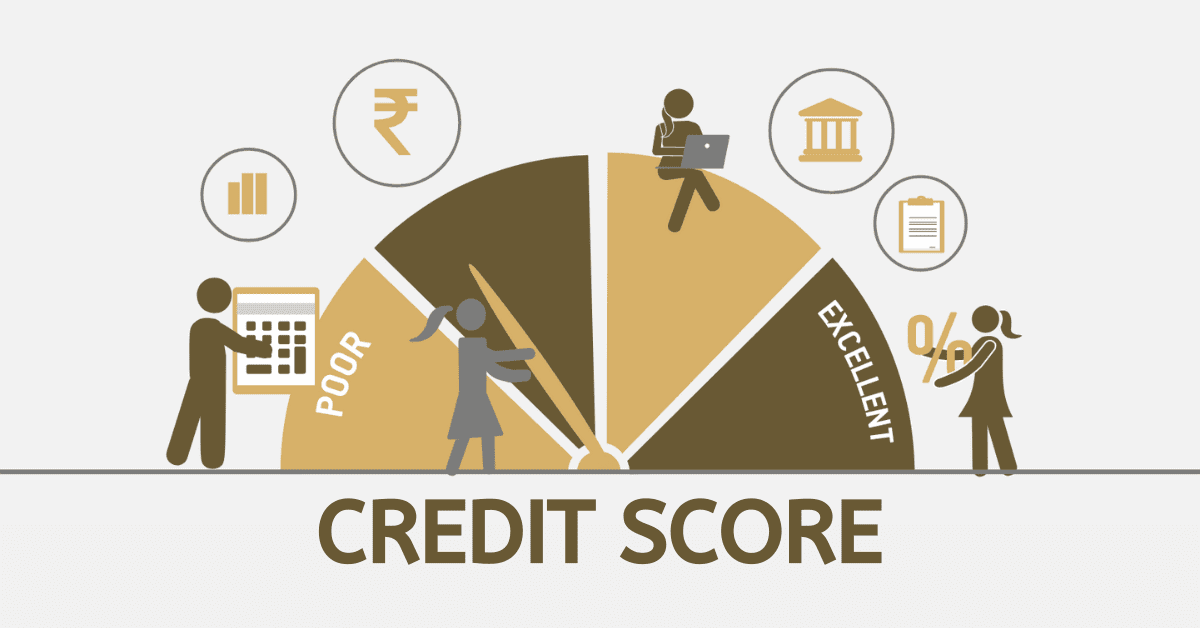

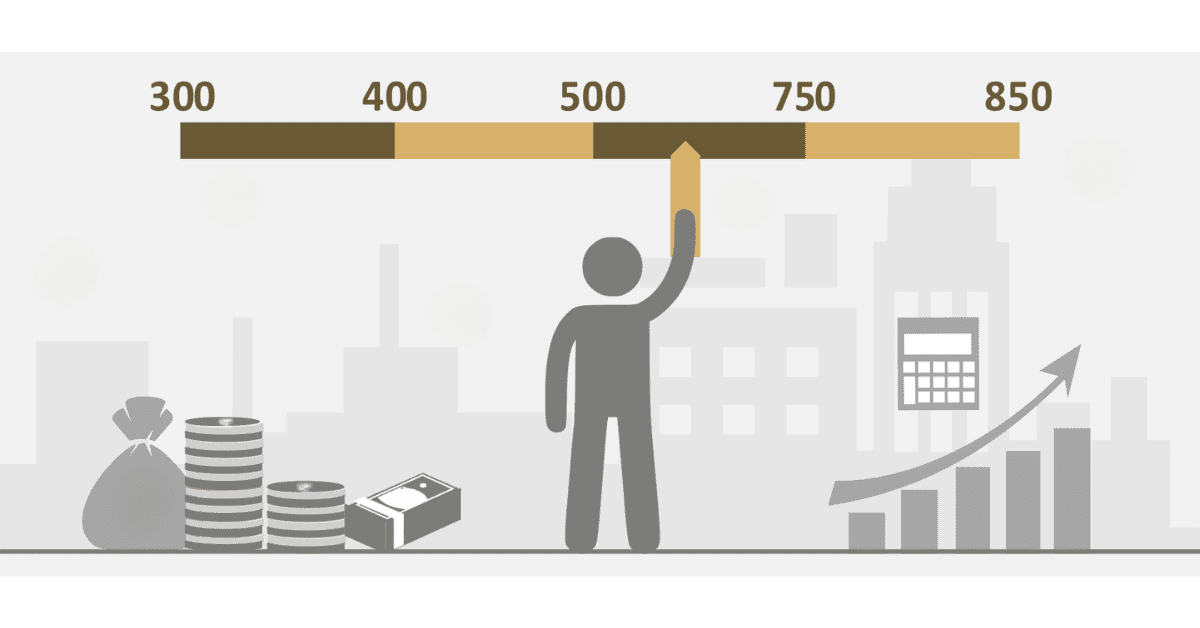

For most term loans, you will struggle to get approval if your credit score is under 640. Luckily, you can easily build your credit score with positive credit behavior. So if you have a poor credit score, taking steps to rehabilitate it will be the best way to get a loan at good terms. It can be more frustrating for those who don’t have any credit score. Sometimes, the ‘you need credit to get credit’ system can feel like a trap. The best thing to do is focus on small, low-stakes loans you can be approved for. With one (or two) of these credit lines in place, you can start building a credit score that will make it easier to access larger loan amounts down the line.

Needless to say, this isn’t something you should be trying to do at the moment you need a large loan. That is why taking charge of your credit journey in advance, knowing where you stand by monitoring your credit score, and taking proactive steps to build or rebuild your credit history before you need it is so important.

What Type of Loan Does Not Require a Credit Check?

There are no traditional loan products that will not require a credit check in South Africa. However, payday loans, some types of secured loans, personal loans from non-traditional lenders, microloans, and peer-to-peer lending, may be able to step into the gap.

That’s not to say these vehicles are easy to get. They are simply going to use other factors- like, perhaps, your employment history and salary- to assess your trustworthiness around the loan. As we cautioned above, be aware that many payday loan schemes, in particular, are specifically designed to be predatory and keep you in the debt cycle. So, if you are trying to access loans with no credit history, it is important to make sure you are doing it for the right reasons. You may have to ‘take what you can get’ if you are facing a medical emergency, for example, but looking for a loan just to ‘keep up with the Khumalos’ or buy the latest tech toy would be foolish indeed.

