Your financial situation may seem bad after experiencing debt settlement, but where there is a will, there is always a way to repair your credit file. When you find yourself drowning in debt, the debt settlement route is one viable option you can consider, but it negatively impacts your credit score. This article explores the measures you can take to improve your credit score after debt settlement.

How to Improve Your Credit Score After Debt Settlement

When you’re struggling with repaying your debt, you can enter into an agreement with your creditors where you will pay your outstanding credit for less than what you owe. This is known as debt settlement and it is more of an informal payment arrangement.

When you undergo a debt settlement, you should review your credit reports to ensure they are error-free. Be sure to check that the debt has been cleared after the settlement so that you can rebuild your credit score without obstacles. Everyone is entitled to get a free credit report from a credit bureau. Once you discover errors on your credit report after the settlement, you should immediately dispute them.

Paying your bills and other recurring monthly debts on time is the most effective option which helps improve your credit score. No matter whether you’re emerging from a debt settlement, timely payment of bills will help you rebuild your credit score quickly. Never miss a payment to avoid falling into the same predicament.

Another viable method you can consider is to lower your credit utilization ratio. You should not apply for credit unless you need to fix an unexpected challenge. It is vital to exercise financial discipline and refrain from borrowing money to build your credit score.

Building an emergency fund is another option that can help you stay on your track when trying to improve your credit score after a debt settlement. Instead of seeking credit, you can use the money in your savings account. Alternatively, you can consider getting a secured card. This card is secured by a deposit in your bank so that you can only use available funds, unlike a credit card.

How Long After Debt Settlement Will My Credit Score Improve?

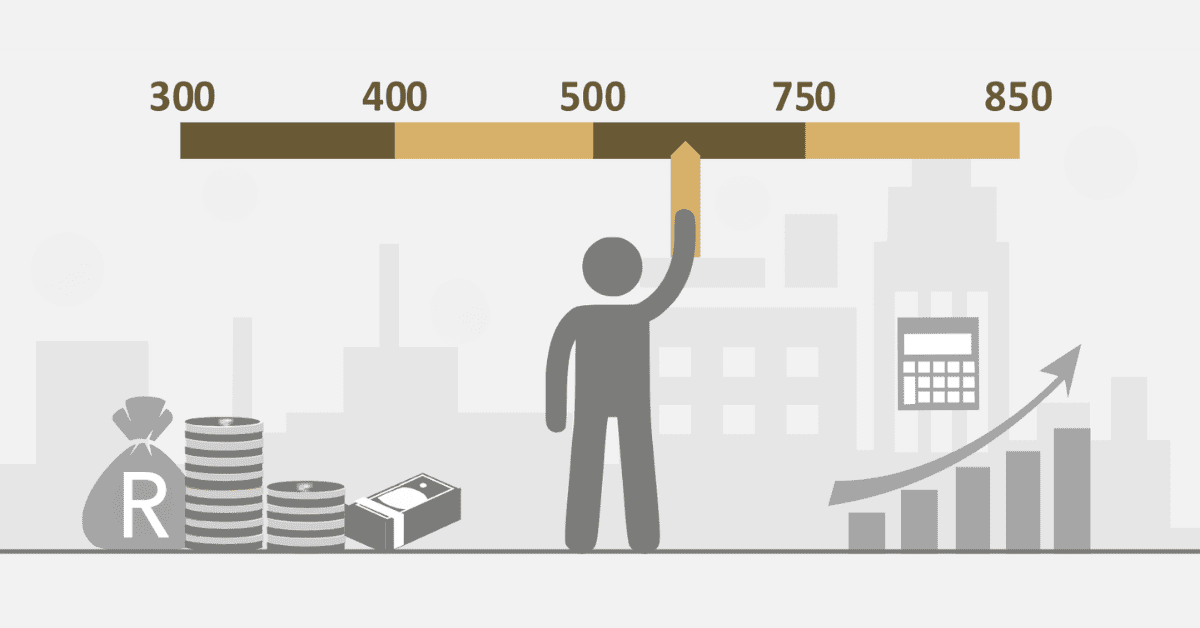

You can start seeing positive changes in your credit score after settling your debts in about six months or more. Significant changes can only be witnessed after two years. Different factors contribute to the time it will take you to repair your credit including the following:

- The total amount you owed

- How fast you settled your debts

- How good was your credit score before the debt settlement

- Your overall credit history

Rebuilding your credit score after debt settlement can take longer than you expect. Therefore, you should be patient to allow the process to take its course.

Is Debt Settlement Bad for Your Credit?

While debt settlement is designed to help you get out of credit, it will stay on your credit report for about two to seven years. As a result, it will negatively affect your credit score, which means you may not be able to get certain types of loans. However, debt settlement does not stay on your credit report forever.

You can still rebuild your credit and start afresh once the settlement is cleared. It is imperative to be patient when you are rebuilding your credit score.

Can I Get a Loan After Settlement?

Yes, you can get a loan after debt settlement. However, it might be difficult to get credit during the period when the settlement is still on your report. Other lenders do not consider the applicant’s credit score. Depending on your financial situation, here are some things you can consider when applying for a loan after settlement.

- Type of Loan: After a debt settlement, you may not qualify to get big loans from lenders like banks. For instance, you will not be able to get an auto loan, mortgage, or business loan when a debt settlement is still on your report. However, you can apply for a personal loan or payday loan once you convince the lender that you can repay the money. These are high-interest loans that can be accessed even with poor credit scores.

- Credit history: Your credit history before the settlement plays a crucial role in helping lenders determine your creditworthiness. If your profile has missed payments, this may negatively affect your loan application.

- Type of settlement: The type of debt settlement can affect your eligibility for a loan. For instance, you may not qualify for certain types of loans if you filed for bankruptcy.

- Employment and income: If you have a stable source of income, you can convince the lender that you can repay the loan.

- Post-settlement era: You need to take time to put your finances in order before applying for a loan. This will show the lenders that you have matured in terms of financial discipline.

- Get a cosigner: If you have a trusted friend or relative with a good credit score, they can act as a surety and apply for a loan on your behalf. If you fail to repay the loan, the cosigner will take over.

- Collateral: By providing collateral like a car, you can obtain a loan, especially if the money you want is less than the value of the car.

If you need a loan after a debt settlement, you should shop around to get the best deal. Other lenders do not consider your credit score when you apply for certain types of loans.

A debt settlement is a viable option that can help you get out of debt. However, a settlement will affect your credit score since it remains on your credit history for up to seven years. The good news is that you can still rebuild your credit score after a settlement. To achieve this, you should exercise financial discipline and avoid new debt while still in the process of repairing your score.