Recognizing the importance of a solid credit score is crucial when it comes to managing your finances effectively.

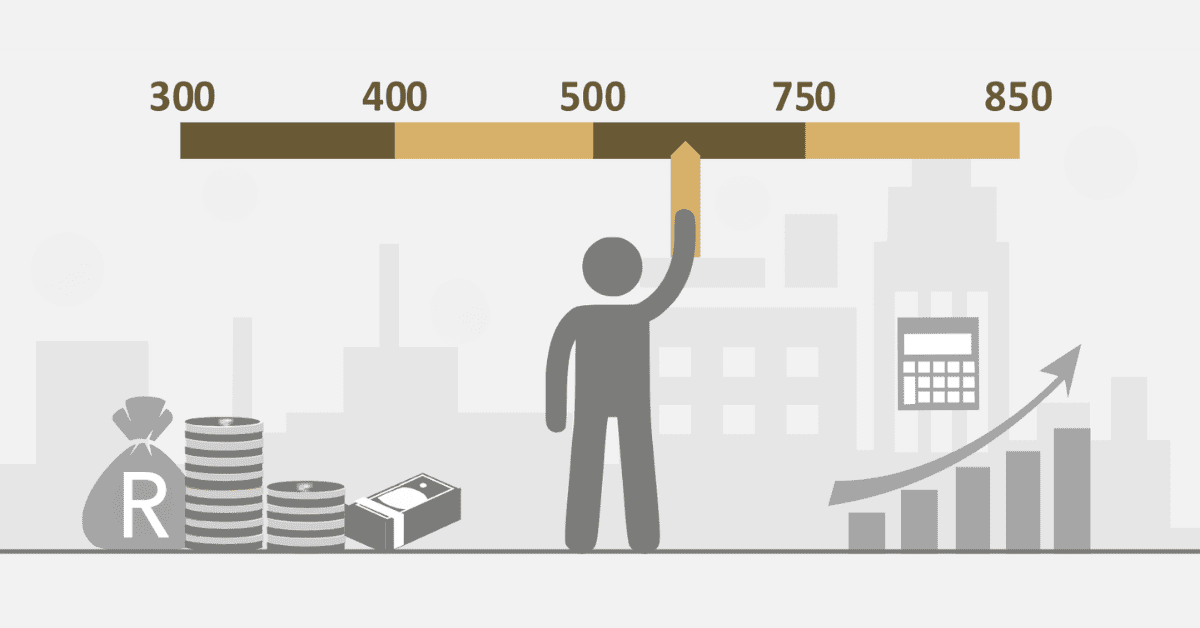

A credit score is a numerical representation of an individual’s creditworthiness, indicating how well they handle borrowed funds. This three-digit number, usually falling between 300 and 850, is extremely important in deciding whether someone qualifies for loans, credit cards, and lower interest rates.

A higher credit score can provide you with more financial opportunities, making it easier for you to obtain mortgages, car loans, and other important purchases. It demonstrates a commitment to financial responsibility and inspires trust in lenders.

By staying diligent in monitoring and enhancing your credit score, you can gain the confidence to secure more favourable terms, ultimately saving you money in the long term.

Knowing the credit score ranges gives you the power to make a better financial decision.

As we advocate good credit scores, we will take you through the required credit score to acquire a house.

What is a good credit score to buy a house?

Do you want to own your own home in South Africa? Are you concerned about the credit score you need to buy the house? Here is what you need to know.

