eFiling has simplified the process of filing tax returns to SARS for individuals, tax practitioners, and organisations. In some instances, eFiliers can even act in different roles and are responsible for filing tax information for their business, employees, and family members in addition to their own.

Generally, you cannot access a second SARS profile

What is SARS primary Login?

Your SARS primary login is the default username and password that you select to access eFiling.

The purpose of having a primary user is to allow you to use a single username when accessing eFiling, and it is mainly used by individuals that have multiple profiles linked to their account.

Users that have a single username linked to their ID number; their default Primary User will be the username that they created originally. By using a Primary username, none of the clients listed on your profile will be affected and will still be accessible as normal.

How to change sars efiling default Primary User

If you’ve already set up your Primary User and want to change your primary User, here’s what you need to do:

Login with new Primary User credentials:

- Visit the SARS eFiling website at www.sars.gov.za.

- Log in using your username and password for the intended Primary User.

When logging in using a username that is not associated with your individual tax type, a screen will appear, letting you know that “SARS records indicate that the personal income tax is associated with one of your other existing login details.

Once you input the username and password of the new Primary User, you will be routed to the ‘Primary Login Credentials screen. This screen should contain a list of the previous login names and related Portfolio types.

- Select the Primary User from the list.

- Click on ‘Done.’

This will now become the only username that you will need to use in the future.

- Select your preferred method of communication for your new Primary User.

- Click on ‘Continue.’

You will then receive a one-time pin (OPT) to the phone number or email you selected.

- Enter the last 6 digits of the OTP.

- Click on ‘Submit.’

- Read and Accept the Terms and Conditions.

- Click on ‘Continue.’

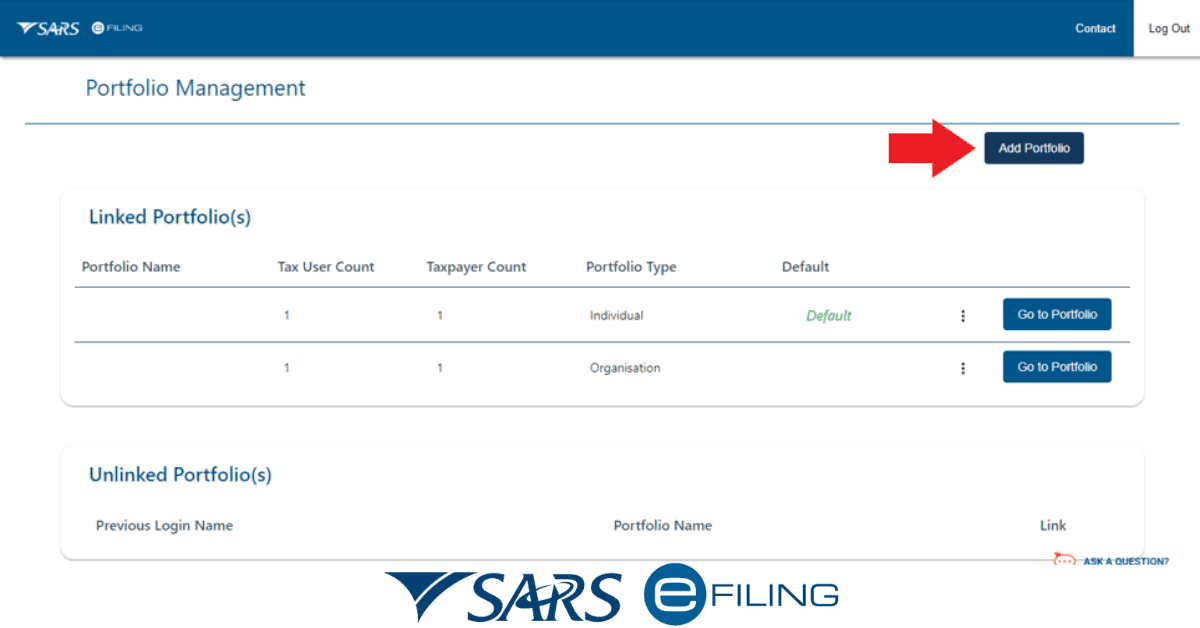

Next, you will be directed to a screen that shows you all the portfolios that are linked to your ID number. The Primary Username that you chose earlier should be displayed as a linked portfolio, while all other portfolios will be unlinked.

You can link any other profile from this screen using the associated passwords.

How can I change my eFiling profile name?

It’s important to keep your SARS profile up to date at all times. Here’s how to update your profile information:

- Visit the SARS eFiling website at www.sars.gov.za.

- Login using your existing username and password.

Once you are on the eFiling home screen, you will notice a button labeled ‘My Profile’ on the left menu pane.

- Click on ‘My Profile

The ‘Profile and Preference Setup’ section will allow you to update and manage the following details:

- Your primary login details

- Security contact details

- Two-factor authentication

- Passwordless login

To change your profile name:

- Navigate to the section labeled ‘Your Login Details.’

- Edit your’ Username.’

- Click on ‘Update and Save.’

How do you set your primary username on eFiling and manage your portfolios?

Login with new Primary User credentials:

- Login to your SARS eFiling profile at www.sars.gov.za.

- Click on ‘My Profile.’

- Click on ‘Portfolio Management.’

You will see a list of the portfolios that are linked to your profile. You can select a default portfolio by clicking the 3 dots (ellipses) in line with the relevant portfolio and then selecting ‘Default’.

To manage a portfolio:

- Click on ‘Go to Portfolio.’

Finally, you will be directed to your chosen portfolio, where you can make changes. To make changes:

- Click ‘Manage Tax Types.’

- Complete the actions you require.

- Click Continue.

Depending on the action completed, the status of the portfolio should change accordingly.

How do I remove my user from eFiling?

Users that are no longer actively using a profile can be removed in the following ways:

Option one: Contact the user and ask them to remove themselves

Taxpayers that are already registered against another party’s eFiling profile have the option to obtain shared access or revoke the other party’s access. They will need to:

- Log into their eFiling profile.

- The taxpayer will then have to link their own tax type to their profile.

- Choose the access that they require – In this case, they would select ‘Remove Tax Practitioner Access’ or ‘Remove My Access’. The option chosen will depend on your specific situation and the access that needs to be removed.

- Click ‘Submit.’

Option two: Portfolio Management

This is often the preferred method as it removes any confusion that the user being removed may encounter.

Once the taxpayer has logged into eFiling:

- Click on ‘My Profile.’

- Click on ‘Portfolio Management.’

- Click on ‘Go to Portfolio’ and enter the password.

The taxpayer can then remove, add, or change users as required.

How do I add a new user to eFiling?

If you are wondering, “How do I give access to a new user? It can be done using the following steps:

- Log into SARS eFiling.

- Search for the required taxpayer.

- Click on ‘Organisations’ on the menu tab.

- Click on Request Tax Types.

- Click on ‘Create New.’

- Click on ‘I agree’ and then ‘Continue.’

You will then need to input all the details of the taxpayer that you want to add to your portfolio.

Once complete:

- Click on ‘Request.’

- Click on ‘OK.’

A message will be displayed confirming the request and pending approval from the individual. The taxpayer will have to approve the transfer request for the process to be completed.