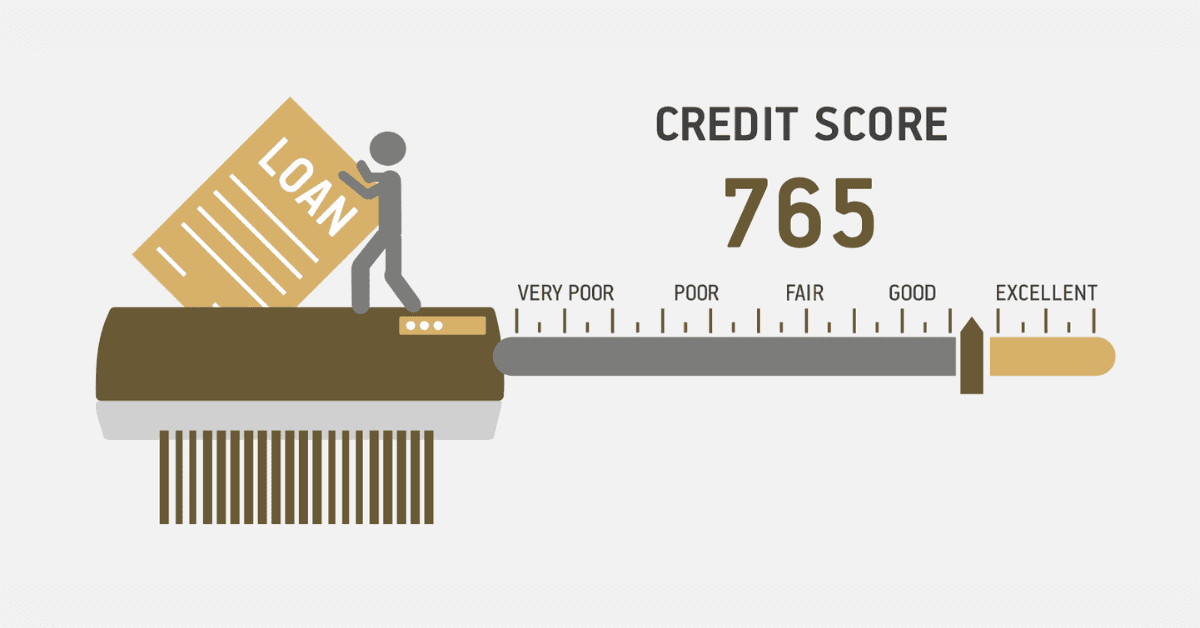

At some point in time, we all need to obtain loans to make big purchases like homes and cars, start businesses, or cover other needs that we cannot meet with our savings. When you apply for a loan, the potential lender will conduct background checks to assess your creditworthiness. Most lenders check the applicant’s credit score to see if they are capable of paying back the money.

With a good credit score, you are likely to get the loan you want at favorable interest rate. To ensure that your score is good, you must regularly check your credit report and take appropriate action to improve it. There are different options you can consider to obtain your credit record from any of the credit bureaus operating in South Africa. This article explains the steps you can take to check your credit report for free in South Africa.

How Do I Check Credit Report for Free in South Africa?

Everyone is entitled to get a free credit report from the major credit bureaus operating in South Africa including Experian, TransUnion, XDS, and Compuscan. For example, Experian has an easy-to-use online portal called My Credit Check that allows South African citizens to check their credit scores. All you need is a valid South African ID to access your credit record.

When you visit the official websites of other credit bureaus operating in South Africa, you can also access your credit report by first creating a profile. Whenever you want to access your free report, you can use your login details on the website.

How to Calculate My Credit Score in South Africa?

