Like it or loathe it, a good credit score is essential to access any form of credit in South Africa. That goes from low-risk items like store credit, right through your credit cards and other short-term debt, and into major long-term credit like mortgages. In South Africa, as elsewhere, this simple three-digit number holds significant power over your ability to secure loans, credit cards, or even favorable interest rates!

Yet credit scores are somewhat mysterious. There’s no real hard-and-fast rule that will equal a certain score. That’s because it is a personalized look at a variety of factors around how you manage and use credit, rather than a set list of things. This makes improving, or even understanding, your credit score pretty tough for most people. Luckily, you have us to help. Today we will look at some of the common factors that affect your credit score, and how to pep up yours.

What Can Affect My Credit Score?

While it may sometimes feel like it, lenders and credit bureaus don’t pull your credit score out of thin air! It isn’t a random figure, it is a meticulous and many-faceted calculation made based on your financial behavior around credit. And it doesn’t mean just right now, either- they will use historical data to predict your credit score, too.

Understanding what exactly goes into this prediction is tricky if you don’t have a background in actuarial science- and few of us do! However, what the credit bureaus want to see for a good credit score is regular, responsible use of credit. Remember, a credit score isn’t an overall picture of your financial health. Just how healthily you use and maintain lines of credit. So people who have hefty sums in the bank and have paid cash all their lives will still find they have a poor credit score- because they have used no credit. So they haven’t proved they can take a loan, handle it responsibly, and pay it back on time. This seems unfair but is just ‘one of those things’ in modern life.

With all that in mind, here’s what the credit bureaus say affects credit score in South Africa:

- Payment History (35%): Timely payments on credit accounts, loans, and other financial obligations are significant contributors to a positive credit score. Late payments, defaults, or judgments, on the other hand, will reduce your creditworthiness.

- Credit Utilization (30%): The proportion of your available credit that you’re currently using matters too. Credit unions typically want to see 50% or less of your lines of credit used. Even if you pay regularly, having a credit line close to max will not reflect well on you.

- Length of Credit History (15%): The duration of your credit history also matters. A long credit history will contribute positively to your score, as it shows a consistent financial track record. Being new to credit won’t penalize you, however. It just makes you slightly less attractive to lenders. Especially for long-term debt like mortgages.

- Types of Credit (10%): A diverse mix of credit types has a small impact on your score. This means having a variety of ‘types’ of credit, like credit cards, installment loans, and retail accounts alongside longer loans like car and mortgage payments.

- New Credit (10%): Opening multiple new credit accounts in a short span might be perceived as a financial risk. Even if they are for small amounts! Each application for new credit can generate a ‘hard inquiry,’ and unlike ‘soft inquiries’ (checking your own credit report), these inquiries count against you. Lenders assume something recent has impacted your finances and you are hoping to take out loans ‘before they notice’.

This is based on information from TransUnion and Experian, two of South Africa’s largest credit bureaus. While others may weigh factors a bit differently, it should still give you a solid picture of how credit scores are calculated.

How to Boost Your Credit Score?

Improving your credit score is not an overnight process, but taking focused, strategic steps will bring you positive results over time. This is why it is smart to boost (or rehabilitate, if you have had a poor credit history) your credit score in advance of needing to borrow. That way, you have the time to identify and rectify errors on your credit report as well as improve your financial behavior before lenders take note. In general, you will boost your credit score by improving how responsibly you handle credit. Here are some key tips:

- Make Consistent, Timely Payments: Ensure that all your credit accounts, loans, and bills are paid on time. This is the most impactful factor in determining your credit score! And one of the easiest ways to improve it.

- Manage Your Credit Utilization: Aim to use a reasonable percentage of your available credit. High credit card balances relative to your credit limit will negatively impact your score. Typically, aim for 50% or less utilization for the best profile.

- Maintain a Credit Mix: While not a primary factor, having a mix of credit types will have a small positive influence on your credit score. This means having a variety of credit types, from long-term car and house loans to credit cards, installment loans, and retail accounts.

