There are two main categories of credit searches: hard searches and soft searches. These two have different purposes; they also affect your credit score and report in different ways. This paper will, therefore, bring to light what they are and how different they are from one another, and will also touch on how you can avoid unnecessary hard searches that can negatively impact your score.

Understanding Credit Searches: Hard Searches And Soft Credit Check

What Is A Credit Search?

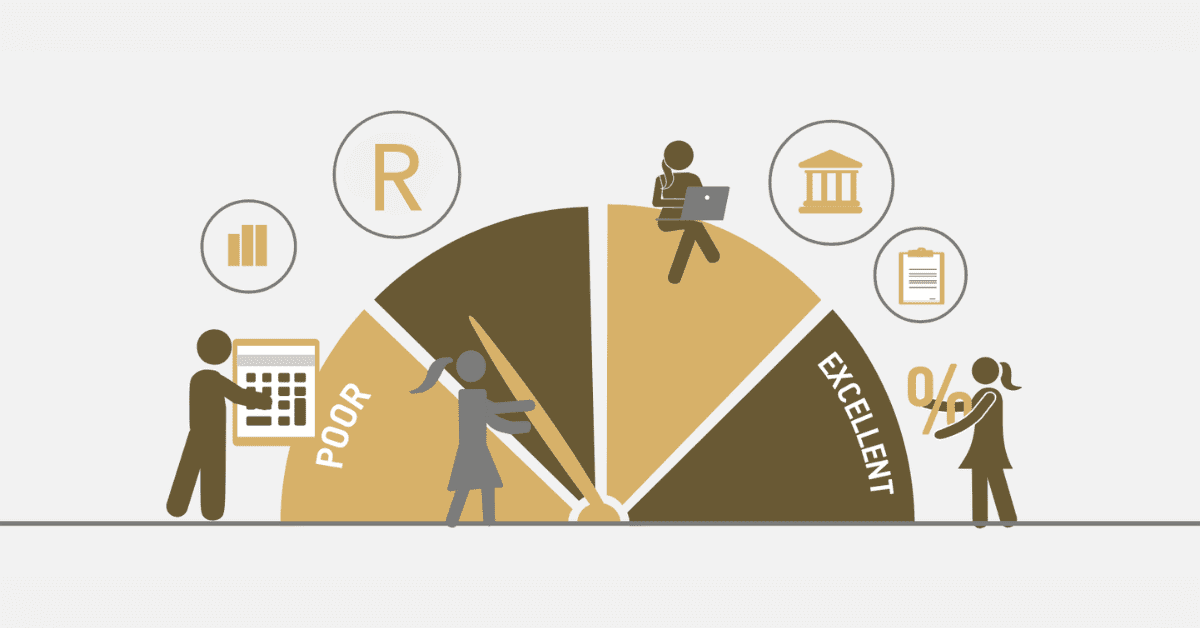

A credit search is equivalent to a backstage pass for the lender, or any other such entity, to sneak a peek at your credit report, which is held by one of South Africa’s credit bureaus, namely TransUnion, Experian, Compuscan, and XDS. Like the librarians, they pick up your credit activities to fashion your credit report and score. They may give you your free annual copy.

Note that a credit search is typically consensual, a part of the process when applying for a loan, a credit card, a mortgage, or any other form of credit. However, cases can include where the credit has to be accessed due to any potential employers, landlords, or debt collectors regarding the validation of the identity or your level of credit.

What Is A Hard Search And A Soft Search?

