There are a lot of things that could happen to your debt when you leave your country. Putting South Africa as the geographical location, there may be consequences for you should you leave your debt.

The debt in this context is related to credit score debt. One way or the other having a credit score leaves you with some debt.

Certainly, every individual has their debt captured in the credit score, and it is important to know the credit score system and structure.

Are you planning to leave South Africa and wondering about the effects and outcomes of your credit score? Do you think you understand the credit score transfer possibilities and debt transfer?

Let us take you through what happens to your debt when you leave South Africa and other related topics.

What happens to my debt when I leave South Africa?

It might surprise you that debt is never erased unless the lender you owe is very lenient. In the world of credit scores, your debt stays with you wherever you go.

If someone leaves South Africa with debt still unpaid, there could be serious consequences that they should carefully consider before acting. People who leave a country do not usually leave their debts behind; they usually stay with them, and ignoring them can have a number of bad effects.

There is a chance that your creditors can go to court against you even if you live abroad. If you get a judgment against you in South African courts, your wages could be taken away, your assets could be taken away, or there could be a judgment on any land you own in South Africa.

Creditors could also send your debt to collection companies that work all over the world, making it even harder to avoid paying.

This will likely have a big effect on your credit score, and it might do so in more than one country.

Not taking care of your debt can also hurt your ties with banks and credit unions, making it hard to gain their trust and use their services in the future.

Lenders and financial companies might not want to work with people who have a history of not paying their debts.

Leaving South Africa with debt may get you in trouble with the law, hurt your credit score, make it harder to make future financial connections, and have an effect on your overall life.

Taking care of your debt before you move is important for a smooth move and to avoid problems in the future.

Does your credit score change if you move to another country?

