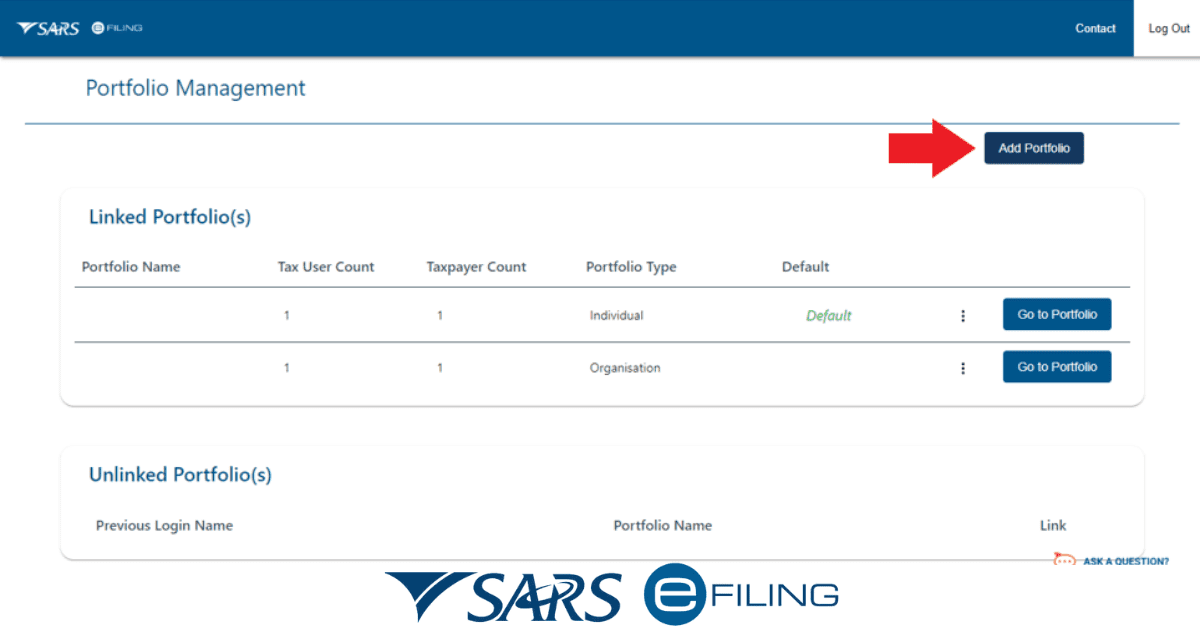

All individuals and businesses earning income must file tax returns with the South African Revenue Service (SARS). To ensure compliance, taxpayers must register with SARS and keep their details updated. In the past, one had to visit their nearest SARS branch to make necessary changes to their personal or business details. However, with the constant development of digital technology, you can now update your tax information using the RAV01 form on eFiling. This article explains everything you need to know regarding RAV01 registration, amendment, and verification forms.

What is an RAV01 Form on SARS?

The RAV01 form is an online form that is used by individuals and businesses to update legal entity or tax information on eFiling. You need to first register for a free account on eFiling to perform different activities related to your tax activities. If you want to update your tax information, you can do everything in the comfort of your home using the RAV01 form. Gone are the days when taxpayers needed to visit their local SARS branches to update their details. As long as you have access to the internet, you can update your tax information on eFiling.

What Is the Purpose of the RAV01 Form From SARS?

The RAV01 is also known as the Registration, Amendments, and Verification form that allows individuals, businesses, tax practitioners, or registered representatives to maintain their legal entity registration on eFiling. To enhance better use, the RAV01 form is now available in HTML5 format on eFiling. This means that you can easily complete the form online.

The main purpose of the form is that it allows users to update their tax information on eFiling. Should you wish to update your details, you can complete this form on eFiling. This mainly involves demographic information and other details related to specific tax types.

Other details you can change using this form include name, surname, registered company name, and banking details. However, you cannot use the form to change your personal ID number or Company registration number since these are locked. If you want to change these details, you will need to visit your nearest SARS branch and present the original documents with the new information you want to change.

What Happens Once You’ve Updated Your RAV01 Form?

Once you update the RAV01 form, all the changes will be effected on your SARS tax profile. Even if you declare your tax changes on the ITR12, you are required to complete the RAV01 form, especially when ceasing tax residency. If SARS selects your ITR12 for manual intervention, you will still be required to update the RAV01 to get your income tax assessment.

In the case of ceasing to be a South African tax resident, your RAV01 form must be updated and submitted on eFiling. The date when you cease to be a taxpayer must be shown on the RAV01 and ITR12 forms. Your tax records at SARS must be updated immediately to show that you are no longer a taxpayer.

If you want to amend your tax information, all the changes you make on the RAV01 form will be updated once you submit the correct details online. This means you will no longer be able to use old data for tax purposes. Therefore, make sure you provide accurate information to avoid errors that can compromise your compliance status.

What Documentation Will You Need to Support the Changes in Your RAV01 Form When Completing Tax Emigration?

When completing tax emigration, you will need the following documentation to support the changes you will make in your RAV01 form.

- Passport copies with exit stamps to prove that you have left the country. Make sure the stamps on your passport are recent.

- If you have residency elsewhere, it is important to provide a copy of a foreign passport or other documentation such as citizenship, permit, or visa to show that you now live in another country.

- A statement reflecting your liabilities and assets before you left South Africa. Provide the correct valuation of each.

- Signed declaration supporting the grounds for considering non-tax residency status. You also need to provide a letter of motivation outlining and supporting your legal argument to SARS for making the move to become a non-resident.

- Declaration obtained from SARS eFiling showing the basis upon which you qualify to be a non-resident.

- A motivational letter outlining all the details that you have ceased to be a tax resident.

SARS does not accept documents that have been completed by hand. Make sure you type all the documents before submitting them. Depending on how you intend to cease your tax residency, SARS may ask for additional documentation. You can cease tax residency in one of the three ways below.

- Application of ordinarily resident test

- Application of physical presence test

- Application of Double Tax Agreement

The moment you cease to be a tax resident, this will be viewed as automatic capital gains disposal activity. You must submit documentation for all assets you owned which were subject to capital gains tax. This shows that you are no longer a tax resident in South Africa.

SARS will assess your documentation in line with your assertion that you have ceased tax residency. Once your application is in order, it will get approval. SARS will prepopulate your ITR12 with the date on which your tax residency has ceased. From this day, you will no longer be required to pay tax in South Africa.

All taxpayers in South Africa must keep their SARS details up to date. If you want to amend your tax details, you can do so via the eFiling platform using the RAV01 form. The form is also used when ceasing tax residency. However, it should be accompanied by certain documentation. Be sure to provide the correct documents so that your application is not rejected.