A good credit history is important for several reasons, including obtaining loans or credit lines, phone contracts, or renting an apartment. However you can rent an apartment without a credit score, but you need to check the requirements first with the landlord. Here are the guidelines for renting an apartment without a credit score.

Can I Still Rent a Home if I Have a Bad Credit Record?

Yes, you can rent an apartment even when you have a bad credit record. No credit apartments are usually found in rural areas or outside large cities and towns where demand for accommodation may be low. However, you can still rent a home with bad credit, depending on how you approach the landlord.

How to Rent an Apartment Without a Credit Score

If your credit score is lower or you don’t have one yet, you can rent from an individual homeowner. Most apartment complexes under the management of companies often require a credit check, meaning that you must have a good score to qualify. However, dealing with an individual is much easier when you know that your credit history is not good. Most landlords are interested in engaging tenants who can prove income stability.

While you need to be aware of scams, it is imperative to look for apartments that suit your budget. Be careful if you see an offer that seems to be too good to be true. You should engage directly with the landlord and don’t send money to anyone before seeing the home or talking to the owner. Only pay the money when you are satisfied with the terms and conditions offered.

Most landlords cannot live comfortably with empty apartments since they have to meet payments like utilities and mortgages. Therefore, if you can identify an empty home, try to look for the owner and present your case. Once you reach an agreement, you should promise the landlord that you will move in quickly. In places where the demand for rental homes is low, landlords are not very strict about credit checks.

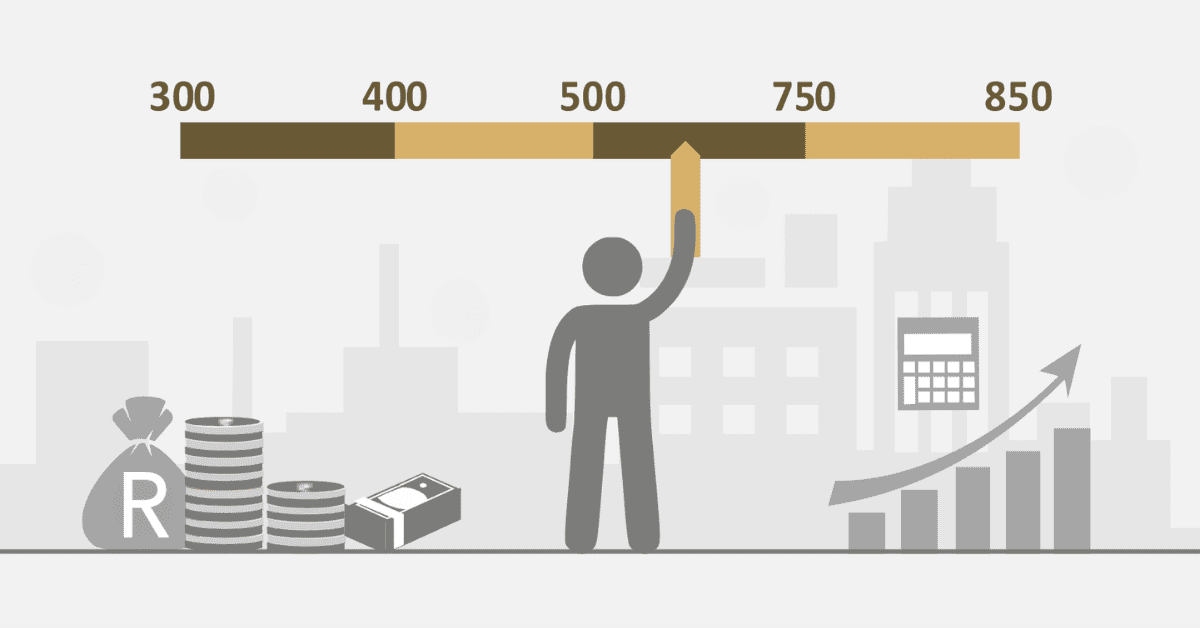

In some cases, you might have a poor credit score, but you’re fixing it, and you also have a steady income. If you can prove to the landlord that you make enough money to afford the monthly rentals for the apartment, you can get accommodation without hassles. For instance, if you earn more than R25 000 every month, you can get a place to stay that suits your income. A high balance in your account may suffice if you don’t earn a stable income. However, the landlord may ask for an advance payment of rent for three months or more. When you pay a security deposit, your landlord will not run the risk of non-payment whilst the tenant is still new.

