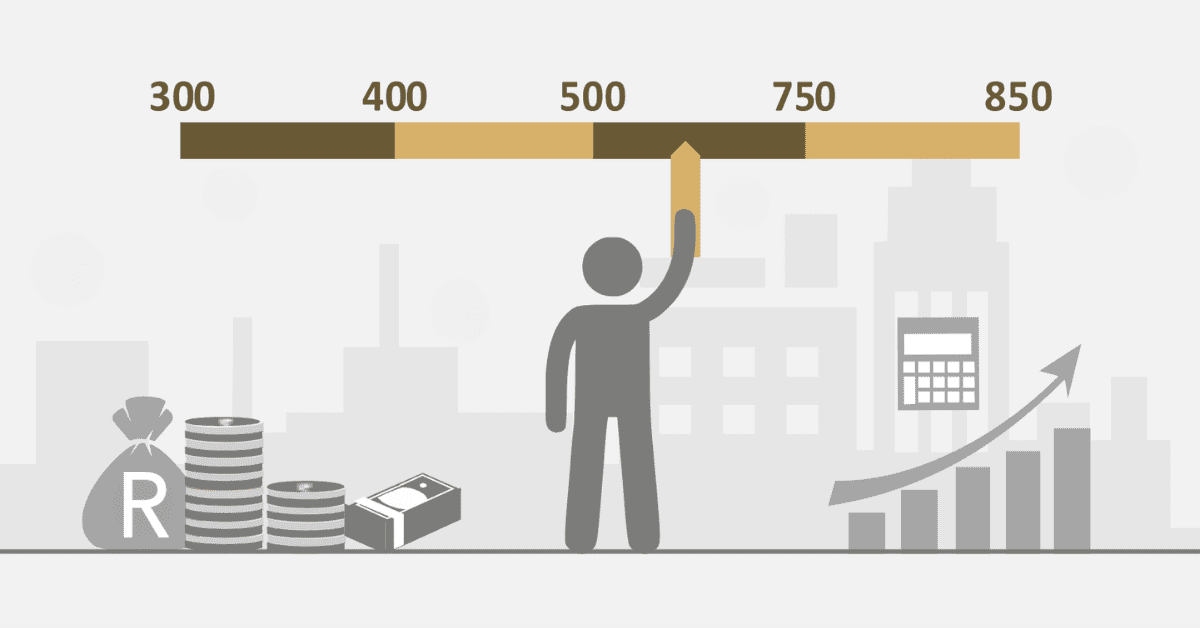

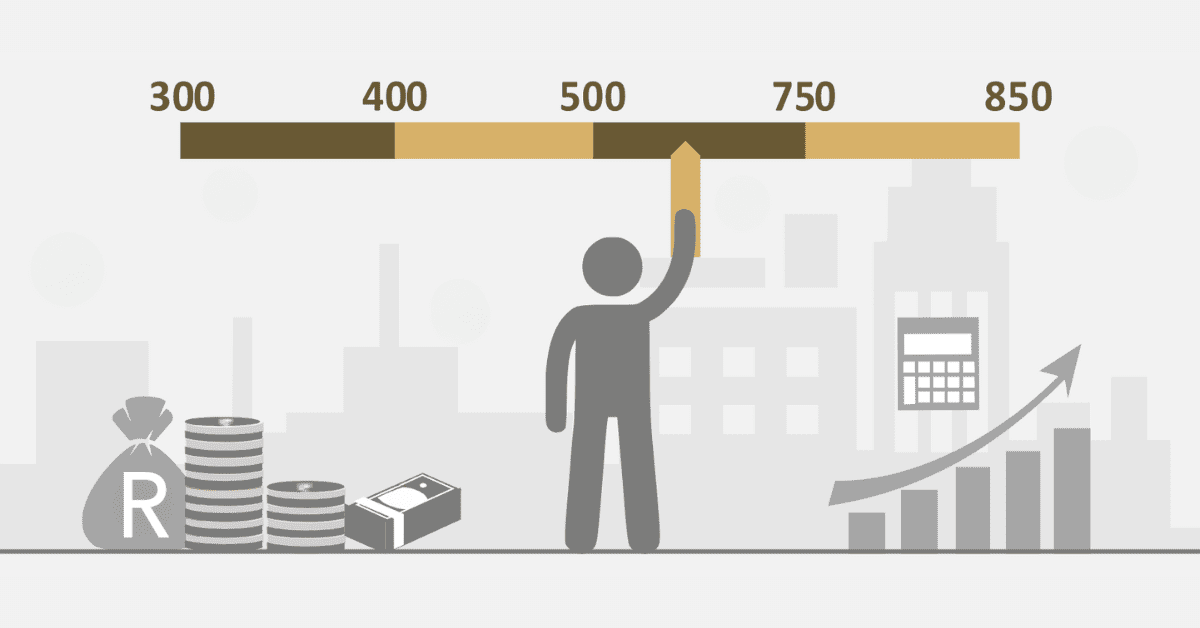

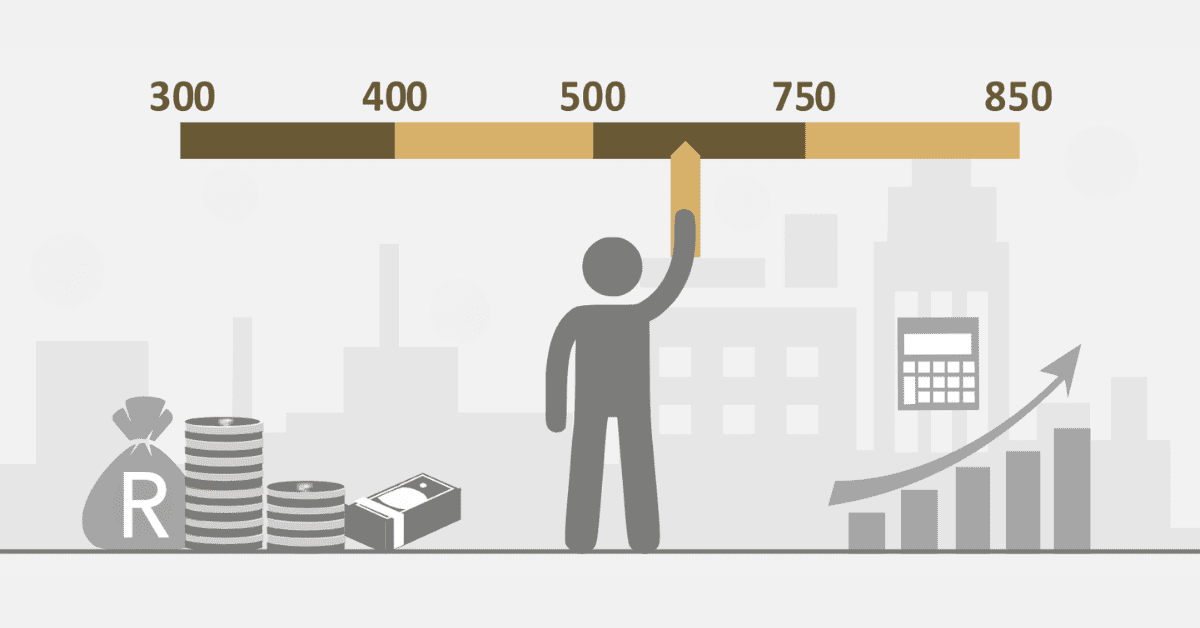

If you’re actively applying for credit, then your credit score will be a critical part of how the lender decides if you are a good risk. This will impact your ability to access credit at all, as well as determine how favorable the loan terms and interest will be. However, it is a little too late to find out you have a low credit score after the lender is already involved!

