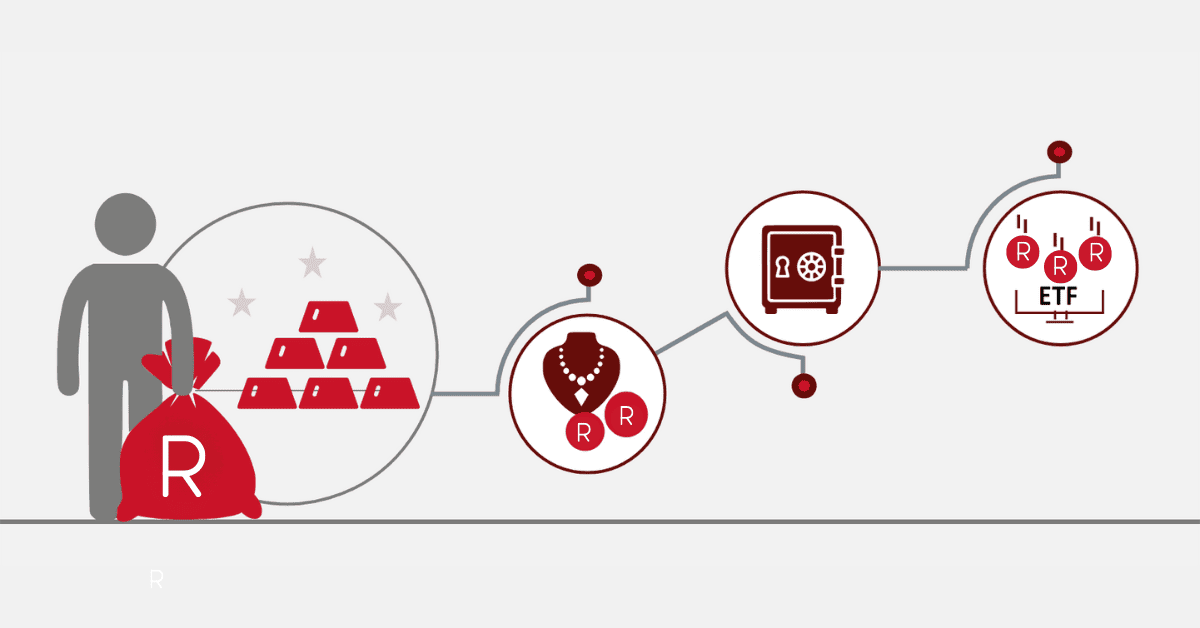

REITs have been showing up as a popular vehicle through which South African investors can be exposed to real estate without the difficulties of directly owning a property. Through a REIT, diversification into a range of real estate assets- office buildings, shopping malls, and apartment complexes, among others- can be made possible, together with income generated from such properties. On the one hand, REITs pay investors regular dividends, found within current income, with the same proposition offering the probable capital appreciation in the long run.

REITs Definition and How They Work

It is an enterprise that owns, operates, or finances income-producing real estate. They acquire a diversified portfolio of properties with funds from several capitalists and manage the profile to generate rent or property sales income. Properties managed and operated by REITs include office buildings, commercial shopping centers, residential complexes, and all types of concern.

South Africa requires listing on the Johannesburg Stock Exchange. It also hews to several specific legal requirements regarding REIT status. One crucial rule requires that at least 75% of a REIT’s taxable income must be disbursed to shareholders through income dividend payments, typically an income source from bailed rentals paid by tenancy or from property sales.

REIT investors purchase shares in the trust, thereby buying into a company. They, therefore, benefit from the underlying real estate without necessarily having the title to the property. This makes REITs more accessible for those wanting to try their hand at real estate but cannot afford the capital outlay or expertise required in property ownership.

REIT share values typically rise and fall with the real estate assets’ overall performance, market performance changes, and property demand. However, the most attractive feature of REITs is that they will provide income regularly to investors by distributing dividends. For SA capitalists, REITs offer a liquid, diversified means to venture into real estate, with the ability for long-term capital appreciation.

How Can You Invest in South Africa REITs?

- Research

First, there is the need to check the available REITs on the JSE. There are established ones in SA, such as Growthpoint Properties, Redefine Properties, and Hyprop Investments. All these have different focuses, whether commercial, industrial, or residential real estate. It is relevant to look further into the organization and performance of the REIT’s profile and its management before the decision to invest can be made.