A professional reference letter can help you secure an apartment without a good credit score. For instance, a reference from a previous employer, teacher, or professor can convince the landlord that you’re a responsible person. Professionals are often regarded with high esteem as a result of their strong background of responsibility in different fields.

Opting for a month-to-month lease agreement is another method you can consider to rent an apartment without a credit score. With this option, you will give the landlord some benefit of the doubt to prove that you can meet your monthly payments. If you fail to honour your obligation, the landlord can terminate your contract.

If the owner of the apartment where you want to stay insists on engaging someone with a good credit score, you can get a co-signer. Look for someone you trust with a good credit score to sign the lease agreement on your behalf. This person will be liable for paying your rentals if you fail to meet your obligations during the lease agreement. Make sure this option will not strain your relationship with your loved one. Sharing an apartment with someone is another option that can help you save money and evade the issue of landlords who demand good credit scores from tenants.

Why Landlords Typically Require a Credit Check to Rent an Apartment?

Most landlords require credit checks to rent an apartment to determine a potential tenant’s capability to pay their monthly rental on time. Although a credit score does not reflect your complete financial story, your credit history reflects your previous behavior, which can help landlords assess liability and level of risk posed by the potential tenant. When landlords conduct credit checks, they will be looking for aspects like late payments, evictions, or bankruptcies. Huge debts can also be used as red flags to determine an individual’s creditworthiness.

Can you pass a credit check with no credit history?

