If you are a foreigner currently living in South Africa, you may find that a lot of day-to-day services are harder to access than they are for citizens. Even if you are in the country legally. Theoretically, getting a credit score isn’t one of them. There are some unique pain points and snags that could impact you in ways a citizen wouldn’t face, however. Today, we are here to dive deeply into that unique landscape with you, to help you better understand how to make the most of your credit opportunities.

Can a Foreigner Get a Credit Card in South Africa?

As a legal foreigner in South Africa, you can get a credit card (or other credit product) provided you meet the same eligibility criteria as anyone else. That’s the theory, at least. In practice, many foreigners report differently. Some even have issues getting a basic local bank account. Why? Let’s take a look.

Some of it is, very regrettably, plain old bias from financial institutions that should not be behaving that way. It probably isn’t even legal, but proving that will be tough and is rarely worth it. However, many times the core issue isn’t about xenophobia or other matters, but about your lack of a local credit score. With some associated issues which we will explore in depth below. Many foreigners don’t even realize they don’t have a local credit score to start with!

How to Get a Credit Score as a Foreigner in South Africa

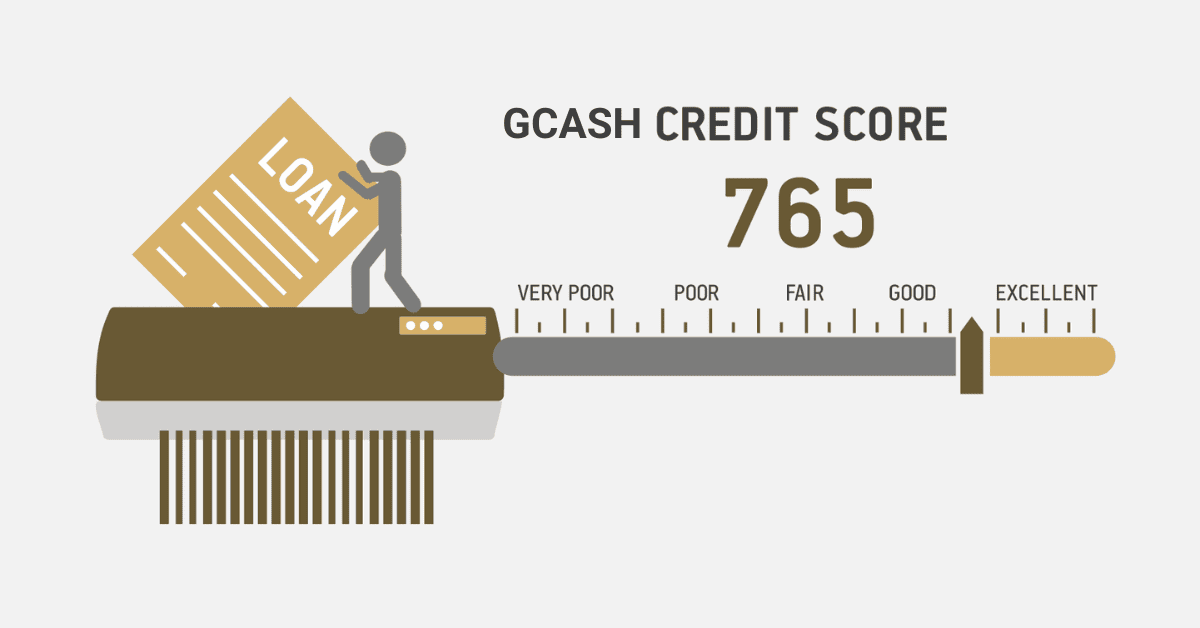

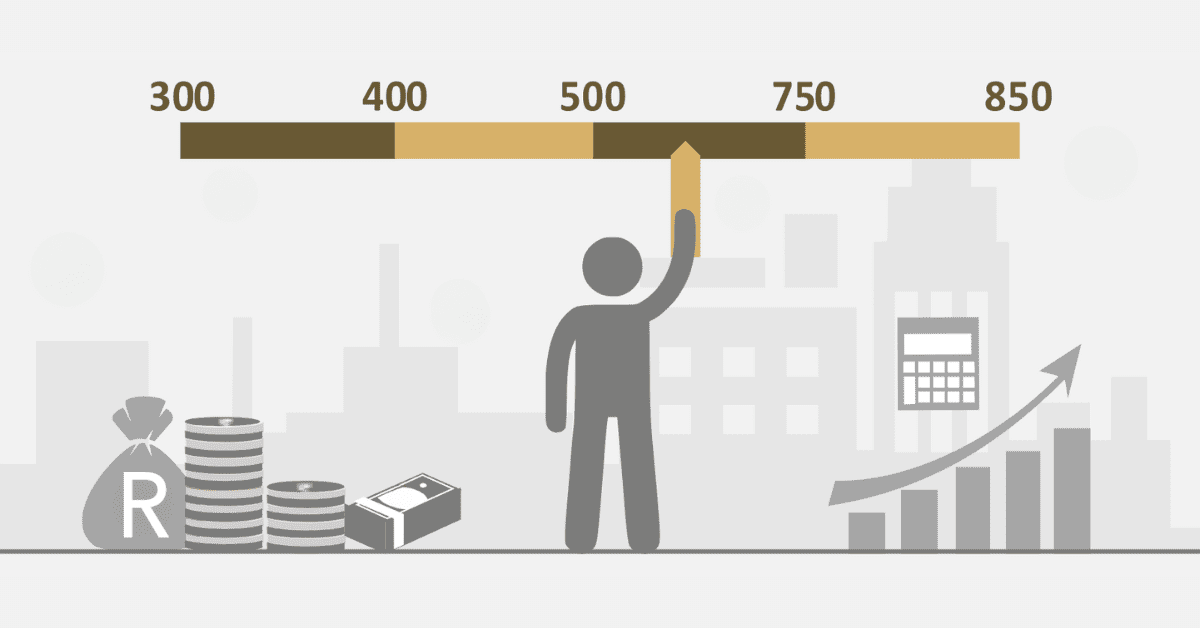

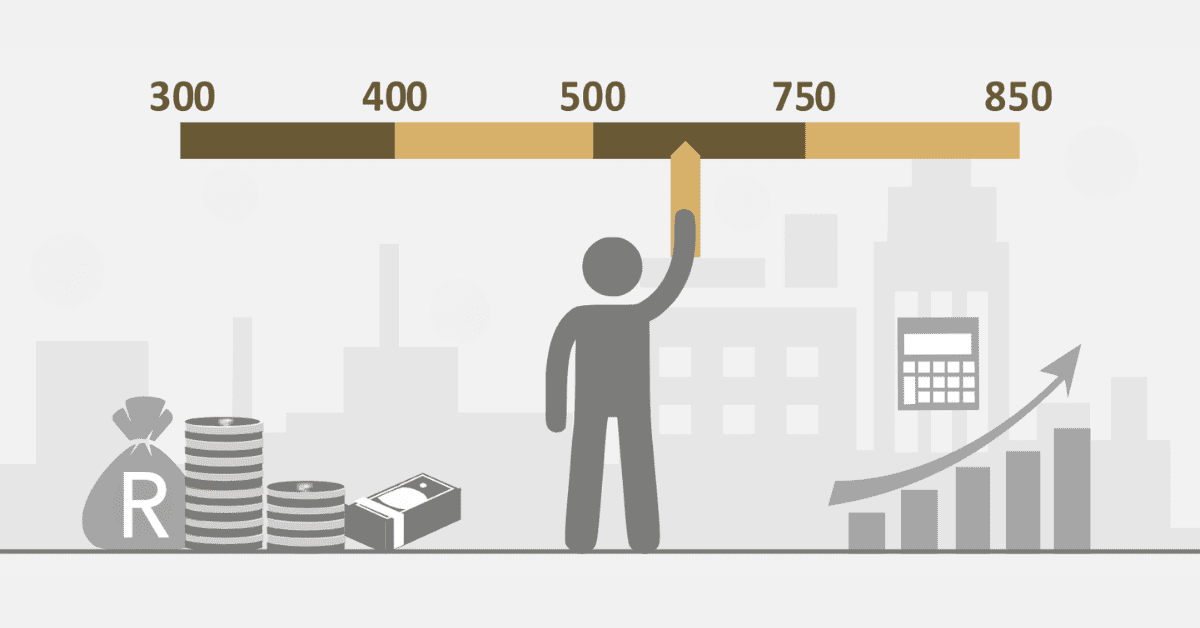

So, you need to get a credit score as a foreigner living in South Africa. You can build your credit score locally the same way as a citizen. This means opening a small, low-stakes credit line to start with, and building up great credit habits. Pay your account on time, don’t use more than 50% of the available balance, and check your credit report regularly. Dispute any errors that creep onto the report timeously, before they do damage. Also, make certain to avoid defaults and other negative events. With time, and as your credit score grows, you can access a wider range of credit types. A diversity of credit will also boost your credit score if it is well-managed.

