Investing in the Johannesburg Stock Exchange means creating more wealth for oneself by becoming a part owner of a company. For both experienced and inexperienced investors, this is the reason familiarity with the JSE is essential — to make independent decisions.

JSE is the oldest and largest exchange not only in South Africa but also in the African market. It provides open access to shares of a broad spectrum of companies from a different side of the economy. This article aims to introduce you to the basics of the operations carried out within JSE, take you on buying your first share

How does JSE work?

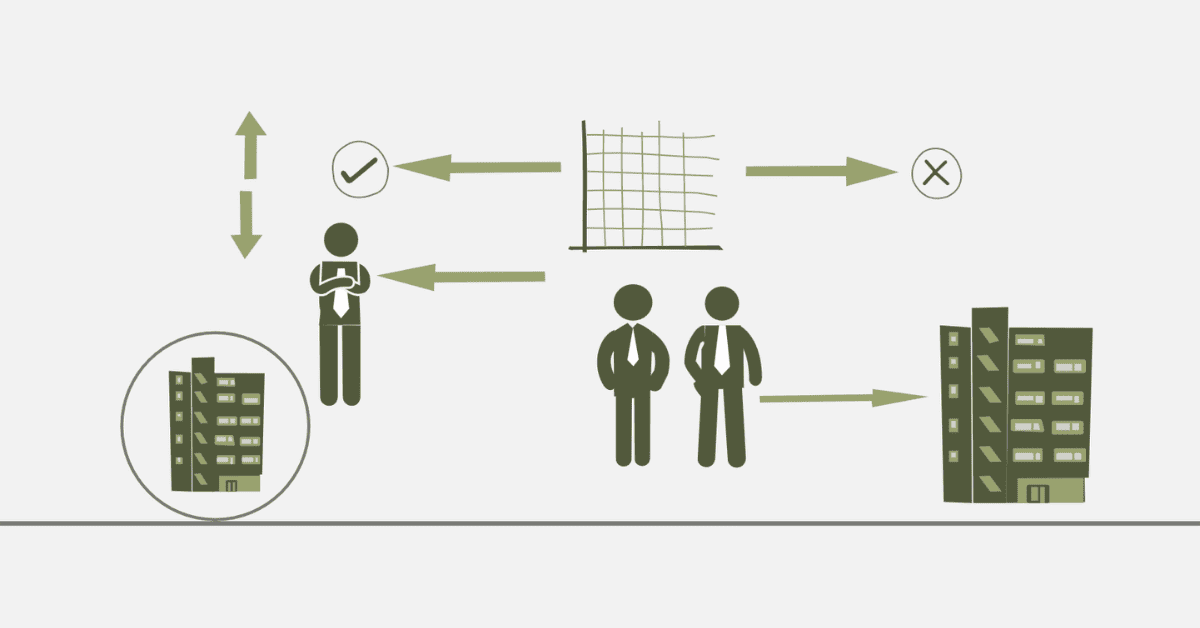

The Johannesburg Stock Exchange offers the selling and buying of shares in publicly listed companies. When a company lists its shares on the Johannesburg Stock Exchange, it raises capital from investors and, in turn, issues stakes to them in such respective ownership. The shares, therefore, are priced concerning market conditions, a firm’s performance, and other broad factors of the economy. They are bought through brokers who execute an order on the exchange on the buyer’s behalf.

The JSE uses an electronic trading system that provides efficiency and transparency in trades. It also offers diverse monetary ventures like shares, bonds, and derivatives. Thus, it suits various investment strategies. Generally, how the JSE works presents an insight into how investment decisions are made. It is at the core of the South African fiscal markets.

How to Buy Shares on the JSE: A Step-by-Step Beginner Guideline

- Open a Brokerage Account: Select a brokerage agency registered with the JSE. A brokerage account is your door to the world where shares are traded.

- Shares Research: It is necessary to research all research companies listed on the JSE before investing. Gauge company performance, industry trends, and market conditions before you invest in that share.

- Fund Your Account: As in any account, you must add money to your brokerage account. The figure will depend on how much you plan to invest.

- Place an Order: Once you have funded your trading account on the exchange, you can place your order through your broker. By doing this, you can choose to execute the purchase in any of the two ways available. First, you can go with a ‘market order,’ which is to buy at the current price. Or, you can go with a ‘limit order’ to buy at a specific predetermined price.

- Keep Monitoring Your Venture: After the purchase, monitor your portfolio occasionally. Watch the market trends and the significant performances of companies. This can help you make quick decisions on holding/selling the shares or on buying more of the same.

- Review and Adjust: Periodically assess your strategy and adjust your portfolio to ensure it stays on course to meet your fiscal goals.

How much does it cost to invest in JSE?

As with all investments, when you invest in the JSE, many costs are involved, such as brokerage, taxation, and cost of shares. Brokerage charges can vary anywhere from 0.1% to 0.5% per transaction at most brokers. Remember, too, there are taxes and specifics relating to the size of your investment in the JSE. Also, be aware that there is a Securities Transfer Tax at a rate of 0.25% on transfers of shares.

These costs must always be ascertained upfront before planning the actual investment. The prices of shares tend to vary, such that some go even for less than a couple of rands, and others can be alarmingly expensive. It is often wise to start small and increase your stake as you get comfortable with the market.

What are the best JSE shares to buy now?

Consider both the current trend in the market and the long-term potential while choosing shares to purchase. Great agencies that come to mind include Naspers and Anglo-American Platinum. Others are Kumba Iron Ore, Nedbank, and Bidvest. For example, Naspers is seen as a consumer internet group leading the way into previously untapped areas. At the same time, Anglo American Platinum and Kumba Iron Ore provide exposure to the materials sector. Nedbank stabilizes the banking sector, with Bidvest positioned as an industrial group boasting a well-diversified strong record. The companies have revealed character and growth potential and become quite alluring to investors.

What are the cheapest shares on the JSE?

Investors who try to start with smaller investments can invest in some of the cheapest shares on the JSE, which are from Curro Holdings Limited (JSE: COH), Brikor Limited (JSE: BIK), Delta Property Fund Ltd. (JSE: DLT), 4Sight Holdings Limited (JSE: 4SI), and Capital & Counties Properties PLC (JSE: CCO). These are usually found in lower pricing due to various causes, including small market capitalization or dwelling in sectors that are in favor. They can, however, yield considerable upside potential if companies go well. Detailed research on companies is also necessary to investigate the risks and other opportunities when considering such investment in lower-priced shares.

Final Thoughts

One powerful means for long-term wealth generation is through the JSE. It requires knowledge of the way an exchange works, careful share selection, and an understanding of the costs involved so that you are sure to succeed in your investment strategy. Combine this with patience and the ability to stay on top of things, and you can ride it out during stock market fluctuations. Start small and informed, gradually increase your portfolio, and you shall be well toward your financial goals.