The South African Revenue Service (SARS) is a government agency in South Africa that is in charge of collecting taxes and making sure tax laws are followed. The goal of SARS is to run taxes in a way that is efficient and effective while also encouraging voluntary compliance and educating taxpayers. SARS wants to ensure that all taxpayers pay the right amount of tax and that everyone is treated fairly and in the same way.

SARS also works to create a tax culture in which people and businesses understand how important it is to pay taxes and willingly do what they need to do. SARS is committed to helping the people of South Africa and building a strong, sustainable, and fair economy. They do this by putting an emphasis on honesty, professionalism, and new ideas.

SARS helps develop tax policies and gives the government advice about tax-related issues. Many individuals who lack knowledge of SARS online banking payment can now learn by reading this article. We will cover the SARS payment options and other related matters dealing with SARS payments.

How do I pay SARS through ABSA online banking?

Before making a payment to SARS, you need to ensure you have the right reference number and payment amount. You might have to wait or deal with other problems if you don’t. It is also a good idea to check with SARS to ensure the payment was received and processed properly. Here’s a simple way to pay SARS through your ABSA online banking account.

- Sign in to your account at Absa Online Banking.

- Use the main menu to choose “Payments.”

- Choose “SARS” as the person who will get the money.

- Type in how much you want to pay for SARS.

- Check the payment details, such as the recipient, the amount, and the payment date.

- Put in your One-Time Pin (OTP) for Absa to confirm the transaction.

- Check and make sure the payment details are correct.

- Once the payment has been processed, you will get a confirmation message and a receipt.

How do I pay SARS Absa EFT?

Platforms for electronic fund transfers (EFTs) are reliable and safe ways to move money electronically. The ability to send and receive money around the clock from any place with an internet connection is just one of the many pros of using an electronic funds transfer platform. Compared to more conventional banking methods, the transaction fees associated with EFT platforms are much more reasonable, making them a viable choice for both small enterprises and individuals.

We have outlined the steps necessary to make an Absa EFT payment to SARS (South African Revenue Service):

- Sign in to your account at Absa Online Banking.

- Use the main menu to choose “Payments.”

- Pick “EFT” as the way to pay.

- Choose “SARS” as the person who will get the money.

- Type in how much you want to pay to the South African Revenue Service.

- Enter the information about the SARS bank account.

- Check the details of the payment, such as the recipient, the amount, and the date of the payment.

- Put in your One-Time Pin (OTP) for Absa to confirm the transaction.

- Check and make sure the payment details are correct.

- Once the payment has been processed, you will get a confirmation message and a receipt.

How do I make a payment to SARS eFiling?

Numerous advantages accrue to filers through the South African Revenue Service’s eFiling system. Because of how fast and easy eFiling is, filing taxes is now a much more manageable task. These easy steps will guide you through the SARS e-filing payment process.

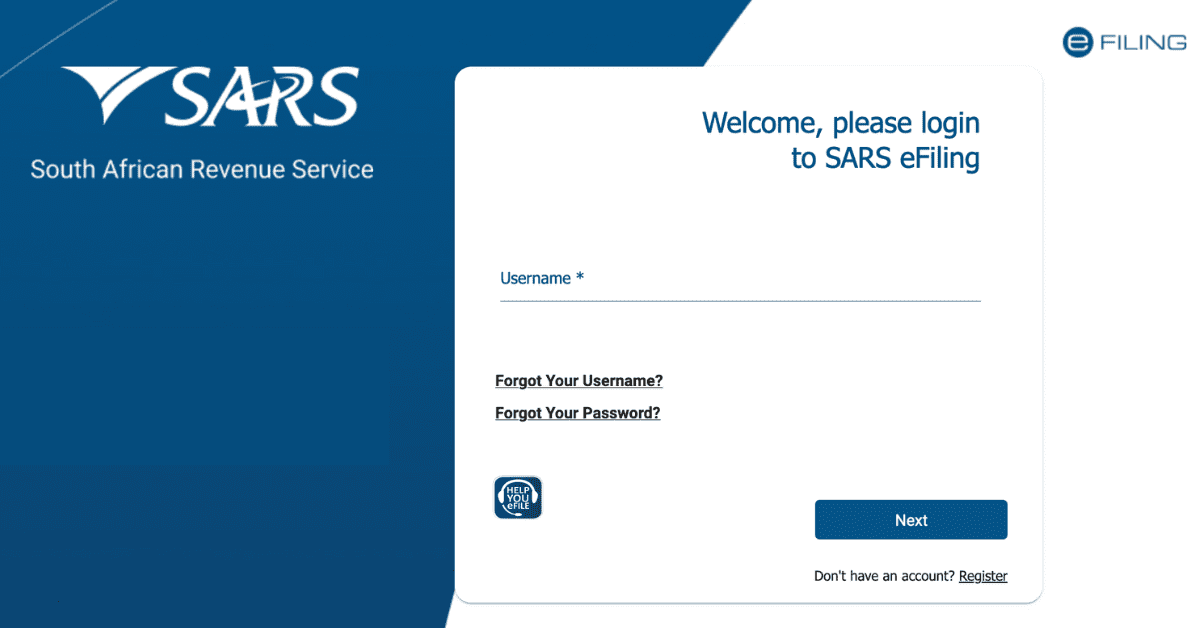

- Enter your login information for SARS eFiling.

- To access the “Payments” sub-menu, click the “Menu” button.

- Pick out the mode of transaction you’re comfortable with (e.g. income tax, VAT, etc.).

- To make a payment, type the sum you’re willing to spend.

- Go over the payment information and make sure it’s correct.

- Pick out your preferred mode of payment eg. EFT, debit card etc

- To make a payment, just stick to the on-screen steps.

What is Absa access number for SARS?

Taxpayers in South Africa can make payments to SARS via EFT (Electronic Funds Transfer), debit card, or credit card. If a taxpayer wishes to pay their taxes using Absa Bank, they will require an Absa Access number to verify that the funds are being transferred to SARS. It is mandatory to use the SARS-issued Absa Access number for all financial dealings. It is much simpler for taxpayers to meet their tax responsibilities when they use Absa Online Banking or Electronic Funds Transfer.

The South African Revenue Service (SARS) accepts tax payments from taxpayers in a separate Absa Bank account. This is the information for SARS’s Absa Bank account:

Account Name: South African Revenue Service Account Number: 4074022689 Branch Code: 632005 Bank Name: Absa Bank

Where do I find my SARS PRN number?

PRN is the payment reference number generated for each payment form and used to cross-reference the allocations on the form with the funds sent. Using the PRN, a customer can specify the amount, time frame, and tax classification of a payment or settlement. You will be given a Payment Reference Number for each tax payment to the South African Revenue Service. Find it on your SARS-issued tax invoice or account statement.

The specific PRN is available on the appropriate SARS payment form. A payment to SARS won’t be properly credited unless the PRN is included with the payment.