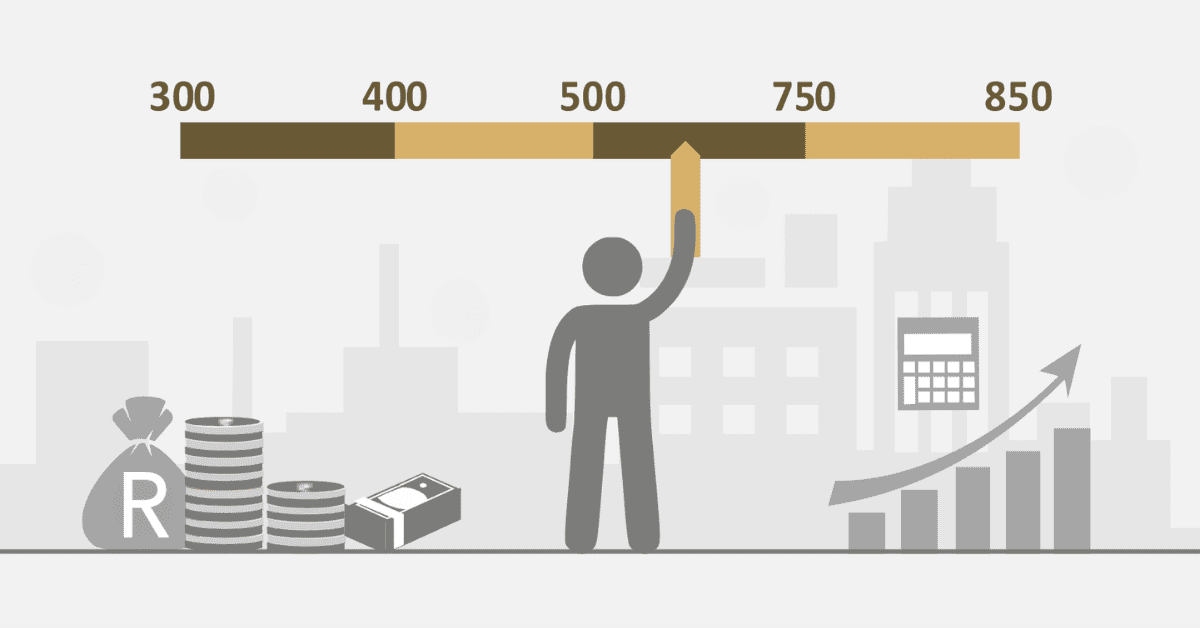

A hard search means a lender checks your full credit report to decide on your credit application. It’s a footprint on your credit report, visible to future lenders, and can slightly dent your credit score—especially if multiples are made in rapid succession. It stays there for two years.

A soft search, however, is a quick look, as opposed to the full examination of your credit report, and one purely for information—so it doesn’t impact your credit score. It wouldn’t be revealed to any possible creditors and would only be visible to you. In cases of checking one’s score, in a pre-approval by the lender for credit, while checking of identity or credit worth, or in a case of updating the report by the credit bureau.

How To Avoid Unnecessary Hard Searches

Hard searches are important when applying for credit since they help a lender gauge the risk in your credit. But if you have many of them, your credit score will be reduced, so you will look like a person hungry for credit, and it might be more difficult to approve applications. Hence, apply for hard searches only when you require credit.

Here’s how to avoid unnecessary hard searches:

- Check your credit report and score before applying for credit. Use a free service like ClearScore to check without affecting your score.

- Shop for the best credit deals, but do not apply for several credits. Use a soft search to see your eligibility and indicative interest rate for a credit product.

- Space out your credit applications. It is best to wait three to six months between applications unless applying for mortgages.

- Apply for only the credit you need and will be in a position to repay. Only apply on a need basis as a way of managing your debt to avoid getting into financial problems.

Does A Hard Credit Search Affect Your Credit Score?

Yes, a hard credit search may lower your credit score a bit. This will be based on your credit history and how many such hard searches are on your report and generally won’t last too long. Your score can bounce back through good credit habits of making bill payments on time, having low credit utilization, and avoiding late payments or defaults.

The impact of a hard search also depends on the kind of credit you are applying for and your application frequency. For example, it considers mortgage or car loan applications to be less risky than applications for personal loans or credit cards, resulting in a small ding to your score. Likewise, it is considered normal to make one or two applications for credit in a year, while more than two in a short duration could indicate desperation and probably result in more reduction in your score.

Does A Soft Credit Search Affect Your Credit Score?

Not at all! It’s like an onlooker who only watches and does not touch your credit score. It’s private, and no one else can be able to see it but you, meaning there will be no lenders or creditors peeping through your credit report. It does not signal that you’ve applied for credit and does not impact your credit risk. So go ahead and indulge in as many soft searches as you wish; your credit score will not bat an eyelid.

A soft credit inquiry can be your friend when boosting your credit score. It enables you to continuously monitor credit reports and scores, detect errors, and plan ways to enhance credit health. Besides, it assists you in hunting down the best deals and credit offers that go along with your needs and budget without nudging your credit score.