Is there a relationship between student loans and credit scores? Many students who are supporting their studies with student loans may ponder about the impact of that on their credit score.

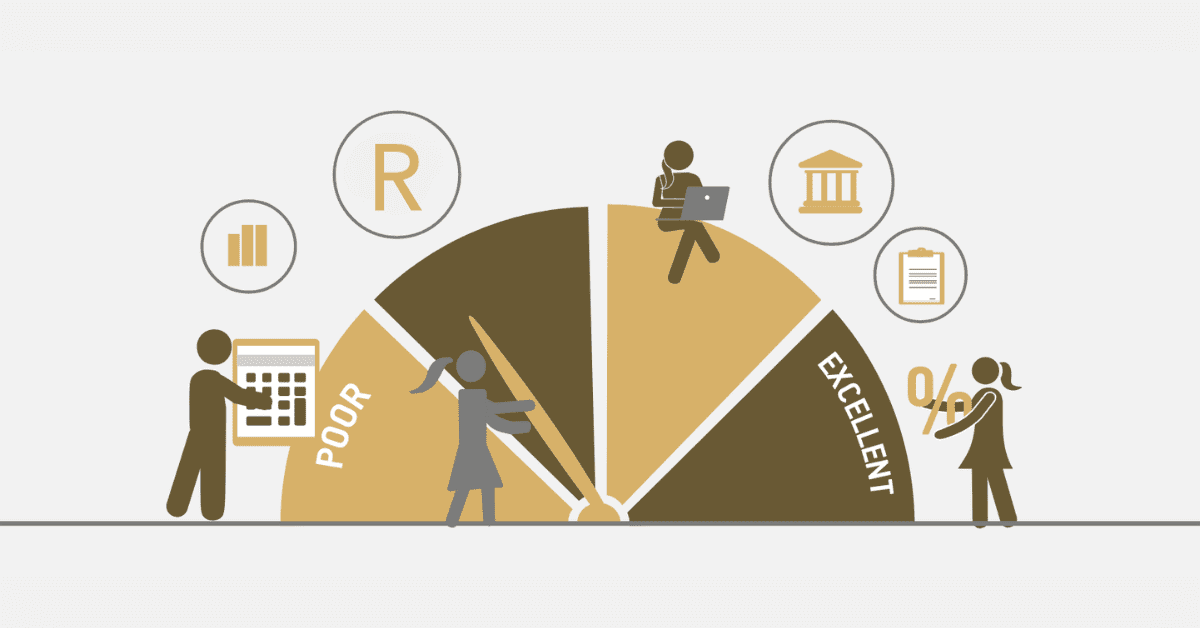

Student loans can have a positive or negative impact on your credit. With Positive, it can help by building your credit history, strengthening your credit profile, and diversifying your credit portfolio. Timely loan payments can contribute to establishing a favourable payment history. However, just like any other instalment loan, failing to make payments can negatively impact your credit.

Indeed, credit holds significant value in the life of a consumer. It has an impact on your chances of being approved for various things, such as credit card applications, car financing, and securing a mortgage for your first home.

Understanding the correlation between student loans and credit scores can help you prepare ahead.

We will share some insight on how student loans affect your credit score and some of the related credit score issues with student loans.

How do student loans affect your credit score

Whether a private student loan or a government student loan; both can influence your credit score. There is a positive and negative side to how student loans can affect your credit score.

Should you secure the loan and pay right on time, you could build your credit history. This is a positive note as it builds up to provide your ability to repay loans on time.

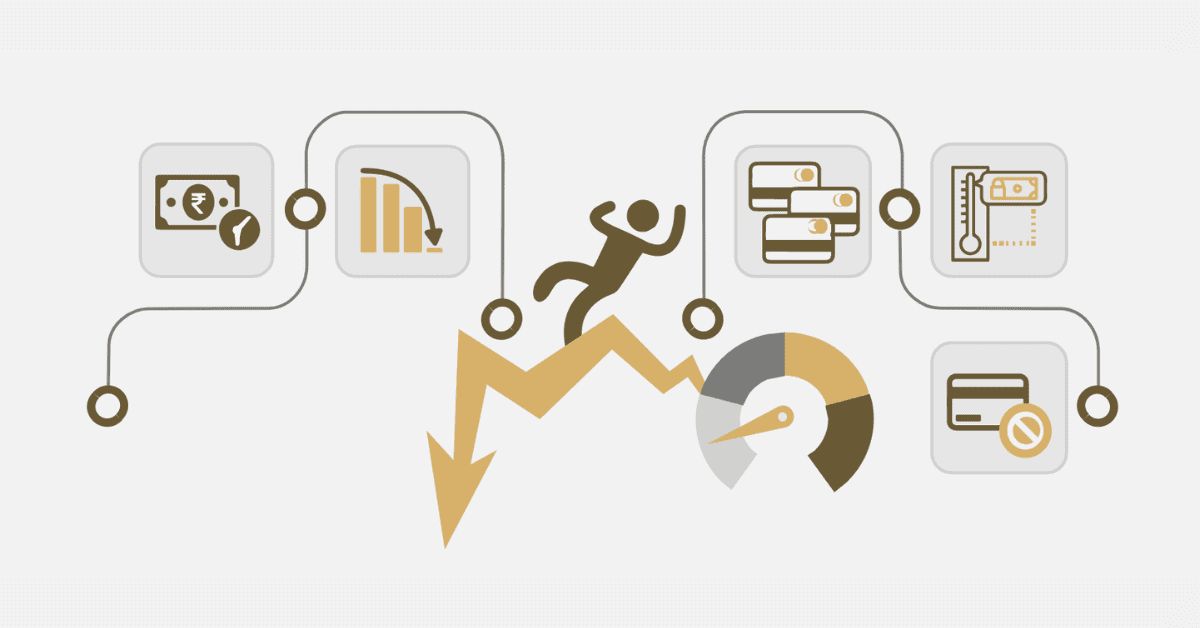

When everyone considers an effect on a particular thing, the first thought is negativity. Let us delve more into how negatively student loans can affect your credit score.

