This index is part of the most indispensable stock exchange indexes globally. It mainly tracks performances for 500 of the largest publicly traded American firms. Exposure to the S&P-500 thus has provided diversification and the potential for growth over the long-term horizon in worldwide markets. This post discusses how to venture into the S&P-500 from a South African perspective, including the process, costs, and available platforms for local investors.

Can South Africans Venture into the S&P 500?

Of course, it would be possible then, as now it is an American stock market index. With advances in the global financial markets, local capitalists can gain exposure to the S&P 500 in diverse ways. These include exchange-traded funds, index trackers, or trading platforms offering international stock market exposure. In this way, South Africans can indirectly own shares of companies like Apple, Microsoft, & Amazon that form part of the S&P-500.

The benefits South Africans can accrue from venturing into the S&P-500 include immense exposure to the US market. That space is currently the world’s largest and most dynamic economy. This, in short, reduces over-dependence on the volatile South African economy and equally volatile rand propelled by domestic factors such as political unrest or commodity price changes. Being historically attractive to investors seeking stability with growth, the S&P 500 should post good returns over the long term.

Of course, when investing in the &P 500, there are two things that one must take into consideration: first, the investments in the index are denominated in U.S. dollars and thus can be affected by currency exchanges in returns; second, there are imposed a limitation as to how much money people can invest outside the country every year. In addition to those listed, investment in &P 500 can be within reach with the proper resources and knowledge.

How to Venture into the S&P 500 from SA

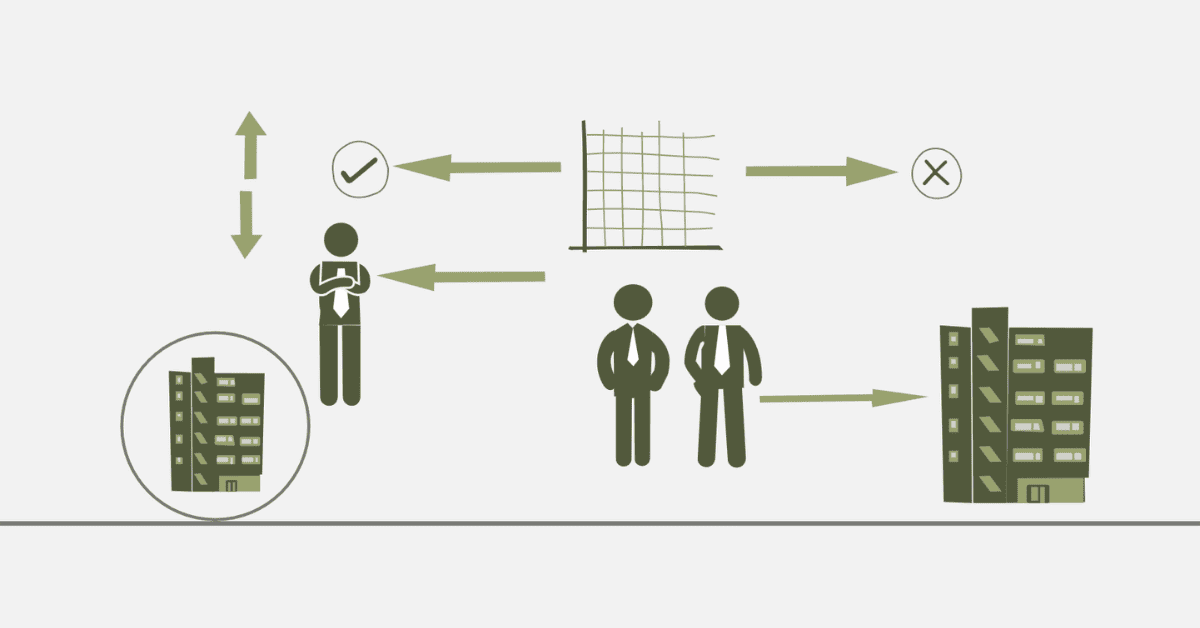

This involves a couple of steps. First, most importantly, is the means through which one selects an appropriate investment vehicle. Two popular ways of accessing the index exist: ETFs and index funds. The ETFs on the S&P-500 are extremely popular since they are affordable and flexible. These include international web-based trading platforms like EasyEquities and Interactive Brokers. They have provided the SA capitalist access to some US-listed S&P-500 ETFs, such as the Vanguard S&P-500 or the SPDR S&P-500.

One must open a trading account with a portal offering access to international markets. Generally, in this kind of trading, the requirements are usually proof of identification, proof of residence, and an operative bank account. Once you have identified the proper online platform on which you will be operating, first deposit money in rands into your account and convert some to U.S. dollars with which to buy or sell securities. Most platforms have very efficient user interfaces through which one can scan and invest in S&P 500 ETFs or funds.

Other options include S&P 500 index funds from South African local financial institutions. Money is pooled from many investors into asset investments that track the S&P 500 Index. It is slightly more expensive than ETFs but provides convenience to diversified, long-term, fuss-free investments.

