If there was one thing in the finance sector of South Africa that has thrived so well, it is the relationship between credit score and purchasing. These two are interconnected, and they play a huge role in shaping the economic landscape in South Africa.

The credit score system was introduced in the early 2000s to regulate and measure the creditworthiness of individuals. The system was made numerical to represent the financial discipline of individuals and extends to make lenders make constructive decisions about credit facilities.

The rationale behind the South African credit score system provides insight into the risk level for lenders and borrowers. By initiating these credit scoring systems, lenders will have a general view of how responsible consumers can be.

Although we have established credit score allows one to make a decision when it comes to purchasing. In this blog post, we will check on how one can buy a car without a credit score.

Can you buy a car without a credit score?

Buying choices are closely linked to a person’s credit score, which shows their financial background, payment behaviour, and overall credit management. Having a good credit score can give you more financial flexibility, allowing you to take advantage of lower interest rates and qualify for bigger loans for important purchases such as houses or cars. This interconnectedness fosters a culture of financial responsibility, motivating individuals to prioritise timely payments and exhibit responsible financial behaviour to maintain a healthy credit profile.

Although the credit score initiates the steps in helping one purchase an item, there are possible ways to buy an item without relying on credit.

In the aspect of buying a car without a credit score, it is very possible to do that. Individuals who do not have a credit score can buy a car through other means.

However, in this type of situation, you may require extensive documentation, a consignor, a guarantor or maybe a third-party service like a lawyer.

What credit score is needed to buy a car in South Africa?

If your credit score is above the required threshold, you can enjoy lower interest rates, which will ultimately save you money on the car loan. It also enhances the chances of loan approval, making the entire buying experience easier. Lenders are more inclined to provide individuals with higher credit scores with beneficial terms, knowing them as borrowers with lower risk.

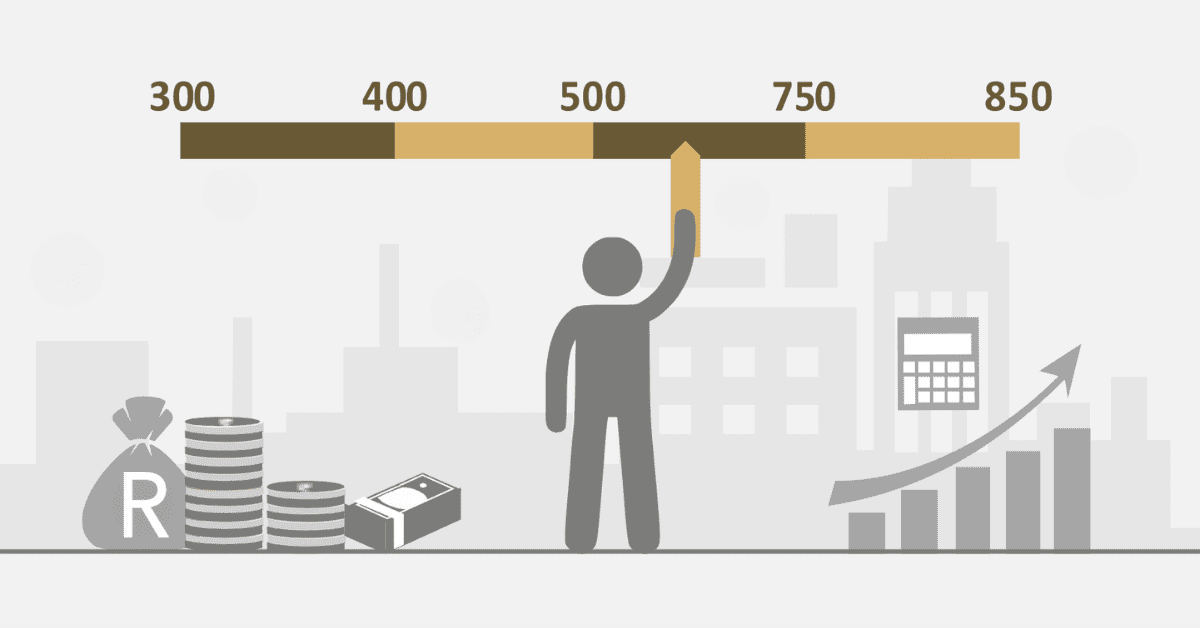

An ideal credit score of 680 or higher is needed when buying a car. It allows you to access better financing options and makes the entire purchasing process much easier. Your credit score is a reflection of your creditworthiness, demonstrating how well you handle your financial obligations. A credit score above 680 is considered favourable, reflecting a track record of punctual payments and responsible credit utilisation.

