Most investors in South Africa look for simple, affordable investment mechanisms that have the potential to guarantee steady long-term returns. Passive funds are a widespread phenomenon where investors would not like to be actively involved in the growth and development of their wealth. These funds are designed to replicate, not outperform, various market indices and offer diversification across multiple assets. But are they the right choice for South African investors? In a South African context, this article explains the benefits, differences, and advantages of passive funds.

Passive Funds: Are They The Right Choice?

Passive funds are phenomenally successful in South Africa because they are simple and cheap. While active funds try to outperform the market with their respective fund managers actively deciding on their investments, passive funds reflect a market index such as the Johannesburg Stock Exchange (JSE) All Share Index. This is bound to impress any investor who wants to make some long-term benefits without worrying about daily monitoring.

One of the most significant advantages passive funds enjoy over their peers in South Africa is that management fees are generally reduced. In fact, active funds charge higher because, among other reasons, they engage fund managers who analyze the market to purchase and sell stocks. Passive funds demand less management since it is just tracking; therefore, they are guaranteed much lower fees. For instance, such a reduced charge will benefit long-term investors, as these fees tend to grow cumulatively over time.

Also, with passive funds comes exposure to the whole market, which is a plus for investors because of diversification reasons in a portfolio. As it follows an index, investors gain exposure to various sectors and companies, reducing the risks of individual stocks.

What Is Meant by Passive Funds?

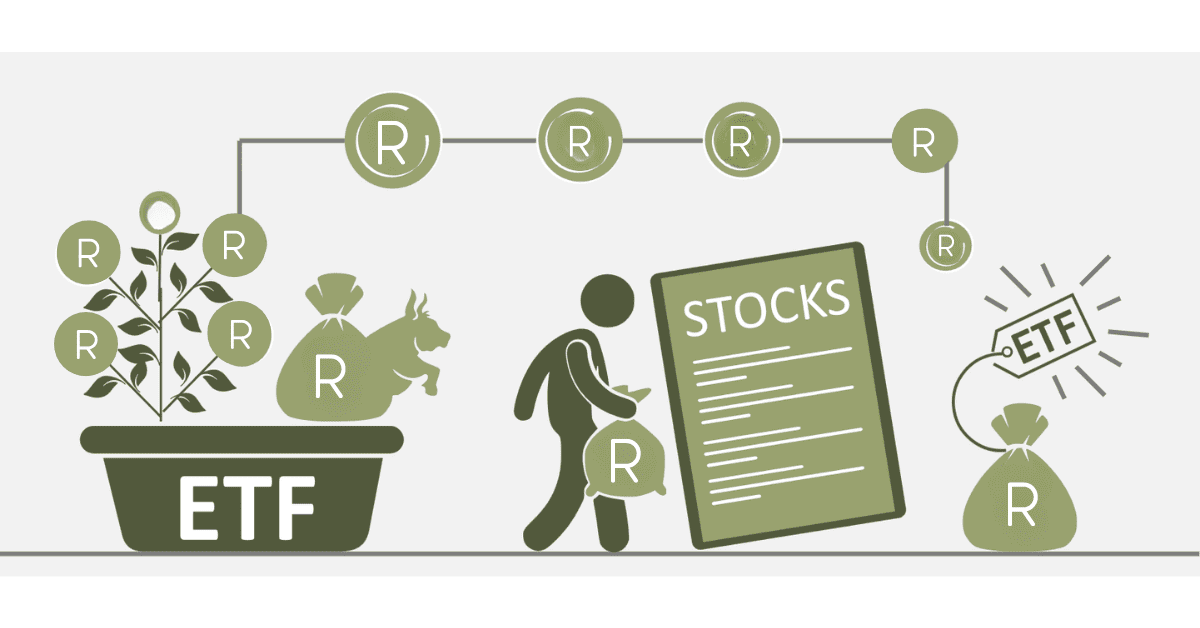

A passive fund is an investment portfolio that tries to replicate returns or track a general market index. Unlike active ones, in which securities are selected by management, a passive fund directly invests in all securities contained in the tracked index. They are meant not to outperform or beat the market but to mirror or represent it.

SA passive funds are typically based on indices such as the JSE Top 40. This index comprises the top 40 largest companies listed on the Johannesburg Stock Exchange. When an investor puts money into a passive fund tracking that index, the investor will go hooked across mining, banking, and telecommunications.

What Differentiates Active From Passive Funds?

This rests on the style of management and objectives. Active funds, as the very name would suggest, imply that the fund managers make certain decisions, like which stock or assets to buy or sell to outperform the market. In contrast, passive funds are designed to track a particular market index without trying to outperform it. Based on this, the two approaches do have a few distinguishing characteristics.

