Once you begin your credit score journey, it maintenance can be the frustrating part of it. Obtaining and maintaining are closely related but they have their own risk.

Beginning with responsible financial habits is crucial for building a solid credit score.

Individuals obtain credit through the creation of accounts and the regular payment of instalments.

Responsible financial behaviour over time can lead to a better credit score, giving you access to more favourable loan terms and opportunities in the financial sector. To ensure a stable and positive credit profile, it is crucial to practise responsible credit habits consistently.

On the contrary, we will take you through how to maintain a good credit score, the need to maintain the credit score and some of the things that can affect your credit score.

How do you maintain a good credit score

Once you have achieved a good credit score, the key is to maintain it. It is necessary to prioritise the key aspects of your credit score, establish automatic bill payments, steer clear of debt, and regularly monitor your credit score.

Understanding credit, its calculation, the importance of maintaining a good credit score, and monitoring it regularly is key to ensuring a high credit score.

Here are some key tips on how you can maintain a good credit score.

- Late payments can have a significant impact on your credit score. Just one late payment can cause your score to drop by a significant margin. It is important to ensure that you pay your bills promptly each month to prevent any issues. Automate payments and reminders to ensure you stay organised and on top of your financial commitments.

- Be mindful of your credit usage. When you assess the ratio of your credit usage to your available credit, you determine your credit utilisation. Excessive use of credit can negatively impact your credit score. It is advisable to keep your credit utilisation below 30% to maintain lower interest rates.

- By regularly monitoring your credit report, you can identify any errors or suspicious activities that might be negatively impacting your credit score. Each year, the three credit bureaus offer a complimentary copy of your credit record.

- Avoid opening multiple new accounts simultaneously. Opening too many new accounts quickly can be seen as risky by lenders, potentially damaging your credit score. It is advisable to apply for credit only when it is truly necessary, rather than all at once.

By following these tips, you can maintain a high credit score and increase your likelihood of securing a loan. Supposing you are looking to purchase a new car and require a loan. If your credit is excellent, you might have the opportunity to secure a loan with more favourable conditions and a reduced interest rate. Throughout the loan, this will result in a reduction of interest payments, potentially leading to significant savings.

Why is it important to maintain a credit score?

There are several reasons why you should strive to keep a decent credit score.

First and foremost, it has the potential to save you money on interest and fees by allowing you to qualify for loans and credit cards that are offered at the most competitive rates ever.

In addition, if potential landlords examine your credit history, having a decent score may make it easier for you to qualify for rental apartments or save you from having to pay a security deposit on utilities.

The benefits that can be derived from maintaining a credit score are unlimited and have a positive trickle effect on an individual’s financial life.

What are the things that hurt your credit score?

Various factors can have a detrimental effect on your credit score. Delinquent payments on credit accounts, such as credit cards and loans, play a major role.

Having high credit card balances compared to your credit limit can negatively impact your credit score.

Opening multiple new credit accounts in a short period can indicate potential financial instability and have negative consequences.

Bankruptcies, foreclosures, and other public records have a significant impact on your credit score. When you close old credit accounts, it can have an impact on your credit score by reducing the length of your credit history.

Defaulting on loans and having accounts sent to collections can leave a lasting mark of negativity.

By consistently keeping an eye on your credit report and adopting responsible financial habits, you can minimise these risks and ensure a strong credit score.

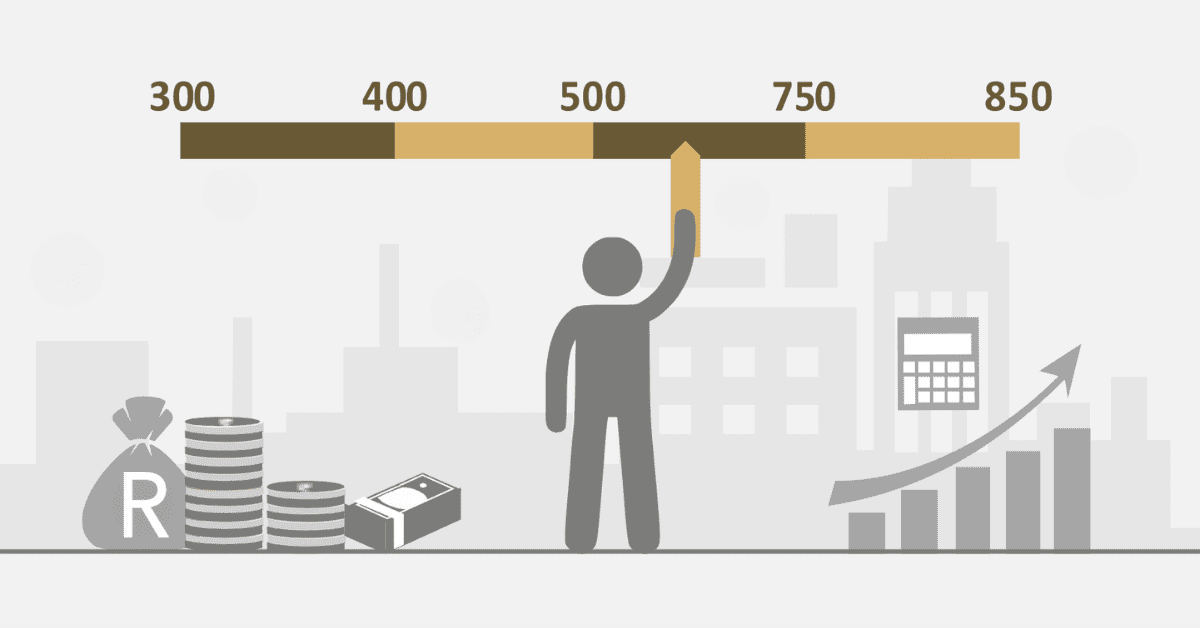

How long does it take for credit score to go up?

It is always optimistic to perceive your credit score going up. A higher credit score can offer you many opportunities. It is quite common for people to get an understanding of the timeline for a credit score to go up.

If you are concerned about how long it will take for your credit score to go up, then you must understand this can alternate.

Credit scores can go up within 30 to 45 days. When you make the right payment on time, that activity may not push your credit score to go up immediately although the payment has been recorded.