The Absa Bank app is designed to provide users with a convenient and user-friendly platform for a range of financial services. A standout feature of the app is its ability to allow users to check their credit score directly within the app itself. This convenient feature provides users with instant access to important financial information that can be crucial for making informed decisions. This feature allows users to make well-informed decisions, particularly when it comes to home loans.

A good credit score is often essential for getting approved and securing favourable terms when you have the Absa app. The app has a smooth interface that guarantees a stress-free experience. It enables customers to easily view their credit scores and check their financial health status.

Absa being one of the best banks has an innovative concept that is well integrated with the bank app. This goes beyond traditional banks creating a premium digital service for individuals and their customers.

Let us look at the possibility of checking your credit score on the Absa app.

Can I check my credit score on Absa app?

Your credit score reflects the level of risk you pose to a lender. Your credit score is a reflection of your capacity to repay a loan, and lenders rely on it to assess the amount of credit they can extend to you. Your credit score plays a significant role in determining the amount of money you can borrow and the interest rate you will be charged on that credit.

You have the option to conveniently access and review your credit score on the Absa Bank. mobile app. While there are some limitations to consider when using the Absa app to check your credit score, it does provide you with the ability to view your credit score at any point in time.

How can I check my credit score over the phone?

Checking your credit score is an important aspect of financial management. Luckily, many banks provide the convenience of allowing you to check your credit score directly on their online platforms. No matter which bank you are associated with, accessing your credit score is a straightforward process that can be done with just a few simple steps.

To access credit monitoring or credit services, simply login to your online banking account and find the dedicated section for these services.

If you are looking to check your credit score over the phone, there are a few credit bureaus that offer this service. Some popular options include Experian, Equifax, and ClearScore.

By using these services, you can effortlessly stay updated on your creditworthiness and make well-informed financial choices.

When you sign up for our platform, you will have a much easier way to manage your bank transactions and gain valuable insights into your credit score. You can easily generate financial reports that give you a clear overview of your financial health by linking your bank accounts.

Which banks show you your credit score?

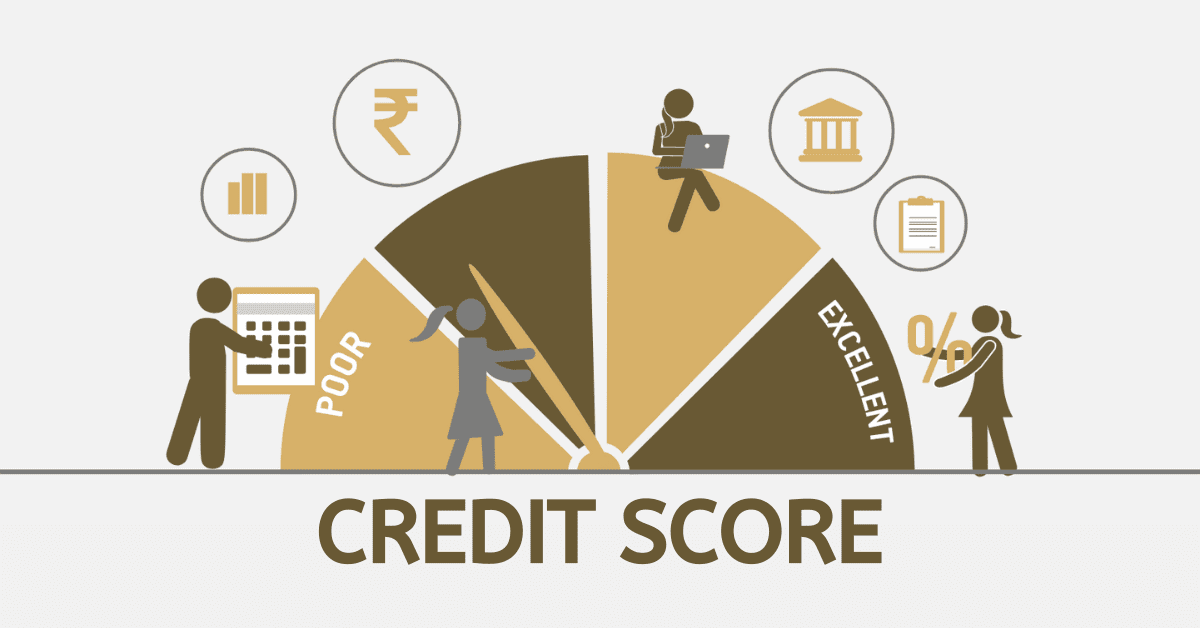

Today’s banking has changed in a tremendous manner providing more meaningful financial figures to individuals. One way to do this is by checking your credit score, which can serve as a helpful resource in effectively managing your finances.