- Open a Brokerage Account

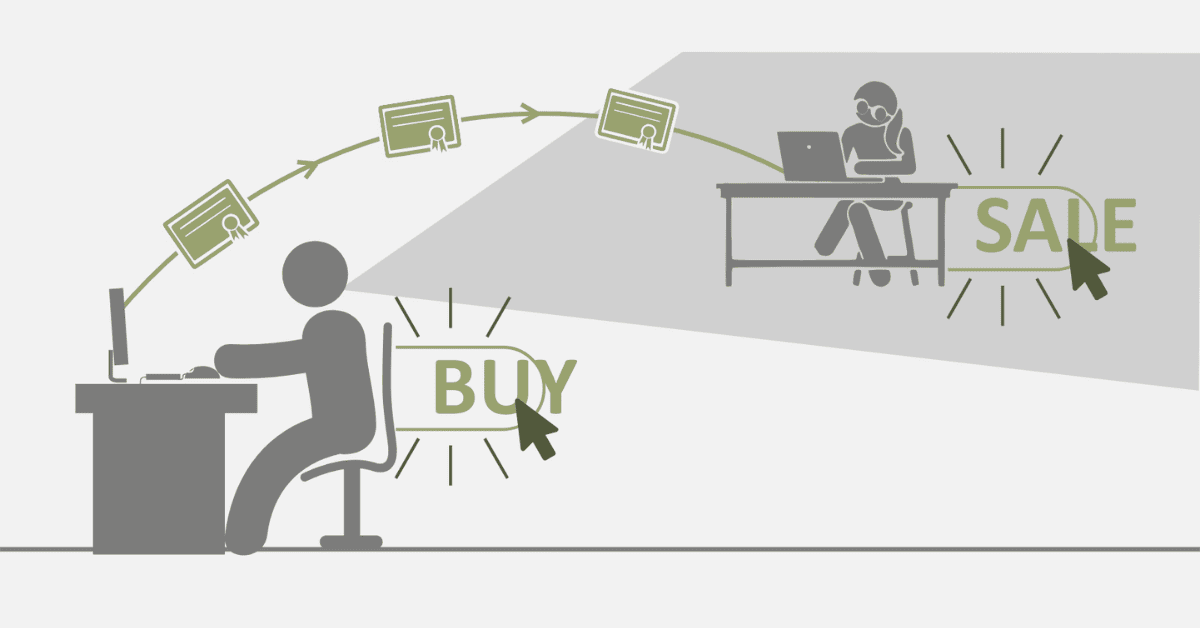

To invest in REITs, one needs to open a brokerage account or a standard stock brokerage account through which one buys and sells shares on the JSE. There are various online platforms and traditional brokers through which REITs are available. Compare the services offered versus brokerage fees with the features that different accounts may offer.

- Order Now

With your brokerage account set up, you can order the REIT shares you choose. You need to determine how much you want to invest and can set your order to reflect your capital. You can buy shares via a market order, securing them at the current price, or a limit order, purchasing at a specific cost.

- Monitor Your Investment

After buying, it’s necessary to pay attention to the workings of your REIT: how often it pays out dividends, the state of the real estate market in particular, and news about your REIT. You might reinvest your dividends or change your portfolio composition over time based on market conditions.

How Do You Make Money with a REIT?

- Dividend Income Focus

One of the major attractions of REITs is that they will pay consistent dividends. Because REITs must distribute a significant percentage of their income to the shareholders, they could expect regular returns from the assets. Look for REITs with a good payout history concerning dividends and whose dividend yields are sustainable. South African REITs typically yield better than traditional stock, generally being an attractive income-generating asset.

- Reinvest Dividends

A thoughtful way to supercharge your returns is to reinvest your dividends. Most brokers have instituted automatic dividend reinvestment plans. These plans enable you to buy more shares with the money that your earned dividends make. Time and this compounding effect create significant investment growth.

- Search for Capital Appreciation

While dividends are a significant source of income, REIT share costs can shoot up. If the underlying real estate portfolio increases in value or rental income increases, the price of REIT shares can rise. When real estate markets grow, one can earn higher dividends and share price rises by investing in REITs.

- Diversify Your REIT Holdings

One of the most critical investment strategies in REIT involves diversification. You can spread your investment across different sectors, such as residential and commercial to industrial properties, to minimize risks on specific market exposure.

What is the Downside of REITs?

- Interest Rate Sensitivity

Interest rates are sensitive to REITs. With the increase in the percentages of interest, the cost of borrowings shoots up, thereby affecting the profitability of the underlying properties the REIT has ventured into. Also, with higher interest readings, other income-producing venturing instruments like bonds become more attractive, thus cutting the demand for REIT shares.

- Market Turmoil

Like any publicly traded asset, REITs are at the mercy of the market. If the more prominent real estate market performs less, or if economic conditions start to deteriorate, the value of REIT firm shares could fall.

- Limited Growth Potential

Because REITs have to pay out most of their incomes to the shareholders, very little, if any, may be left to reinvest. This might hamper their growth in comparison with other investment alternatives.

How Much Cash Does One Need to Invest in REIT?

The good thing about venturing into REITs in SA is that one doesn’t need big cash; therefore, it can be affordable for almost any capitalist. Depending on the REIT share price and your brokerage platform, the minimum investment will dictate this. You can quickly start investing with a few hundred rands on average. Similarly, some online brokers provide the opportunity to buy fractional shares, making it even easier for those with smaller capital to enter trades quickly.