Working your way through the never-ending puzzle of credit scores can be very frustrating since problems keep coming up. To avoid this stress, it is very important to keep learning because information empowers people to actively enhance their credit scores.

To improve your creditworthiness, you can take strategic steps like learning about the factors that affect credit scores and developing good money habits and habits.

The answer to long-term problems that can hurt credit scores is ongoing schooling and a strategic approach to managing your finances.

This will give you a way to deal with the constant problems. Being able to make choices based on correct information is a useful skill that may reduce the stress of credit scores and help you build a stronger financial future.

As we continue, you will learn more about bad credit scores, the time it takes for credit scores to improve and many more.

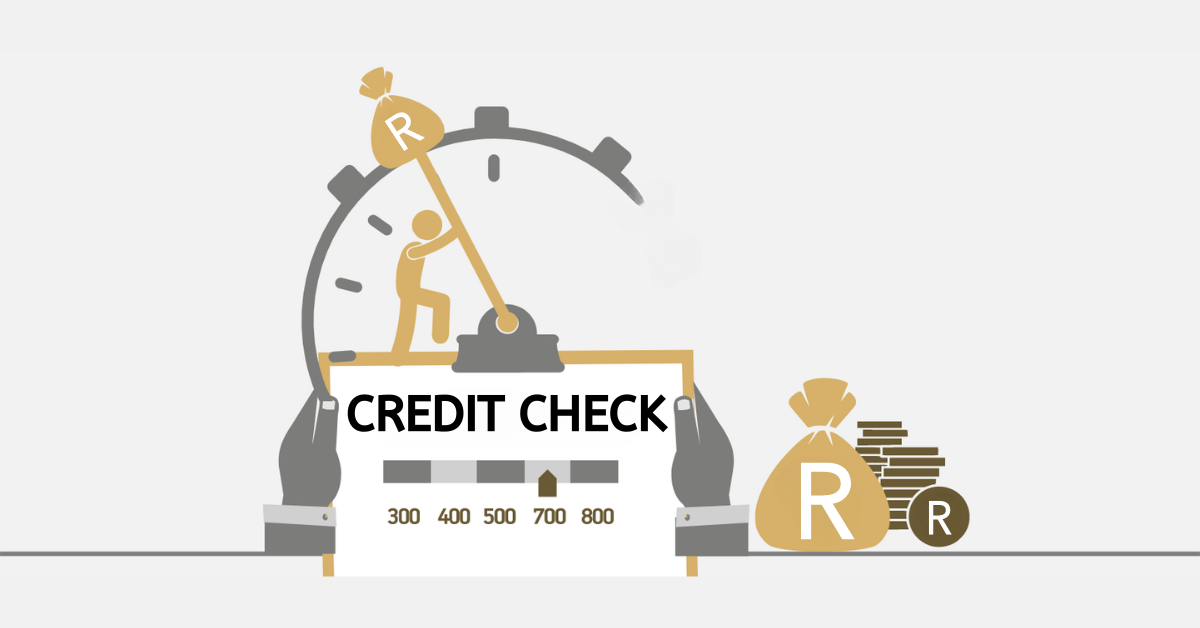

How long does credit score take to improve

In the past, your low credit score could have been caused by many different factors, including a bad payment history, a high credit use ratio, several credit products, mistakes in your credit report, and so on.

It usually takes between 3 to 6 months to improve your credit score. Although there is no guarantee on the timeline, it can reflect on your credit history.

How quickly does your credit score rise after paying off debt?

Getting rid of debt can help your credit score, and the rate at which it goes up will depend on many things. In most cases, you should start to feel better in a few weeks to a couple of months.

Your credit utilization ratio goes up as you pay off your debts. This is an important factor that determines your credit score. Making payments on time and being careful with money can also help your credit score rise faster.

But the exact date can change depending on your credit history, the type of debt you are paying off, and other things you do with your money. Having good money habits and paying off your debts on time can make a bigger and longer-lasting difference in your credit score over time.

Usually, it can take between 30 to 45 days to see some credit score rise after paying off your debt.

What is a bad credit score?

People with bad credit may have a harder time getting loans, credit cards, or good interest rates. Also, it might make it harder to rent an apartment or get some jobs.

People with bad credit can work on improving their scores by making payments on time, lowering their bills, and fixing any mistakes in their credit reports.

For people with bad credit to improve their creditworthiness over time, they need to make changes to how they handle their money.

In South Africa, a credit score below 580 is usually thought of as bad. Credit scores are very important for figuring out if someone can get credit and other financial goods.

Lenders see a low credit score as a bigger risk because it means the person has missed payments, defaulted on loans, or had other money problems in the past.

No one seeks to have bad credit, but when the unfortunate happens you have to seek ways to improve your credit score in a faster way.

What causes a credit score to go up?

In South Africa, there are several means which could impact your credit score by making it go up.

Paying your bills on time, including credit cards, loans, and utility bills, has a positive impact on your credit score.

Using credit consistently and managing different types of credit, like credit cards and instalment loans, can help improve your credit score.

Maintaining low credit card balances concerning the credit limit and refraining from reaching the maximum credit lines can be beneficial.

Having a long history of credit accounts with a positive repayment record can greatly improve your creditworthiness. It is essential to regularly review and rectify any mistakes on the credit report.

Working towards financial responsibility and keeping a positive credit history are crucial factors in building and enhancing credit scores in South Africa.

There are several methods to start creating a credit history. One option is to consider applying for a credit card that is suitable for individuals with fair credit, such as a secured credit card. Another possibility is to become an authorized user on someone else’s credit card account. Additionally, obtaining a loan is also a potential avenue to explore.