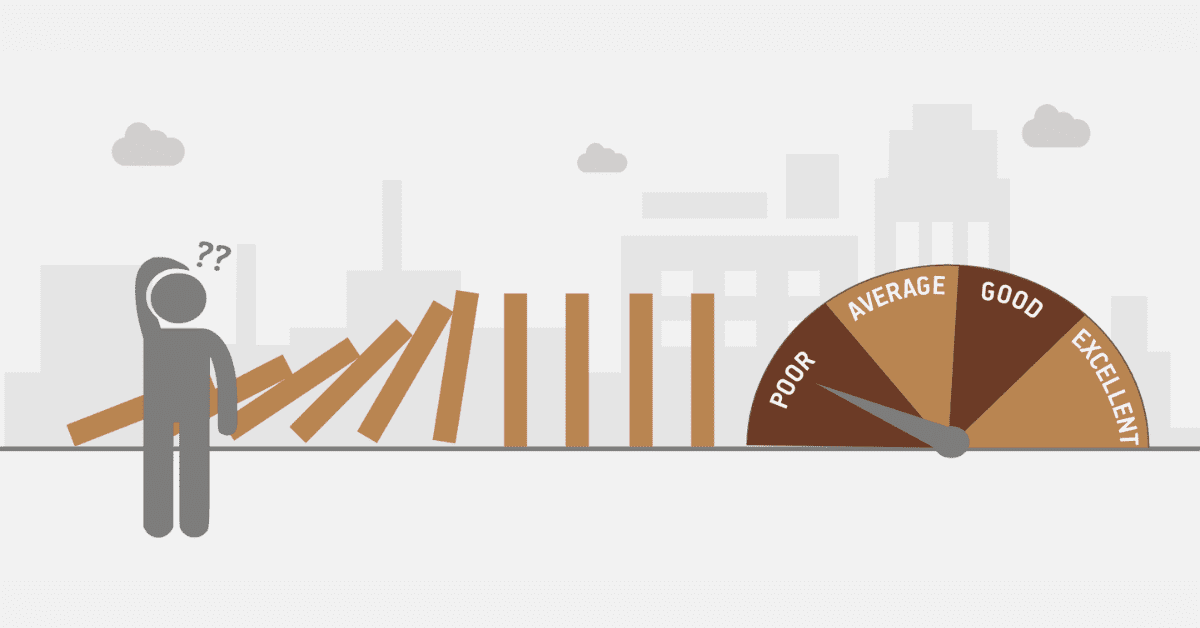

Your credit score is an important factor that can have a big effect on your dream. Many banks use this three-digit number to figure out how creditworthy you are, and it is one of the most important factors in deciding if you can get a home loan.

For a home loan in South Africa, the lowest credit score that is usually needed is around 640. You may have a good chance of being approved if your credit score is 600 or higher, but this may depend on the bank you choose.

Your credit score shows how responsible and healthy your finances are by showing how well you can handle debt and pay your bills on time.

Maintaining a high credit score is very important if you want to buy a home. It not only makes it more likely that the loan will be approved, but it can also change the interest rates that lenders offer.

If you want to improve your chances of getting a home loan in South Africa, you might want to start good money habits like paying your bills on time, lowering your debts, and regularly checking your credit report.

Knowing how important it is to have a good credit score is a big step toward making your dream of owning a home come true. So, keep an eye on that three-digit number and do what you need to do to make sure it gets you into your dream home.

Credit score tips for first-time home buyers

It is exciting to buy your first home. However, it might be hard for first-time buyers in South Africa to understand their credit scores.

This advice can help people who are buying their first home. It explains in detail how to buy a house.

You should know a lot about the house, where it is located, and why you want to buy it before you do it. It depends on what you want to do now and in the future.

Think about whether you are getting a house to live in or to rent out.

First-time owners can get help from the government through FLISP. It makes it easier for first-time homebuyers to get a loan and gives them money for a down payment or to pay back the loan.

The amount of the rebate depends on how much the buyer makes. It can be anywhere from R30,000 to R130,000 per year. People who want to buy a house should make around R10,501 to R22,000 a month. But people who want to get a home loan must meet certain standards. You must be married, living with someone, or single with a child.

It is possible to lower your mortgage costs by choosing a shorter mortgage term. You might have to pay more each month, but you can own the house faster and save a lot of money on interest on the loan over the long run. But if this would put a strain on your already tight budget, think about the longer-term choice instead. Your bond amount can go down if you put large amounts of money into your account when you get them.

Looking to acquire your first home? Here are some more tips to help first-time home buyers.

- Even if you are on the fence about owning a home start now. Good credit helps in many areas beyond owning a property. Some credit difficulties might take over six months to resolve, so be on top of your credit all the time.

- Credit reports detail credit and financial information. Get your free annual credit report at a reputable credit bureau. Understanding your credit profile is essential to managing it. Mortgage lenders will evaluate your credit report for how long you have handled credit, your overall debts, and your repayment rate.

- Examine your finances carefully. Specify which expenses are recurring and which can be eliminated. As seen below, cutting monthly or daily spending might help you pay off debts, which affects your creditworthiness.

What is the minimum salary to buy a house in South Africa?

In South Africa, the province can determine the property value. Based on statistics and some policies within the financial space, a minimum salary of R12,600 can help an individual buy a house.

Depending on the province you wish to secure the house, you must first cross-check if you can secure the mortgage to purchase a house.

By and Large, individuals with a salary of at least R22,000 have a stronger chance of buying a house in South Africa.

What is the lowest credit score to buy a house?

In South Africa, the credit score is widely used and also gives opportunities to individuals with a consistent income, whether monthly, weekly or daily.

Based on the lenders and banks, there is room for a lower credit score of about 610. While this may seem very low to lenders, seekers may look for more options to qualify for the mortgage.