Failure to pay due tax types in South Africa is a criminal offence. However, there can be many reasons that people have become non-compliant, and SARS prefers to work with people to bring their tax status into compliance, so if you have accidentally missed a tax return or found out that an employer has not paid over taxes on your behalf, don’t panic!

There’s plenty to do to remedy the situation, and SARS will typically work with you if you are willing to bring your account into compliance. Harsh penalties are typically reserved only for those actively evading paying tax. Today, we will look at some common questions about not paying taxes in South Africa and what to do in specific situations.

What Happens if You Don’t Pay Taxes in South Africa?

It is, as we stated, a criminal offence not to pay due taxes in South Africa. This also means ensuring all tax returns are submitted timeously- even if the return was a zero balance, you could earn quite severe admin penalties for failing to file it correctly. All arrears balances that are due will attract administrative penalties and interest. The administrative penalty for failing to pay or file a return starts at R250, and can be as high as R16,000, depending on the time for which it has not been paid and the tax type. As of the 2026 tax year, all grace periods to bring your tax into compliance have expired.

If you have discovered an unfiled return or unpaid bill by mistake, the sooner you address the issue, the lower these penalty fees will be, although you can still expect to pay some punitive costs. SARS are typically willing to work with taxpayers to bring accounts into compliance, so it is better to deal with the matter head-on rather than evade it further unless you are willing to risk criminal judgements and possibly jail time when they catch up with you.

Can you go to Jail for Tax Evasion in South Africa?

Both tax evasion and tax fraud can carry jail time in South Africa, with a maximum prison sentence of 5 years. You will also attract punitive fees and interest on balances owed. Remember, however, that SARS would rather see you bring your account into compliance than pursue criminal charges against you, especially if the error was honestly made. You can discuss the issue with them and possibly enter a repayment plan to address the issue.

How Many Years Can You Legally Not File Taxes?

If you are earning above the tax threshold

- You earned less than R500,000 in gross income

- You have one employer only, with no other income source (eg rental income)

- You have no allowances you wish to claim

- You do not wish to use any deductions or rebates, such as medical expenses or retirement annuity contributions.

Of course, SARS do not particularly care about the last two points if you fail to utilise them to your advantage! They will simply take the higher tax amount provided your employer has been paying it over as PAYE on your behalf, and you will miss the chance to make those allowances or deductions work for you.

How Much Do You Have to Earn to Not Pay Tax in South Africa?

To not pay tax in South Africa, all of your combined income must come in under the tax threshold. That is R91,250 per annum in the 2026/26 tax year, and is adjusted annually or bi-annually. This includes wages and salaried income as well as supplemental income from side gigs, rental, investments, and other sources.