- Regularly Check Your Credit Report: Monitor your credit report for inaccuracies or discrepancies. Report any errors to the credit bureau for correction as soon as you spot them. Not only will this help keep your credit score strong, but it will help you avoid fraud in your name, too.

- Avoid Opening Unnecessary Credit Accounts: Be mindful of the number of credit accounts you open within a short timeframe. Each application will result in a hard inquiry that will ‘ding’ your credit score for a while. Whenever possible, space out opening new lines of credit as much as you can.

If you are managing your credit well, making payments as agreed, and behaving sensibly with your available credit, your credit score will improve over time.

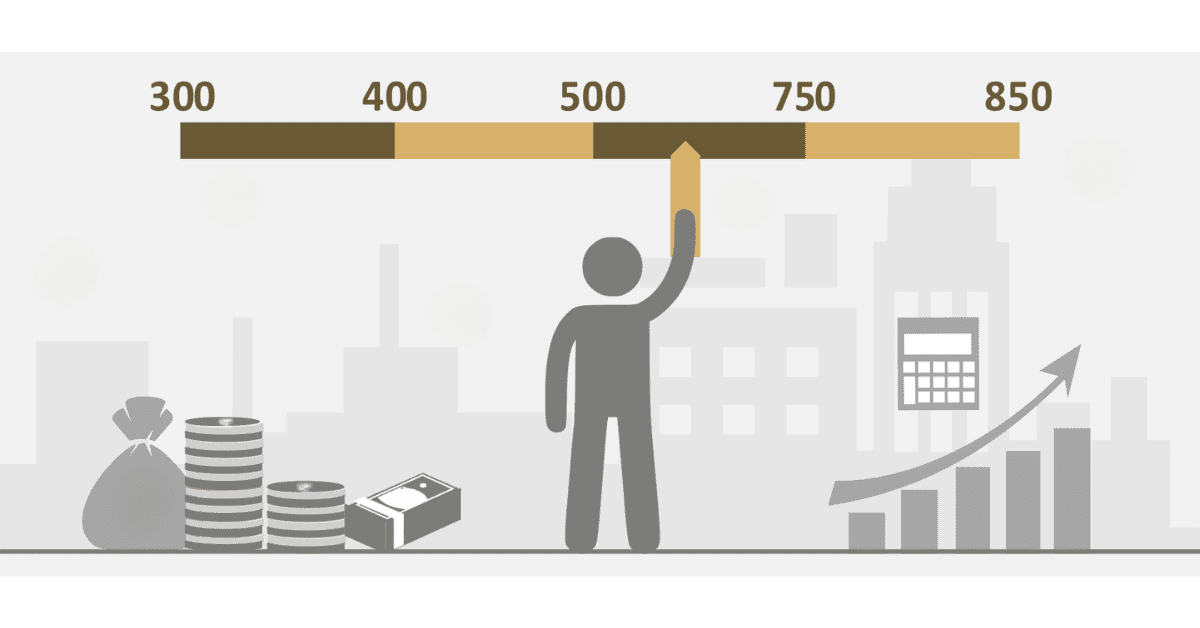

What’s a Bad Credit Score?

In South Africa, a credit history below 579 is seen as poor to bad. If it is below 300, you either have very terrible credit due to past actions, or you have no credit lines at all and they have no data on you. Sadly, the current SA average credit score sits at 560, inside the ‘bad credit’ band. It’s a sign of our poor savings culture and spendthrift ways, unfortunately.

What’s a Good Credit Score?

In South Africa, credit scores above 670 are seen as good, with 740 representing very good, and above 800 being excellent. However, many South Africans regularly use credit in the 580 plus credit score band, so don’t feel you have to get the best possible score to access credit at all. As long as you look like an average, or even better above average, credit candidate, you should be able to use credit sources as lenders will feel you are a safe risk.

Many things affect your credit score. The more responsibly you behave with credit, the higher your score will be. It is smart financial management, too!