After investment, the important thing is to monitor the holdings and reach an understanding that this kind of investment has a long-term implication. The S&P 500 investments suit those willing to hold positions over several years, capitalizing on the compounding returns, including market growth.

Where Might I Purchase S&P-500 in SA?

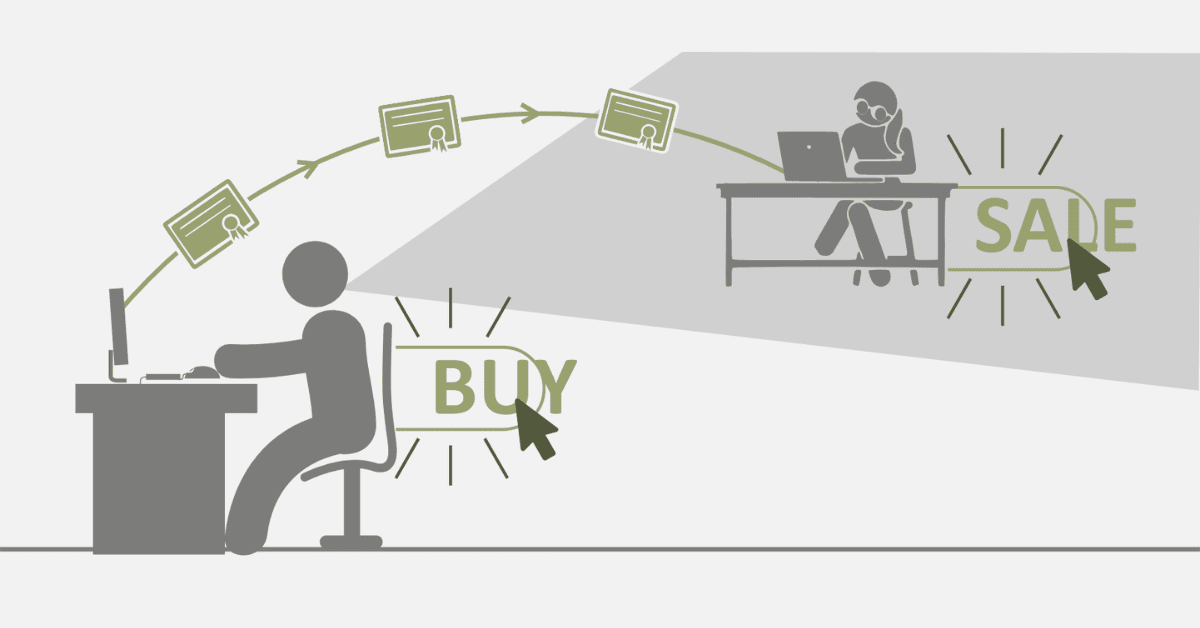

Indeed, among the online brokerages now that have this capability for investors from South Africa to invest in S&P 500 stocks, you will find Interactive Brokers, eToro, and EasyEquities. In fact, with such a platform at your fingertips, you can easily buy U.S.-listed ETFs that track the S&P-500 index. A couple of the most traded ETFs

In addition, one can invest in fractional shares of US ETFs, which opens up enormous opportunities for smaller budgets. Another good option for investing could be Interactive Brokers, offering a tremendous variety of products at exceptionally competitive fees. Besides the two locally domiciled options of the S&P 500 index funds, it is also available with the asset managers Sygnia and Satrix. Structured to mimic the performance of the S&P 500, they are inwardly engineered to suit the South African investor’s needs. They access through most major banks or financial advisory firms in the country.

Salient features against which to choose between a platform and a fund involve the foreign exchange conversion rates of each, the annual account maintenance fees, if any, and even more critical, what help resources it will provide to get you started, considering you are fresher in investing at international markets.

How Much Cash Do You Need to Venture into the S&P-500?

It depends, of course, on the class of venturing vehicle you want, which may depend on the platform you’re using. With the use of ETFs, you can have options to start investing with a sum as low as that for one share. One share of the SPDR S&P 500 ETF Trust costs about $300-$400 at market conditions. Of course, if this platform allows fractional investing, you need even less. EasyEquities can let one invest as little as R100 in fractional shares. Hence, the S & P 500 is open to all and sundry.

The minimums in index funds vary across houses. Some fund houses will require a minimum upfront investment of at least R1,000 or more. Besides, it’s also good to consider transactional costs like platform fees, foreign exchange conversion charges, or annual management fees taken from index funds. All these are minor, but starting an investment process costing less would be good.

We also have to be more realistic with the long-term investors regarding the return on their investment, keeping the budget and the objective in perspective. Small sums invested regularly can yield enormous returns once compounding takes its ultimate course. You could invest little or a lot, depending on the situation. What is essential, however, is being consistent and patient.

Final Thoughts

Therefore, the investment in the S&P 500 from South Africa makes prudent sense in light of the portfolio diversification and growth potential. Learning about the options, going through a reliable platform, and considering the South African investment regulations should empower you to make prudent choices in line with your financial goals. Through ETFs, index funds, and fractional investing, the S&P 500 becomes a venue for solid long-term wealth-building to take care of your future financial securities.