In addition, having a credit score between 650 and 740 opens up more financing options, giving buyers the flexibility to select from a wide range of lenders and loan products. Consumers have the freedom to choose terms that match their financial goals and budget, creating a car ownership experience that is both sustainable and enjoyable.

Can you apply for car finance without a credit score?

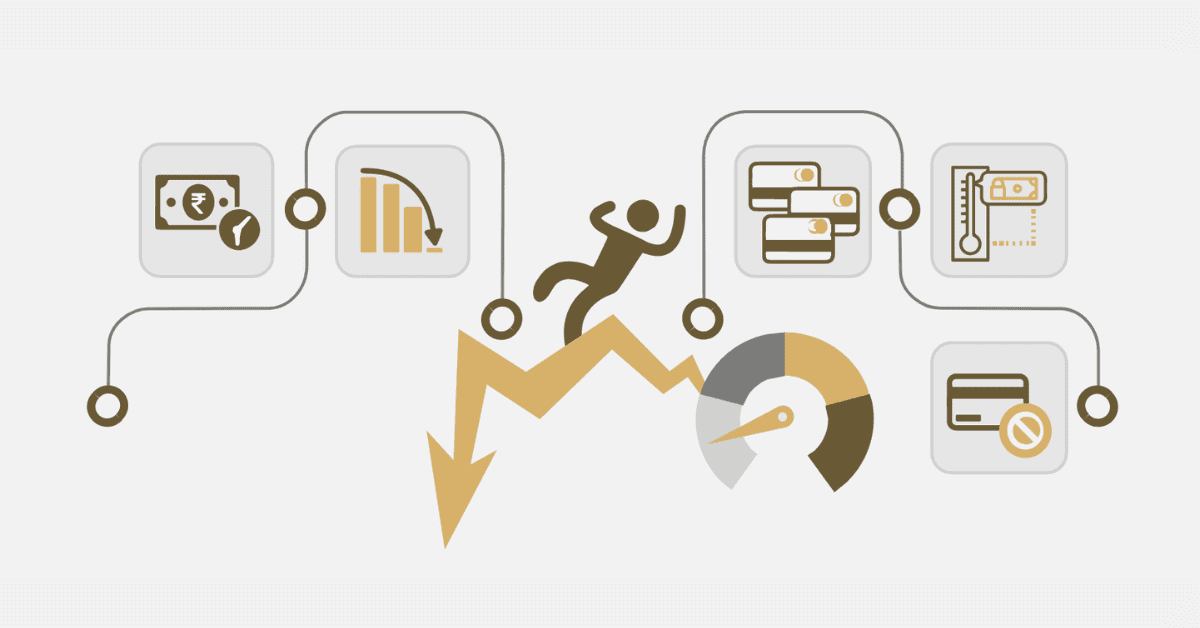

The process of car financing can be very cumbersome, especially when you don’t have a credit score. The amount involved requires a lot of documentation, screening background checks, investigation and many others to ensure the individual sees fit.

It is very possible to get car financing without a credit score. Although it can be tricky, you can apply for a car loan by providing a steady income flow, bank statement, employment contract, steady bill payments etc.

What is the minimum salary to qualify for car finance in South Africa?

In South Africa, individuals have the opportunity to qualify for car loans with a minimum salary of R6500. Individuals earning R6500 per month have access to financing options that are tailored to their budget.

Lenders and financial institutions have recognised this trend and are offering loans to individuals earning the minimum wage. This promotes openness and has a positive impact on the economy, as it facilitates mobility and consumer activity.

In South Africa, the minimum income of R6500 is a crucial factor for individuals to consider when planning their car financing options.