One key difference is the cost: active funds generally charge higher fees owing to the extensive research, analysis, and trading involved in running the portfolio. These management fees erode returns considerably over the long term in South Africa. Passive funds charge much less for their services as they have the relatively simple task of tracking an index. Very little management or trading activity is required.

The other main difference related to performance is that even though active managers try to outperform the market, quite a significant part of the academic research proves that many active funds fail to do so regularly. As a matter of fact, after accounting for fees, many active funds underperform the market. Passive funds are not constructed to outperform but deliver returns in line with the market with a great deal of predictability for the investor.

Why Is Passive Investing Better Than Active?

Passive investment is usually better than active investment for long-term investors in South Africa, among other countries, for many reasons. To begin with, passive investment comes with a lesser cost. Generally, the fees for active funds are higher because of the expectation that the manager will be actively trading stocks in an attempt to outperform the market. These added costs take away from your overall return, particularly over a longer period. Passive funds are cheap since all a passive fund does is attempt to track the market index by its nature; hence, their trading activities are at a very low value with minimal management cost.

Second, passive funds return regularly. Whereas the active fund manager makes every effort to outperform the market, it has been proved that most active fund managers fail to perform better than the benchmarking indices over the long run. In this respect, the passive funds become more dependable for the investors who would like to return along with the market and avoid the possibility of underperformance.

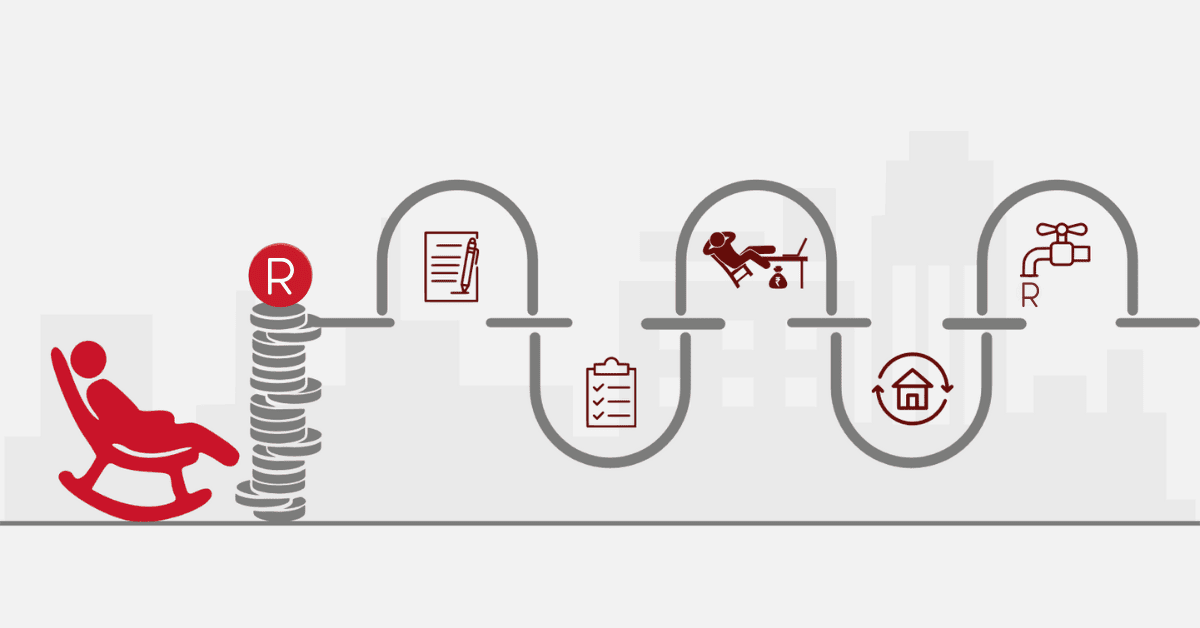

Lastly, passive investment is less time-consuming. With active investment, there is a constant need to monitor market conditions, the performance of stocks, and even trends in the economy; it is a hands-on investment strategy. In these ventures, a capitalist can adopt the “set it and forget it” approach.

What Is the Most Profitable Passive Income in South Africa?

One lucrative means of passive income in South Africa is through passive investment mechanisms or channels like index funds and exchange-traded funds. It is pinned to market indices like the JSE Top 40 or the JSE All Share Index. It permits investors to be exposed to the market without active management. These investments generally yield solid returns over time and prove to be a very reliable mode of passive income.

Another passive source of income available in South Africa concerning investment in properties is REITs. REITs allow one to invest in a widened diversified portfolio of real estate instruments and earn an income that accrues from rentals and appreciation of the property without having to deal with the headache that arises from managing the real estate themselves.