Unless you are very rich and have a trust fund to fall back on, living life in the modern world without ever using credit is highly unlikely. This means every one of us needs to be aware of our credit score, and actively work to build a strong, healthy one. Whether you’re aiming to ultimately get a loan for a car, a home, or even to start a business venture, having a solid credit history is the best way to qualify for credit, and even get better interest rates and terms. What if you don’t want a credit card? Maybe you don’t trust yourself not to spend all that ‘free’ cash, or perhaps you simply don’t like this type of credit.

While they are an often-recommended product for building or rebuilding credit, they are far from your only option! Today, we will walk you through building your credit without a credit card- it is easier than you may think.

Can I Have a Credit Score Without a Credit Card?

You absolutely can have a credit score without a credit card! Despite the similarity in names (after all, they both work with credit), they have nothing to do with each other. As a line of credit, any credit card you did own would be on your credit report. A credit report, however, is simply a holistic picture of your overall credit products and how you behave with them. Any source of credit in your name will count towards your credit score, and it doesn’t have to be a credit card specifically. Some people with fantastic credit scores may not even own one!

How To Build Credit Without A Credit Card

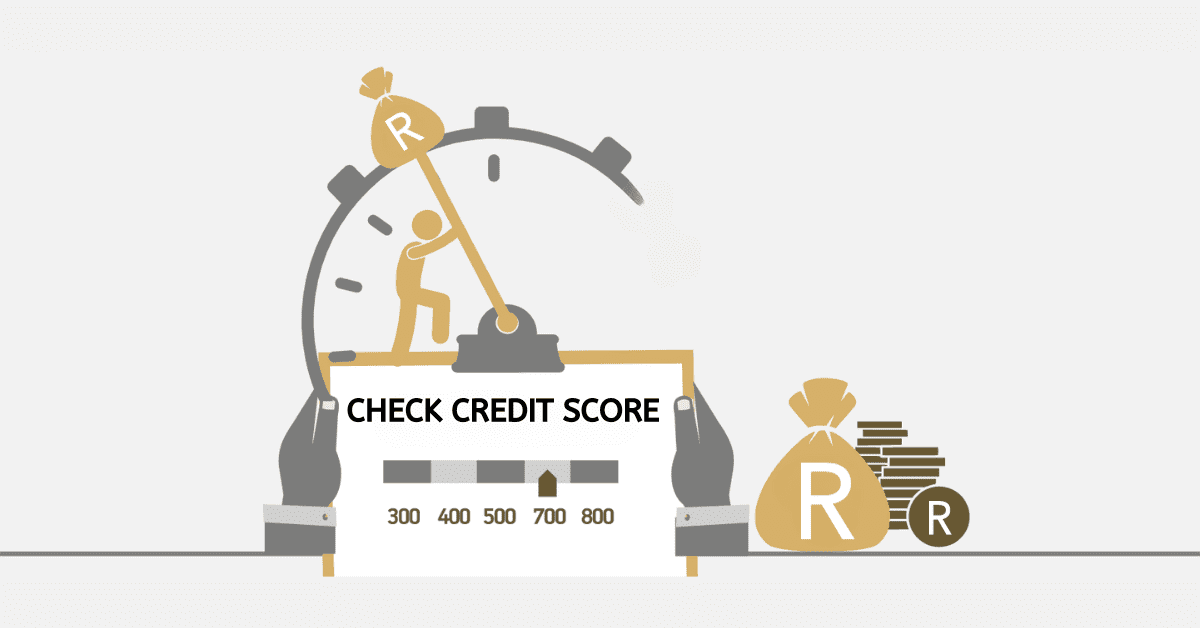

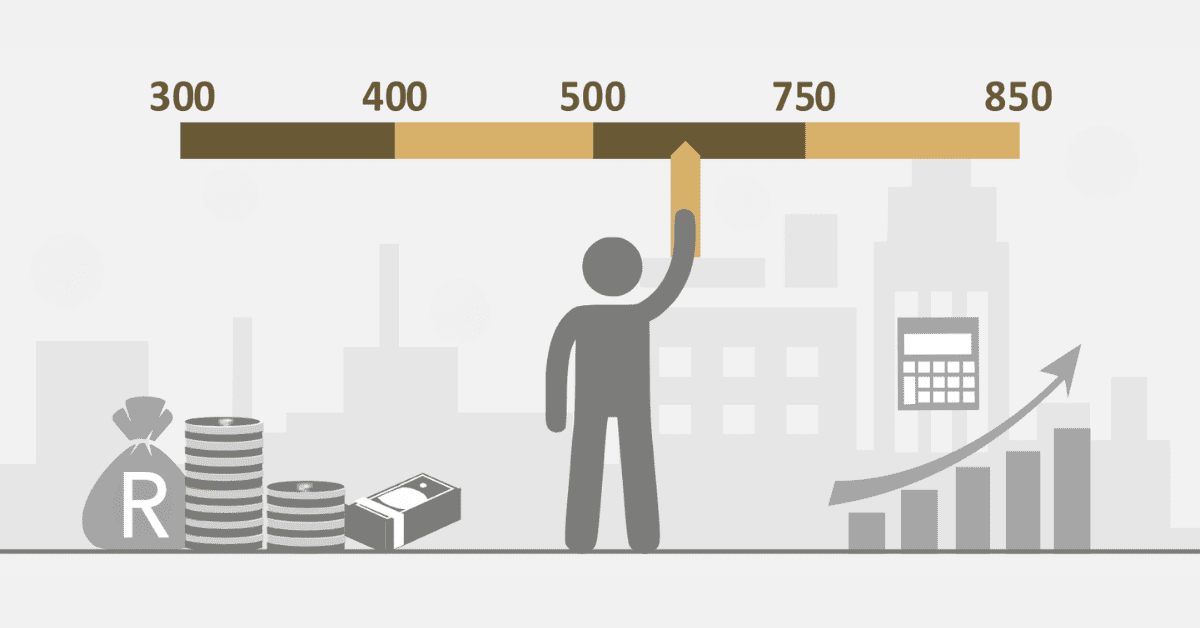

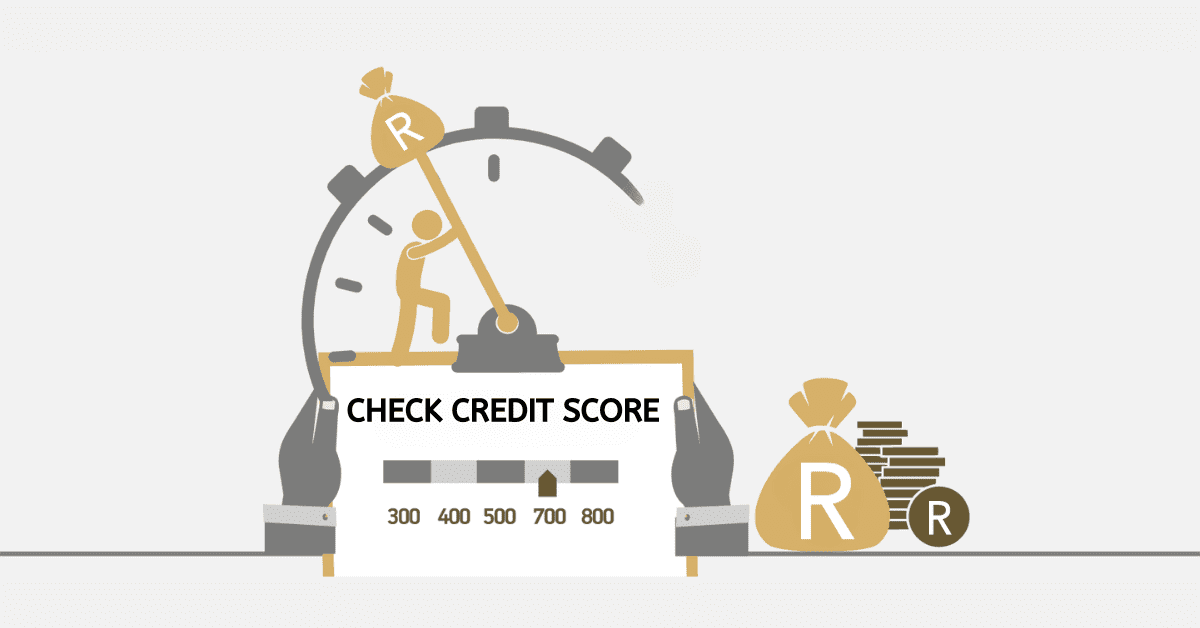

The easiest way to build credit without a credit card is to apply for (and receive) a different type of credit. Credit and your credit score are tricky beasts. You need a good credit score to qualify for credit, but you can’t build a good credit score until you have credit. Ironic, right? So your very first attempt to qualify might be a frustrating experience- but it will open up a positive credit future for you. Hang in there.

If you don’t want a credit card product, your best bet will be other low-stakes loans like store accounts. You might also be able to qualify for a (very small) personal loan through your bank. Applying through your bank means they can see your full financial history with them, not just your credit score. Banks will often be a little more lenient on the credit score side if they can see other positive financial behavior, so it can help greatly.

