Banking apps have become a must-have in the digital age, providing innumerable services at our fingertips. Such is the ABSA Bank app, which is exemplary in providing all things financial in South Africa. Here, the user manages their finances and checks their credit score, which is a great parameter for financial planning. This article will take you through checking your credit score on ABSA App, delving into the credit rating of ABSA Bank, discussing the approval time for ABSA personal loans, and evaluating the correctness of credit scores supplied by banking apps.

How To Check Credit Score On The Absa Application

One key feature of the ABSA Bank app is the credit score check, which is accessible from within the app. This enables the user to get instant access to their credit health information and allows them to make informed choices.

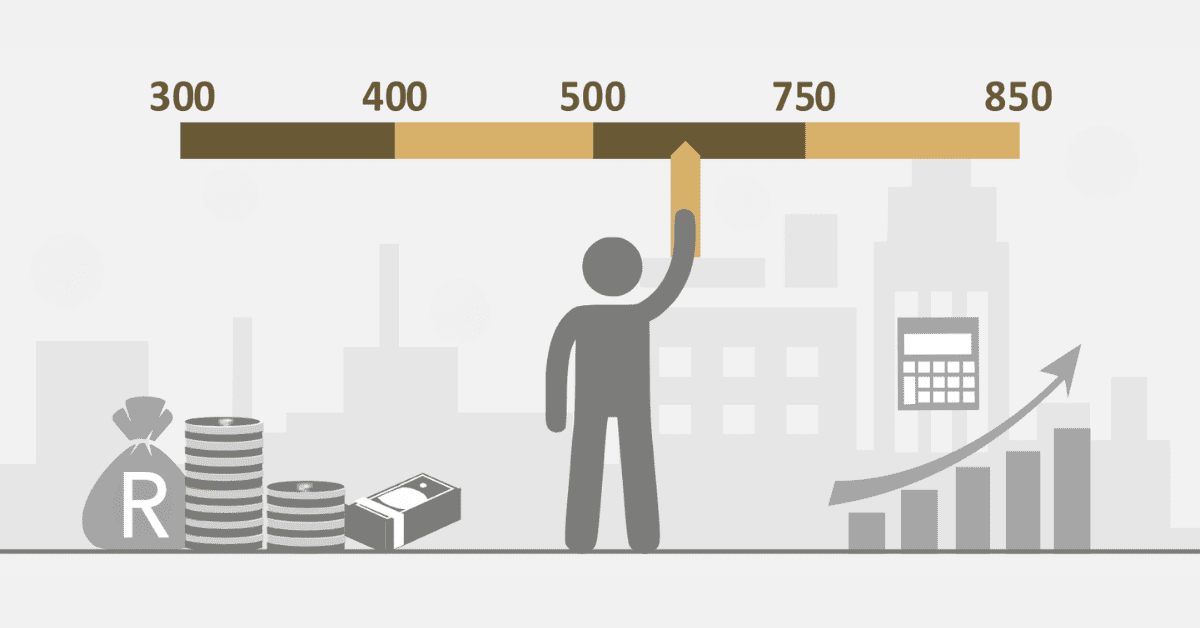

Your credit score is a quantified report card that says how much of a liability you are to your lenders. It measures your capacity to repay a loan and gives a lender the basis to understand what amount of credit they can extend to you. You may simply check your score on the ABSA Bank app and look at it when necessary.

To check your score on the ABSA app, your device needs to link to the application first. Click on the ABSA Banking App and tap ‘Link this device.’ Enter your South African ID number and tap ‘Next.’ You can see your accounts from the dashboard once the device has been connected. Your credit score is available in your credit card information.

At the same time, while there are some limits when checking your credit score within the ABSA app, it allows you to view your credit score at any time. This is very helpful, especially in home loans, because generally, the better a person’s score is, the easier it is to get approval and the better the terms will be.

The ABSA application features a flawless interface that warrants zero tension. It makes it easy for customers to view their credit scores and check their financial health status. Absa, one of the best banks, has integrated the concept well with the bank app. This goes beyond traditional institutions, creating a top-tier digital service for guys and their clients.

Remember that your credit score is not fixed; it changes as your financial status changes. Regular checks on your credit score through the ABSA app keep you posted on the health of your finances and guide well-informed financial choices.

What Is The Credit Rating Of Absa Bank?

Credit rating is an important measure for a bank, which discloses financial strength and stability. Since ABSA Bank is considered one of the top financial institutions in the country, its credit ratings are under periodic assessment by several international rating agencies.