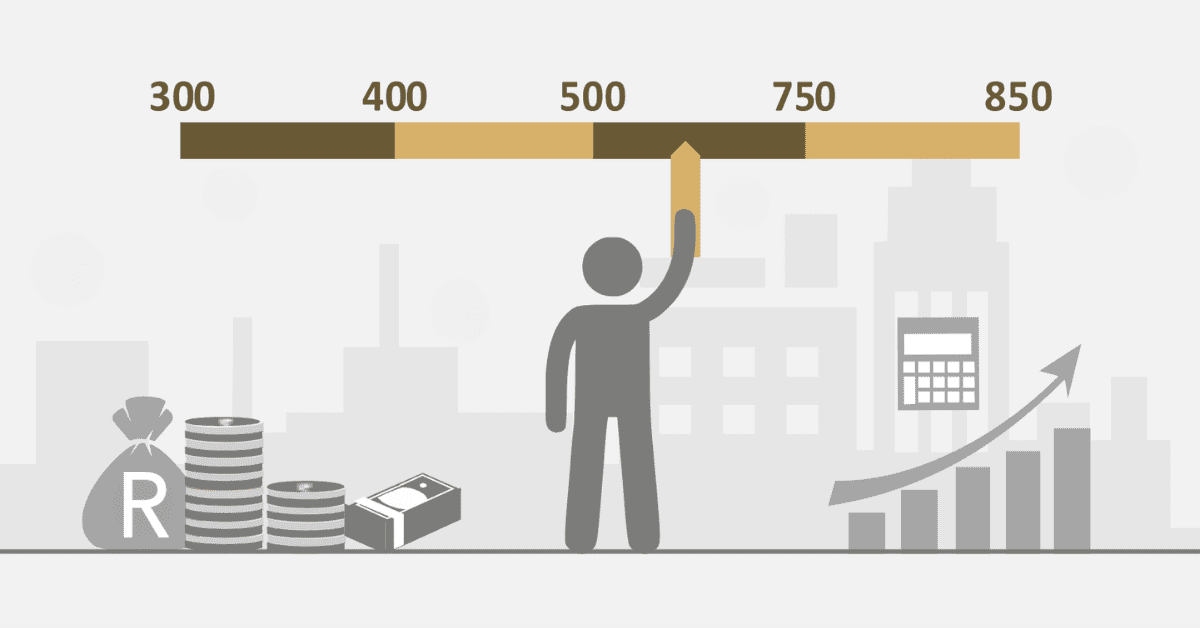

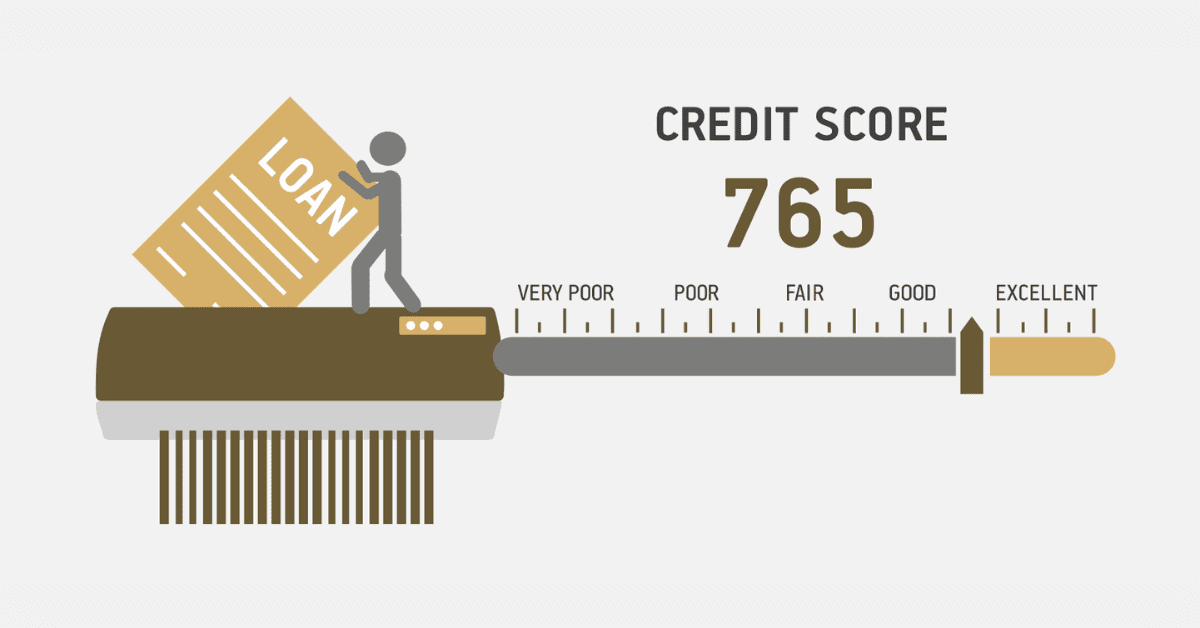

Credit scores are numerical expressions of your payments and debt within a specified location. Moving to another country can change your credit score in a certain way. Although your credit score will not follow you to the other country, the existing debt and payment on your credit score will still be active.

Considering the timelines on your payments and amount, moving to another country can cause a significant drop in your credit score. Once you move to another country without clearing all debt or payment on your credit, it can cause a drop in your credit score.

However, once you move to another country, all things being equal, there is no alteration to your credit score.

Does your credit score transfer to different countries?

Certainly no, your credit score does not transfer to different countries.

In the case where you move from one country to the other, the credit score you acquired can not be transferred to the country you move in.

Credit scores can not be transferred as the structure differs from other countries. Not only that, but your identification you used for the credit application is tied to the country in which you applied and this makes it impossible to transfer your credit when you move to another country.

For example, if you are staying in South Africa and you plan to move to the USA, your credit score can not be transferred.

There are no medium and acceptable terms among credit bureaus to transfer credit to different countries. Although credit bureaus could share information about deadly defaulters among countries, it still does not make it possible to transfer your credit score from one country to the other.

How long does bad debt stay in your name in South Africa?

A bad debt is considered an amount owed to a lender that can not be recovered. Supposing an individual owes a lender an amount of R5000 and the lender is not able to get the money back for some period, it could be regarded as a bad debt. In this case, it is mostly assumed, the individual in debt can not pay that particular debt.

In South Africa, if you have a bad debt, it could stay in your name for not less than 5 years. Until there is a court judgment to pass a final verdict on the debt, you could have the bad debt to your name for 5 years or more.

Does your debt follow you if you leave the country?

Your debt can not follow you if you leave the country, but there are instances where you may have to clear yourself, confirming you do not have any huge existing debt.

When you leave your country, your debt stays but will not be cleared.

Once your lenders exist, your debt stays with your name and the country you may find yourself in. but in the case of leaving the country, the debt will not follow you to that new country.