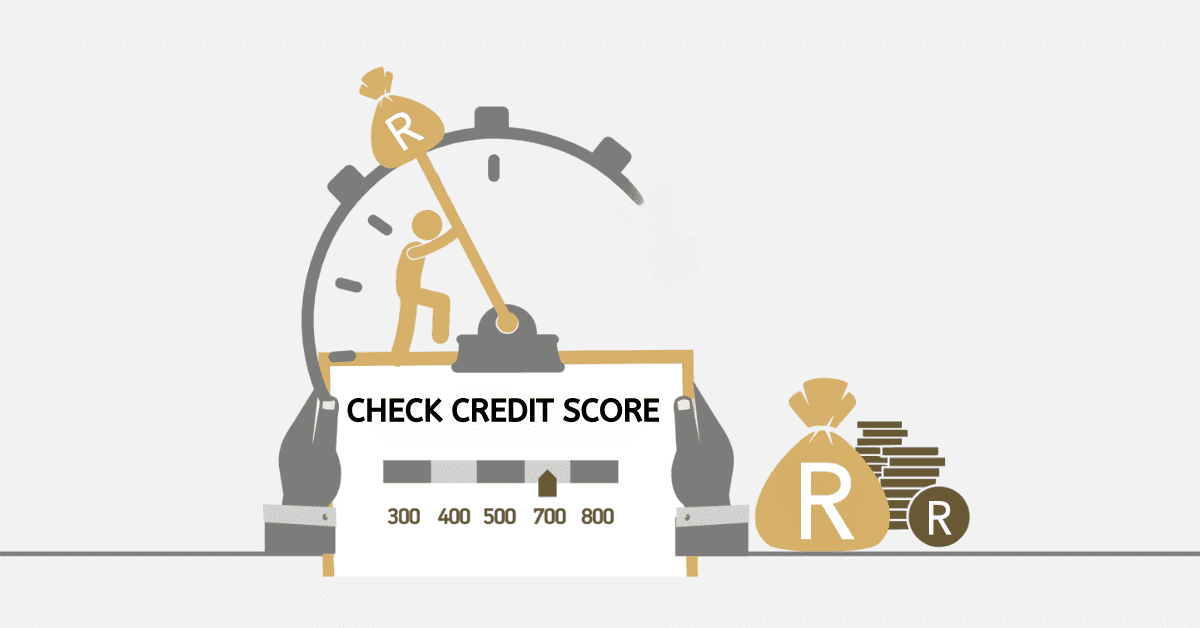

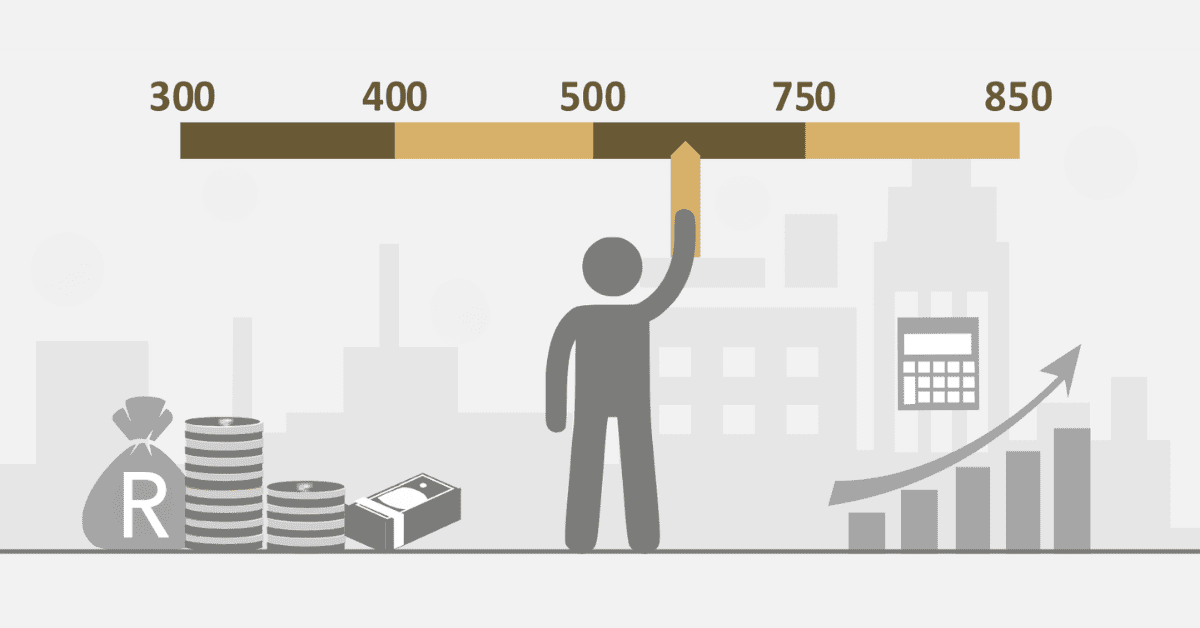

Although lenders prefer dealing with individuals with good credit scores, you can still pass credit checks with no credit history. When you’re said to have no credit history, it simply means that credit bureaus don’t have your financial history in their records. You can still access credit depending on the type of loan you want to get.

Credit reporting is conducted by major credit bureaus that provide financial institutions and lenders with a detailed financial history of an individual. This information reflects the person’s habits, and lenders will use this information to assess if one is suitable for getting credit or not. However, when you have no credit at all, it does not necessarily mean that you’re bad with credit. You can still get into debt and manage to repay it.

Without a credit score, it might be difficult to access loans or credit cards since most creditors consider an individual’s credit score. A credit report reflects your financial history, which is used by lenders to determine if you’re capable of repaying your debt on time when you apply for a loan. Some landlords conduct credit checks to see if the potential tenant is a good fit to meet their monthly payments. However, it is possible to rent an apartment without a credit score. By following these tips, you can rent different properties without strong credit.