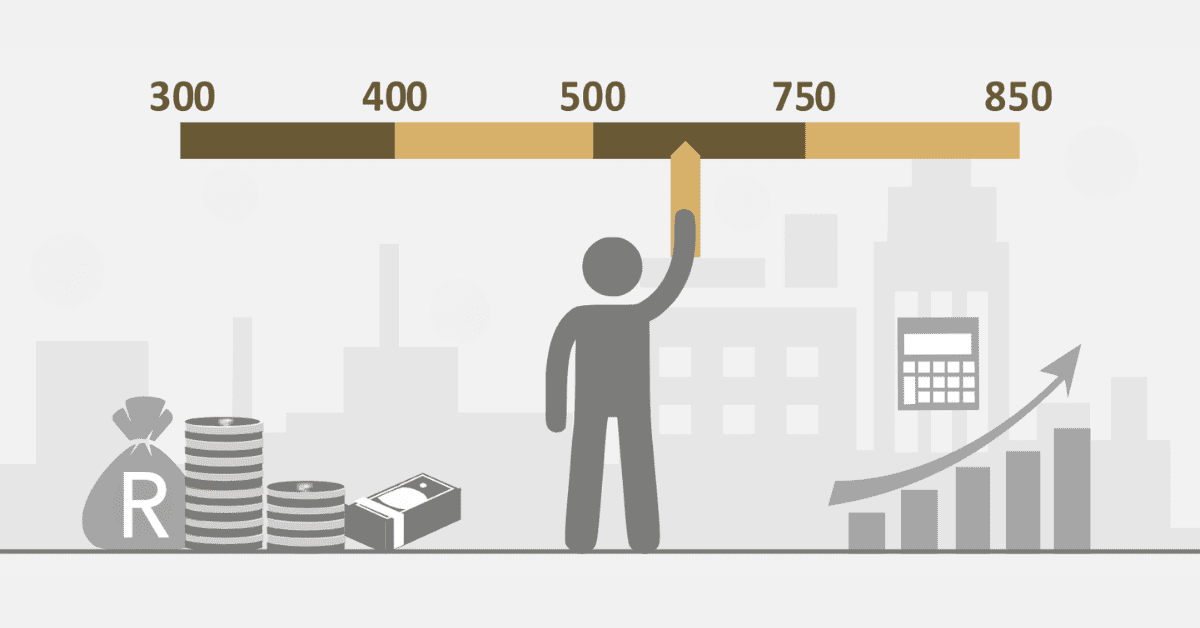

The calculation of credit scores in South Africa like anywhere else is the responsibility of credit bureaus operating there. Ordinary citizens or even financial institutions cannot calculate credit scores. To ensure transparency, only credit bureaus can calculate credit scores for different consumers using data obtained from banks and other financial institutions that provide lines of credit.

Basic information used to calculate your credit score includes credit accounts, personal loans, other lines of credit, public records, administration orders, and judgments. Additionally, if you have late payments or missed payments on your account, the lenders will provide this information to credit bureaus, and it is used to calculate your credit score. Details such as location, gender, or race are not used in calculating credit scores.

How Do I Check if I’m Blacklisted?

When you hit hard times in life, your financial health may be negatively impacted to the extent of failing to fulfill your credit obligations and other financial responsibilities. If you have unpaid debts for an extended time, lenders will report you to credit bureaus, and you’ll be blacklisted. Once you are blacklisted, you will not be able to access a line of credit in South Africa.

You can only know that you have been blacklisted when you obtain your free credit report from any of the credit bureaus in the country. Your credit report contains comprehensive details about your credit history including defaults, late payments, and judgments against you. Analyze your credit report carefully to see if you have been blacklisted. You will get everything from your credit report.

Another option you can consider to check if you are blacklisted is to make a follow-up with your employment references. You may realize that all your employment applications always hit a snag even when you have the right qualities for the job. If a potential employer discovers negative information on your report, they may provide unfavorable feedback. Therefore, it may be necessary to approach your references to seek some answers that may clear your suspicions. Remember to be polite when you approach your approach your reference.

In South Africa, regulatory bodies or specific industries have the authority to legally blacklist people who have violated certain provisions of the law. If you think you may have crossed the line with these bodies, you can consult them to get first-hand information about your status. You need to gather relevant information that may support your case. Once you discover that you’ve been blacklisted, you can take appropriate action to rectify the issue. There are different options you can consider to have your name cleared from a credit bureau.

What Is the Easiest Way to Check Someone’s Credit Score?

The National Credit Act (NCA) states that no ordinary person in South Africa can check someone’s credit score. If you are not authorized to access the account owner’s credit record, you should never attempt. Accessing someone’s credit record without permission attracts heavy fines and leads to imprisonment.

However, certain persons including businesses can access other people’s credit scores for a lawful purpose. Whatever the reason you may want to check someone’s credit rating, you should seek written consent from them. Persons who can check other people’s credit scores include landlords, employers, insurance companies, lenders, utility providers, and others. Before approving clients to access specific services, the providers need assurance that the client will be able to meet their obligations.

It is vital to seek written permission from a potential client before you access their credit report. Both individuals and businesses must seek permission from clients to avoid lawsuits. Government agencies are the only entities that can access other people’s credit ratings without seeking consent.

To maintain a good credit score, it is imperative to check your credit report regularly. Each individual is entitled to get a free credit report and credit score from credit bureau agencies in South Africa. Your credit report has comprehensive information about your credit history. If you have been blacklisted, you will get the details from your credit report.