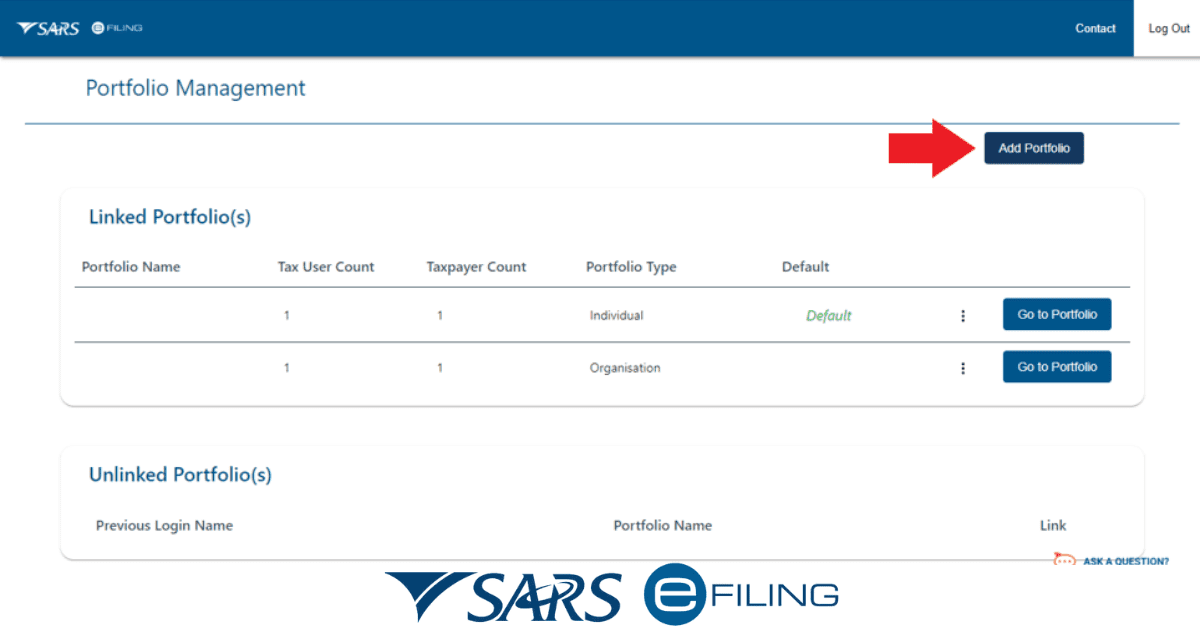

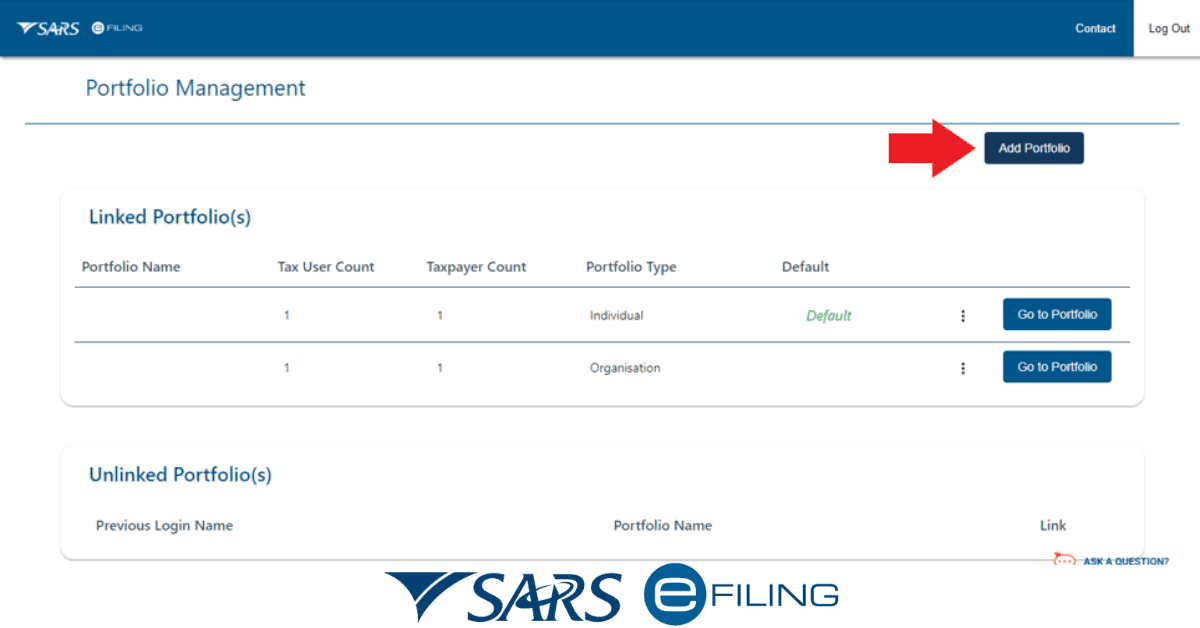

How to Pay Unpaid Taxes

If you have become non-compliant with SARS, they will first require you to bring all missing/unfiled returns up to date on their system. This allows them (and you) to see the full picture of unpaid taxes due to them. You can then request a statement of account from them and make a plan to bring the amounts up to date and your account into compliance.

If there are amounts you wish to dispute, you can lodge a dispute with them. You will then have 7 days to pay all due amounts, or you will need to request a payment plan with a supporting reason. Once this is in place, you will need to pay the agreed amount monthly until your backlog is cleared.

While it can be scary to owe ‘the taxman’ money, addressing your non-compliance issues and bringing your accounts into compliance rather than running from the problem is always best. Remember that SARS are typically willing to help you address the issues and become compliant and will not usually enact criminal penalties unless you are deliberately evading taxes or forcing them to ‘come looking for you’ rather than openly declaring your intention to remedy the situation.