Before you can start building that beautiful high credit score, however, you will face some unique challenges that locals will not- most of them centered on the notorious logistical problems foreigners face in South Africa.

A key issue is your lack of a South African ID card. So much of our identity verification processes are tied to that little piece of plastic. Some lenders are not flexible enough to allow alternative identification. Yes, that is silly and short-sighted of them! If you have a foreign passport stamped with a valid visa, a refugee permit, or a naturalization document, it should be sufficient for more agile lenders.

Next, consider the other criteria that lenders use. This includes income, formal employment, a local bank account, and your expenses. You will also have to have a permanent local address for FICA registration purposes.

Lastly, but rather importantly, know that the provision of credit to non-South Africans is governed under the South African Reserve Bank’s exchange-control policy as well as the National Credit Act. Make sure you understand what type of local residency (non-resident, temporary resident, refugee, or immigrant) you hold to expedite the process.

Who Qualifies for a Credit Card in South Africa?

To qualify for a credit card in South Africa, you need to meet eligibility criteria set by the bank or financial institution. These criteria include:

- Minimum Age: Applicants need to be at least 18 or 21 years old (depending on the bank’s policy) to hold their own adult bank account and take out credit.

- South African Citizenship or Permanent Residency: You should be a South African citizen or permanent resident.

- Sufficient Income: Applicants must have a stable income to ensure they can repay their credit card debt. The lender will have minimum income requirements. You will also need to prove you are formally employed. Getting a credit card as a business owner or entrepreneur is a lot harder, but some lenders will consider you.

- Good Credit History: While some banks offer credit cards to individuals with limited credit history, a positive credit history greatly increases the likelihood of approval. It will also affect the credit limit you are granted.

- Ability to Repay Debt: Banks assess your ability to manage debt responsibly based on factors such as income, employment status, and existing financial commitments.

Qualifying for a credit card is not guaranteed, even when you meet these criteria. Every lender evaluates people differently, too. A credit score over 650 will help considerably.

Can a Foreigner Apply for a Loan in South Africa?

Foreigners can apply for a loan in South Africa if they meet all of the same criteria that residents do. These include:

- A good enough credit score to qualify

- A local residence and local bank account

- Clear and legal identification that displays your right to live and work here

- Sufficient income, formal local employment, and other standard eligibility criteria asked by the lender

Which Bank is Best for Foreigners in South Africa?

Most of our local banks offer specialist banking products tailored specifically to the needs of foreign nationals and asylum seekers. These are more limited than the standard accounts on offer to legally resident foreigners and locals. They could be a good first choice as you establish your South African roots, however. Of the Big 4 banks in South Africa, FNB has the best reputation among foreigners. Notably, Discovery Bank does not accommodate foreigners and refugees in any way.

Getting a credit score as a foreigner in South Africa is the same as for local residents. In theory. In practice you will need to ensure your lenders will accept your non-South African identification, and ensure you have a permanent residence and bank account before applying for credit. Good luck!