Luckily, credit scores don’t have to be a mystery. With greater accessibility directly from the bureaus themselves, as well as the development of third-party credit score websites, it’s easier than ever to empower yourself and proactively monitor and improve your credit score so there are no nasty shocks. Once you do so, however, you will notice small differences in your credit score between different sites and bureaus. Today, we look at why and what you need to know about this phenomenon.

Why is My Credit Score Different on Different Sites?

The difference in credit scores across different websites is caused by several factors. Firstly, let’s look at the difference between credit monitoring sites and credit bureaus. Credit monitoring sites only collect data from credit bureaus and share it with you. They do not create their own credit scores.

Credit bureaus, on the other hand, are the people who make your credit score. Unlike credit monitoring sites, their target audience is lenders, not you. Lenders send financial data about your existing credit to the credit bureaus regularly. They then ‘interpret’ these factors, using distinct scoring algorithms and methodologies, to assess your overall creditworthiness. However, your credit score will not be consistent even between the bureaus. Each bureau weights the data slightly differently based on different financial models and the priorities of the lenders in their target market. Additionally, some lenders favor specific bureaus, so there can be timing discrepancies in when data is reflected.

Credit score websites simply collect this data as third parties, interpret it understandably, and help you to access it freely. Some sites will aggregate data from several bureaus to give you a more holistic picture. Others will favor data from one bureau for accuracy, but they may still differ in the specifics due to timing factors and availability. Remember, updates to your credit file may not be reflected simultaneously across all platforms.

Which Credit Score Website is More Accurate?

Many people are under the impression that one specific credit score is the ‘most accurate’. Especially the one that makes you look the best! This is a bit of a fallacy, however, and you can’t choose what bureau your lender will use, so it is also largely irrelevant.

The recognized and trusted credit score websites, like ClearScore and Kudough, are all reliable enough to help you get the big picture of your credit score and what is impacting it. A few points here and there rarely make a huge difference in the eyes of lenders. Instead of looking for the ‘most accurate’ option, look for one that is trusted, registered, and secured so your private data is safely handled.

If you are actively applying for credit, you can always ask your lender what bureau they use. This way, you can pull your free report directly from the bureau, and see exactly what score they will use.

Why is My ClearScore and Experian So Different?

Now you understand how ClearScore and Experian are different, let’s look at why their scores will be different, too. After all, ClearScore uses Experian data, doesn’t it?

Yes, but that’s not the only data they use! ClearScore also uses data from illion, a smaller bureau. The results you see are aggregated between these two data sources. While Experian is weighted as more important, the illion data can affect the overall data you see. Additionally, don’t lose sight of the fact that ClearScore is as susceptible to small delays in data processing as the bureaus themselves, and so some fresh movements in your credit profile will show on Experian, the source, before ClearScore can access it.

How Can I Check My Credit Score Without Lowering It?

We have great news- if you check your credit score, you will never lower it! There are two types of inquiry on credit reports. A soft inquiry, which is what you do when you check your own credit report, just provides information. It will never affect your credit score. You must regularly check your credit report, in fact, to watch out for fraud and other issues as well as to empower you on your journey to a better credit score. To add to that, checking with a third-party monitoring site like ClearScore will not even register as a soft inquiry. Remember, they are not a credit bureau, just a third-party service!

On the other hand, when a lender looks at your report to offer you credit, that is called a hard inquiry. These will have a small impact on your credit score, to deter you from chasing many lines of credit at once. It alerts subsequent lenders that you have recently applied for credit. If you were approved, this credit line may not yet have data to show on your report but could impact your creditworthiness, so the small drop ensures they are aware there is a potential change in your credit circumstances. These will fall away shortly, so don’t stress about them too much.

Understanding why credit scores differ across websites, monitoring services, and bureaus is crucial to navigating the South African credit landscape. Hopefully, you now feel much more secure about why these small differences in credit score occur.