There are serval banks that offer this service to their customers in terms of viewing credit scores. Thanks to partnerships with credit bureaus and the use of advanced technology, these banks have made it incredibly convenient for individuals to access their credit scores. Customers can simply log into their online banking platforms or mobile apps to view their credit scores directly.

In South Africa, many well-known banking institutions have emerged as industry leaders in the field of banking. The banks in question play a vital role in offering financial services and making significant contributions to the financial sector of the country.

Here is a list of banks that can show you your credit score: Some of the banks in Africa include Absa Bank, African Bank, Nedbank, FirstRand, Standard Bank, and Old Mutual, among others.

How do I find out my credit score for a home loan?

If you are looking to determine your credit score for a home loan, the first step is to obtain a copy of your credit report from well-known credit bureaus.

Although your credit report does not typically include your actual credit score, certain credit card companies and financial institutions may offer the convenience of providing access to your score as a complimentary service.

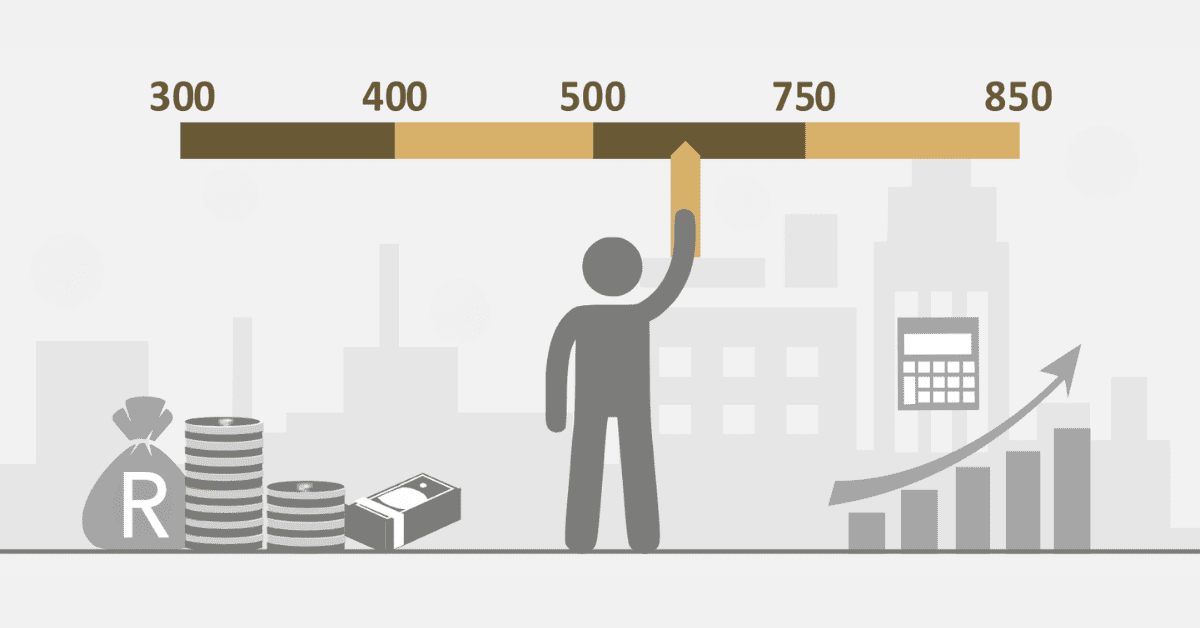

Home loans in general are categorised as mortgages; getting the needed finance for a particular home. It is obvious for banks or financial institutions to be interested in your credit score before processing home loans. Your credit score gives an overview of how reliable you are in terms of paying loans.

To know the required credit score for a home loan, you can do that by checking with your bank and credit bureau to get an understanding. Doing this will let you know the category you fall in when it comes to the health status of your credit score.

Once you fall beyond “good” in your credit score, there is a higher chance of securing a home loan.

However, it is most important to inquire from your lender about the requirements for a home loan. This information becomes more beneficial in your application for a home loan.