Firstly, when you apply for a student loan and the lender checks your credit, it will show up as a hard inquiry on your credit report. When you decide to apply for a credit card or any other loan, the lender or credit card issuer will obtain your credit report from one of the three major credit bureaus; Experian, Equifax, or TransUnion. This is commonly referred to as a hard inquiry or hard pull. Applying for new credit can harm your credit score, even if you are ultimately approved or denied.

Depending on the timing and reporting by your lender, a delayed student loan payment can potentially lower your credit score.

In addition, it is important to note that according to the major credit bureaus, late payments have the potential to stay on your credit report for years.

Furthermore, once you are approved and take out the loan, it will be reflected on your credit report as an instalment loan.

While your student loans are reflected on your credit report, the crucial factor is not the actual loan balance, but rather the payments you make towards it. Lenders expect borrowers to consistently make timely payments on their loans throughout the repayment period.

If you happen to fall behind on payments or default on your student loan, it can have a negative impact on your credit report.

Will my credit score go up after student loan?

Failing to pay your student loan on time can hurt your credit score. However, should you pay the required amount and also on time, it is more likely to have your credit score build to a good range.

Certainly, your credit score could go up should you do the needful and adhere to all the credit score and payment regulations.

In contrast, any late payment or failure to pay could have serious consequences on your credit score for years.

Why is my student loan not on my credit report?

It is very possible for your student loan not to show up on your credit report. This can happen as a result of various factors. Below are some of the reasons that could result in your student loan not showing on your credit report.

- If you are currently in your grace period or if your student loans are in deferment, they may not be reported to credit bureaus at this time. Lenders typically report loans once they enter repayment status.

- Lenders usually provide updates to credit bureaus on a regular basis, usually monthly. If your loan information has not been reported yet, it could be because of the timing of the reporting cycle.

- Another reason could be error reporting on the side of your credit agency. It is important to double-check with both parties to make sure all the required information has been provided and there are no inconsistencies.

- If your loan has recently been transferred to a new loan servicer, there might be a slight delay in the reporting of your loan information to the credit bureaus hence student loan not showing on your credit report.

- If you have recently consolidated or refinanced your student loans, it may take a while for the updated loan details to be reflected on your credit report.

Why did my credit score drop when I paid off my student loan?

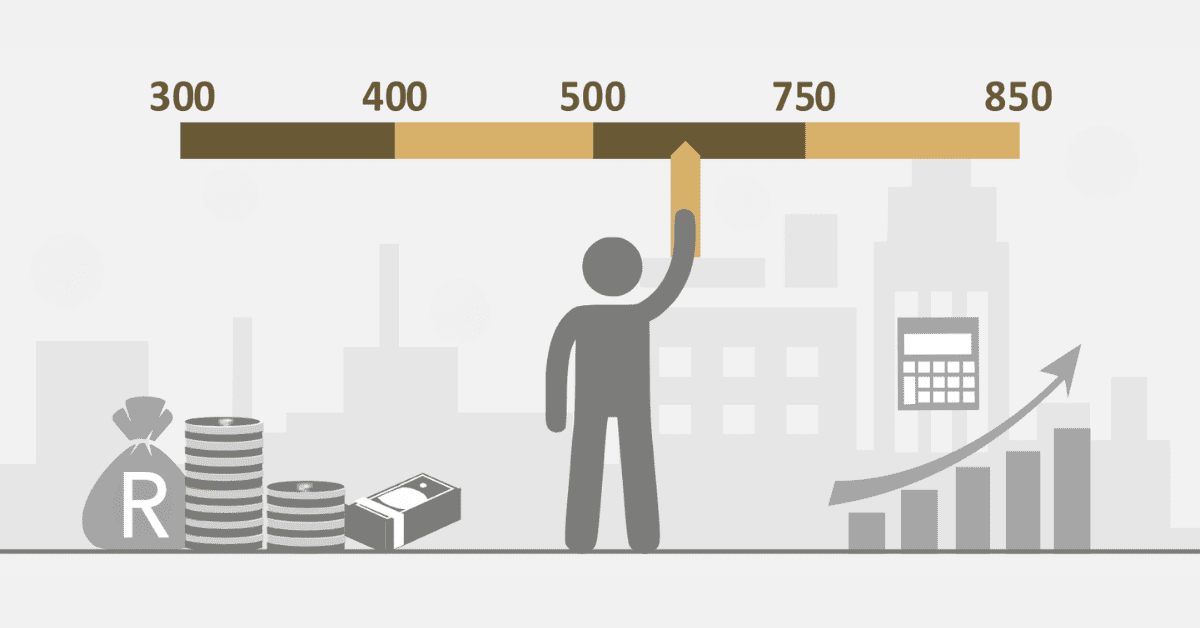

Credit scores are indicated using formulas and the entire payment behaviour of an individual.

Your credit score can drop after paying off your student loan, and this is due to credit utilisation.

However, this drop is only temporary, and your credit should recover in a few weeks to months.

Indeed, there could be several reasons for your credit score dropping after settling on a student loan, and these are associated with credit score factors or elements.