How Big of a Loan Can I Get With No Credit Score?

If you manage to get a loan with no credit score, don’t expect it to be a large one, either. Most legitimate providers of non-traditional lending will cap you to a small loan amount, especially if this is your first time lending through them. Remember, they want to reduce the risk of losing the loan capital and make sure you can pay it back easily.

Never forget the old saying, ‘If it seems too good to be true, it probably is.’ If you are being offered a large loan amount, with no (or worse, poor) credit, ask yourself why the lender would be willing to take such a big risk on you? Chances are, there is something not legitimate about the loan supposedly on offer.

What is the Easiest Online Loan to Get with Bad Credit?

The easiest online loans to get with bad credit are going to be the same- payday loans, term loans, secured loans, and loans from lenders who specialize in no/poor credit history. If you are looking for an online loan, you need to be extra vigilant about making sure the lender is a legitimate, registered financial institution with a track record of non-fraudulent behavior. Online scams are frighteningly easy to perpetrate, and tracing any illegal activity will be that much harder than with brick-and-mortar stores.

It can be frustrating to be unable to access loans when you need them. However, remember that the credit score system is in place to help you, too, by ensuring you don’t take on debt you can’t afford to repay. Unless in an extreme emergency, it might be a better idea to spend some time evaluating and improving your credit score instead of taking on predatory or high-interest debt that will have an impact on you for years to come.