These terms could be new to you because taxation or tax issues are not often discussed. Before we look into the relationship between eFiling and tax practitioners, it is important to understand the roles of these terms.

A tax practitioner is a person who works in the field of tax law and helps people and businesses get their tax returns ready and filed. In South Africa, tax practitioners are registered with the South African Revenue Service (SARS) and owe a duty of trust to their clients

Tax experts use the eFiling system to send in their client’s tax returns and get access to important information like tax assessments, payment status, and tax-related correspondence. The relationship between tax practitioners and eFiling ensures that tax returns are sent quickly and correctly, which helps both taxpayers and SARS.

Now let us look at how you can activate tax practitioners on efiling, relating it to the South African Revenue Service and all the necessary requirements involved in the eFiling process.

How do I activate tax my practitioner on eFiling?

By activating your tax practitioner on eFiling, you will be able to transmit tax-related information and documents securely and efficiently, reduce the risk of making errors, save time, and gain access to important updates and notifications. The practitioner will also be able to assist you and represent you when dealing with the South African Revenue Service.

Follow these steps to get your tax professional set up on eFiling:

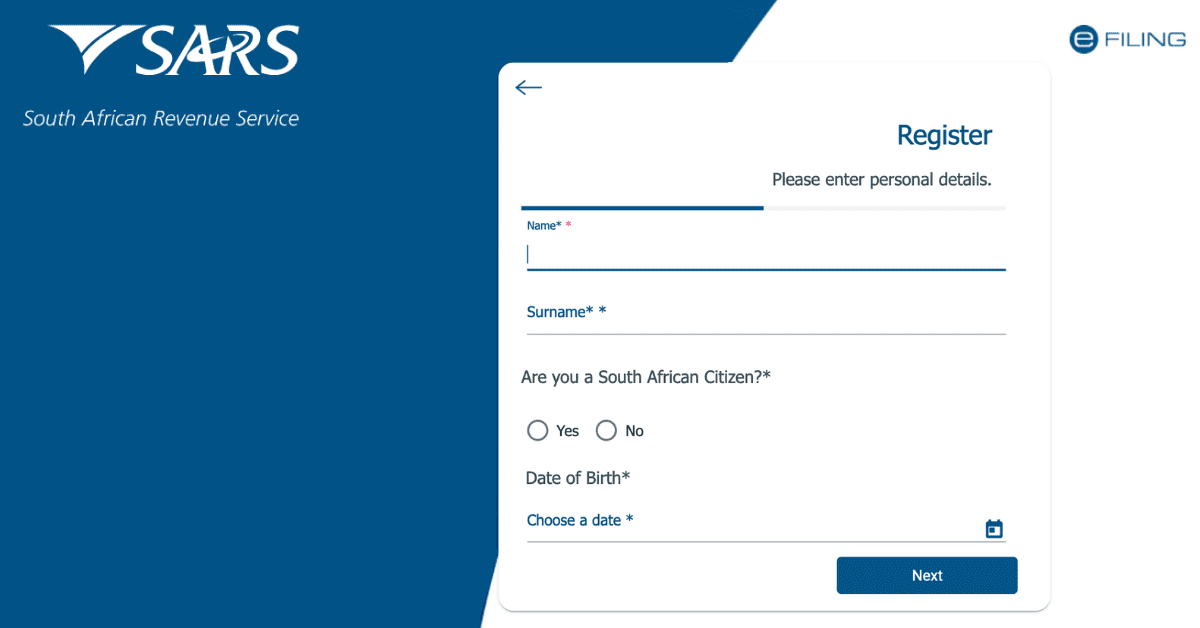

- Go to www.sarsefiling.co.za to find the South African Revenue Service (SARS) eFiling website.

- If you haven’t already, sign up as a new user.

- Choose “Add/Change Tax Professional” from the menu.

- Type in the practitioner’s information, including their name, tax reference number, and email address.

- Make sure the information is right and send the request.

- SARS will send the practitioner an activation email with instructions on finishing the activation process.

- Once the practitioner is set up, they can access your tax returns and send them in on your behalf.

How do I get a tax practitioner number from SARS?

A tax practitioner is someone who completes SARS returns on behalf of third parties for reward/a fee. A person who completes their own tax returns

If you decide to use a tax practitioner for your tax matters, it is important to check if they are registered before asking for their number. You can do so by using this link to verify if they registered. Confirming their registration details allows you to safely use them for your tax matters. You can request their numbers by reaching out to them on their profile or requesting it from the SARS office. This could even be a recommendation from a SARS officer.

How do I register as a tax practitioner in South Africa?

In South Africa, registering as a tax practitioner is a multi-step process. First, you must pass the Board Examination for Tax Practitioners and get the required education. Next, they have to finish a program of hands-on training and get experience in tax practice. Once all of the requirements have been met, the candidate must apply for registration with the South African Revenue Service and show proof that they have met the requirements for continuing professional development. The application will then be looked at, and if the candidate is accepted, they will be registered as a tax practitioner. This process ensures that only qualified people in South Africa can offer tax services to their clients.

What are the requirements to be a tax practitioner?

The South African Revenue Service (SARS) has strict requirements that must be met before one can practice tax law there. This article will discuss the essential requirements and processes for becoming a registered tax practitioner in South Africa.

It is required to have a National Diploma in Taxation or an equivalent qualification in tax, accounting, or finance in order to practice tax law in South Africa.

It is recommended that those seeking to enter the field of taxation have at least three years of experience in an accounting or tax-related role. An accountant, tax consultant, or lawyer can attest to your legitimacy and verify your work history.

Certified public accountants and tax preparers in South Africa must be members of the South African Institute of Professional Accountants or the South African Institute of Tax Practitioners. These bodies ensure that tax practitioners maintain the highest standards of ethics and professionalism. Having these requirements are essential for you to be a tax practitioner and also have that integrity for your operations.