Knowing where you stand is a key part of healthy financial habits. While we don’t often think of our credit until we need it, it is a reality of life. So it is just as important to know what your credit score is, and what is impacting it, as it is to check your budget or bank account. There are many ways financially-savvy South Africans can monitor their credit score and access their credit report. You can go directly to the credit bureaus themselves, but there are also a host of new tools to help make it easier and more accessible. Among these, ClearScore is one of the first and oldest. Today, we will be looking at it and what it can do for your creditworthiness in more detail.

Does Checking My Score with ClearScore Decrease It?

No, checking your credit score with ClearScore will not decrease it. In fact, it will have no impact on your credit score at all! This is for a few reasons:

- Firstly, ClearScore is a third-party service, not a credit bureau. It simply pulls and aggregates the data from two of South Africa’s credit bureaus and shows it to you in an accessible, friendly way. It isn’t generating anything that affects your credit score, simply reporting it. And ClearScore can’t take any action on the report, even if you spot a mistake. You will need to clear it up with the credit bureaus.

- Secondly, there’s an important concept in credit checks, which is the ‘hardness’ of the check. ClearScore pulling that data is only a ‘soft’ inquiry. Soft inquiries will never affect your credit score. They are just a sign that someone has looked at the report recently. In contrast, ‘hard’ inquiries are a sign a lender is seriously considering you for a loan, whether or not you receive it. This sort of inquiry will reduce your credit score a little, but only by a few points. Problems arise if you have many hard inquiries in a row, as you start to look like you are shopping for credit and being declined.

Is it True That Your Credit Score Goes Down If You Check It?

No, it is not true that your credit score will go down if you check it! This is a common misconception arising from the soft and hard inquiries we mentioned earlier. There is nothing you can directly do to access your credit score that will raise or reduce it. You are not a lender, and the bureaus recognize that. They also recognize how important it is for you to know and understand your credit position. They encourage you to check your report regularly!

Remember what we explained above. Only hard inquiries will have an impact on your credit score. Even then, one single hard inquiry will have very little effect- you may see a few points slip, but nothing more. Hard inquiries come from lenders who are seriously considering offering you a line of credit. Any kind of ‘for interest’ check will be a soft inquiry and will have no impact on your score at all.

What is the Best Way to Check Your Credit Score?

The best way to check your credit score is by obtaining a full credit report. Every South African citizen is entitled to one completely free credit report from each credit bureau in a 12-month period. And the fee to run another is very tiny- typically in the R20 region. You can get yours by approaching the bureau directly. Some also allow you to create an online account. Today, there are many third-party tools (like ClearScore) that pull the data for free every month and let you access it, too. So you don’t need to pay anything at all to monitor your credit report regularly!

Tools like the banking app widgets that pull your score only, with none of the report data, are still useful. They let you monitor your credit score and act if something looks fishy. However, they lack the comprehensive data to explain why that score exists, so you will always be better off with a full report.

Why is my Credit Score Going Down if I Pay Everything on Time?

Your payment history is an important part of your credit score, but it isn’t the only factor. Credit scores are a mix of payment history, amount of credit open, how much of that credit is used, how many types of credit you have (diversity of type, not number of accounts), your past behavior with credit, and the length of time you have been an active credit user. Paying off your debts on time is a good thing! But in doing so, you may tweak one of the other factors- perhaps you take an account to zero, so it no longer looks like active credit use. Or you close a type of credit you had. This can negatively impact your score even though you are doing the right thing.

This is why it is important not to fixate on the number itself too much. Rather learn to use your overall credit score as an indication of how lenders view you, and don’t sweat every tiny detail too much.

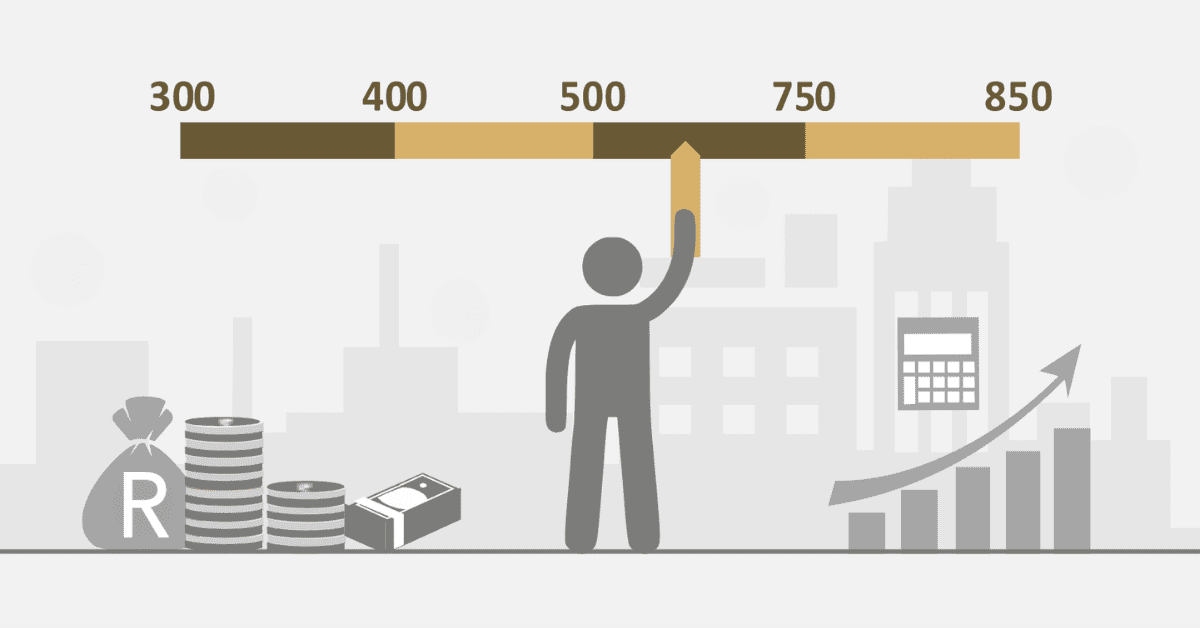

What is the Highest Credit Score?

In South Africa, the highest credit score you can have is 850. Very few people manage to keep their scores that high, and if yours is lower, don’t worry. It doesn’t mean you are doing anything wrong. If you have a credit score in the 600 plus range, you are already doing better than most South Africans, and once you reach the high 600s and 700s, you are doing excellently. Keep up the hard work!