Student loans, either entirely in your name or with a parent or guardian to cosign for you, are another good way to build credit without a credit card. In recent years, some financial institutions in South Africa have introduced new products specifically to help people build credit without relying on credit cards. For example, some banks offer credit-builder loans or secured loans where you deposit funds as collateral.

Lastly, Microfinance institutions (MFIs) are a special type of financial service provider that offers financial services to people who may not have access to traditional banking products. These institutions offer small loans with flexible repayment terms, making them accessible to many borrowers. By borrowing from MFIs and repaying the loans as agreed, you can gradually build a positive credit history.

Can I Borrow Money Without a Credit Score?

While having a credit score certainly enhances your borrowing prospects, it’s not impossible to borrow money without one. Having no credit history is very different from having bad credit history.

A bad credit history means someone has outright shown that they have poor borrowing habits, pay late or skip payments, and possibly even have defaulted on loans in the past. This makes them unattractive to lenders, as they have a high risk of not repaying the loan. Whereas someone like you, with no history at all, is simply unknown. You might turn out to be the best-paying client they have!

So some financial institutions are willing to look at other criteria to help guide the decision, especially if you are a young person who is expected to need credit. We already mentioned that banking with the same institution might be enough to sway them. Many lenders in South Africa offer loans specifically tailored to individuals with limited or no credit history. These loans may have higher interest rates or require additional documentation, but they do allow you to borrow money without a credit score.

Does Paying Rent Build Credit?

Technically, having a rental payment will count towards building your credit, too. In reality, that will likely only be reported to the credit bureaus if you are working with a formally managed lease from a registered rental company or professional agency, however. Even that isn’t guaranteed! Although they should report your rental payments to the bureaus, a frightening number of South African landlords simply don’t bother. Almost no private landlords will. So while this could be a useful credit-building tool in the right hands, don’t pin all your hopes on it.