ABSA Bank Limited has been assigned a long-term issuer default rating at BB- and a national long-term rating of AA+ (zaf) by Fitch Ratings. Moody’s Investors Service has downgraded the long-term local currency and foreign currency deposit ratings of ABSA Bank Limited to Ba2 from Ba1. Further, GCR has maintained the issuer credit ratings of ABSA Bank Limited at AA (ZA) /A1+ (ZA) on the unsolicited national and international scales and BB on the national long-term rating scale.

These ratings are constrained by the country’s economic conditions and the associated risks. For ABSA Bank, the franchise strength is good, the liquidity is sound, and the absorption capacity is high against the macroeconomic challenges.

It should be noted that credit ratings change with the performance of the bank and the economy. Hence, the latest ratings should be obtained from rating agencies’ websites for the most updated, correct information.

How Long Do ABSA Personal Credits Take to be Approved?

Getting a personal loan could be one of the most important steps toward getting your financial management in place. In the context of ABSA Bank, as it happens to be one of the important financial institutions in South Africa, the general process involved in approving a personal loan is efficient and transparent. A general loan from ABSA can be approved within 24-48 hours, provided a complete and accurate application is given and one has a good credit history. Normally, they decide on the same day, and another three to four working days are taken for underwriting. However, it is very important to note that such timelines can be longer based on a couple of other factors, including individual circumstances and the details of the loan application.

How Accurate Is Credit Score On Banking App?

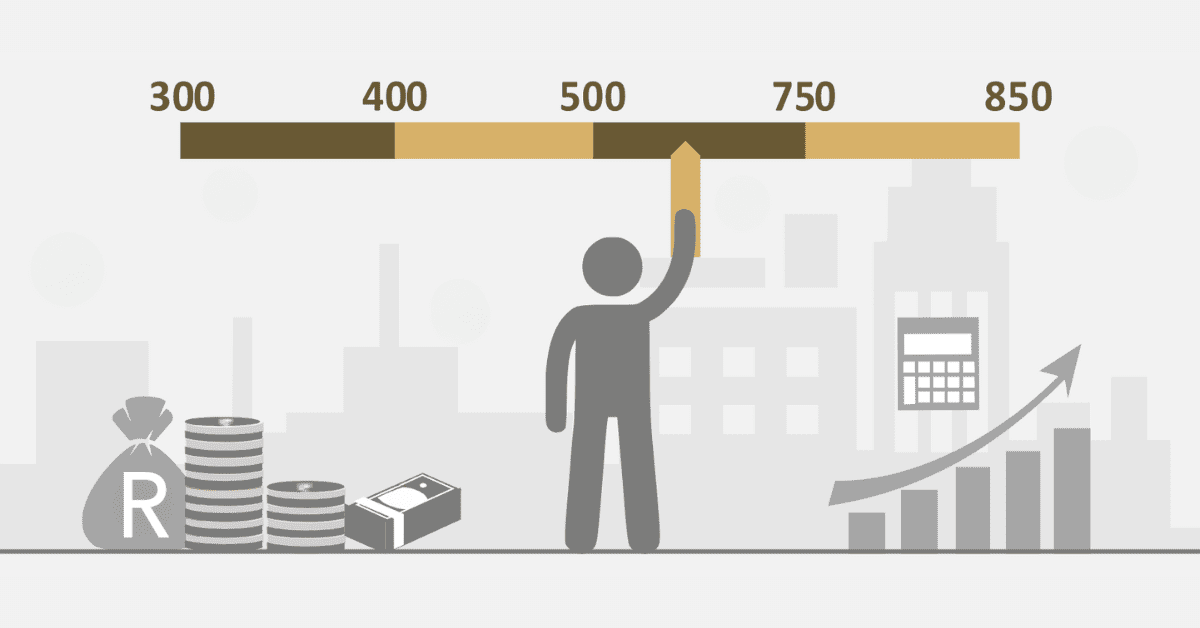

Like in the case of ABSA, the scores for most of these apps are obtained with credit score data from the registered credit bureaus. The score calculations are upon the nature of debt repayment history, amounts owed, types of credit applied for, and how long your accounts have been opened.

It is essential to note that credit scores available through these services only indicate your credit health and, at times, are not a true reflection of the score that the lender would use, as different lenders may use different scoring models. Banking apps, therefore, provide a handy way to stay on top of your credit score, though it should be used as a yardstick rather than a precise measure of creditworthiness.