Once you begin working and earning an income, whether as a PTY LTD, a sole proprietor, or as a salaried employee, you will need to register for tax with SARS. Today we will walk you through the complete process of registering for tax with SARS.

How do I Register for Tax at SARS?

Before registering for tax, it is important to determine what type of tax you are required to register for and if you need to register at all. Common tax types include income tax, value-added tax (VAT), provisional tax

You must gather the necessary information and supporting documents to facilitate your registration. This includes your personal or business details, bank account information, and proof of identity.

While you can register as a new taxpayer on the mobi app or in-person at a SARS branch or be registered for tax by your employer when they submit PAYE on your behalf, it is far easier to do this via the eFiling site. This means you can pay, file, and maintain your tax without hassle and inconvenience. You also remain in full control of your tax affairs.

Once your registration is confirmed, you will need to start filing tax returns on a regular basis. You can file tax returns online using the SARS eFiling system. Make sure you are aware of your relevant tax types and their filing dates.

How do I Register for SARS Online?

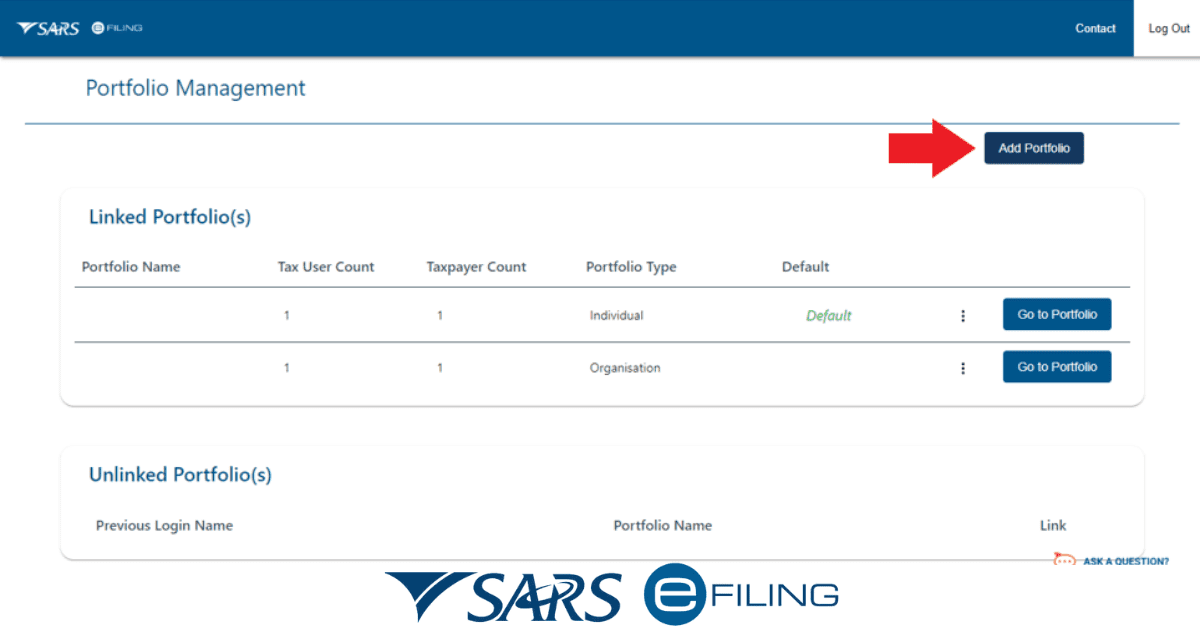

To register for SARS Online (eFiling), do the following:

- Visit the SARS eFiling website and click on the “Register” button.

- Select whether you are registering as an individual, a company, a trust, or another type of taxpayer.

- Enter your personal information, including your full name, contact information, and a valid email address.

- Choose a unique username and password to use when logging into the eFiling system.

- SARS will send an email to the address you provided to verify your registration. Follow the instructions in the email to complete the verification process.

Depending on the type of taxpayer you are registering as you may need to provide additional information and documentation. Follow the prompts on the eFiling website to complete the registration process and upload supporting documents like your ID as required.

Once you have completed the registration process, you will be able to log into the SARS eFiling system and start to manage your tax obligations, file tax returns, make payments, and access a variety of other features and tools.

How do I Qualify for SARS?

You do not need to ‘qualify’ for SARS in any way. Once you start earning an income in South Africa, you can simply register online for eFiling to meet your tax obligations easily. Your company may even have registered you if they need to pay PAYE on your behalf. We have outlined when people and entities are eligible for tax in the section below.

What Documents do I Need to Apply for Tax?

The documents you need to apply for tax in South Africa will vary depending on the type of tax you are registering for and the type of taxpayer you are. However, in general, you will need to provide the following information and documents:

- Your full name, contact information, proof of identity (such as a passport or ID card), proof of address, and a valid email address.

- Details of a South African bank account, including the bank name, account number, and branch code, so that SARS can make payments to you or receive payments from you.

- If you are registering as a business, you will need to provide information about your company, such as the company name, registration number, and type of business.

- You will need to provide information related to the type of tax you are registering for, including income tax, value-added tax (VAT), or other types of taxes.

You may need to provide additional supporting documents for specific taxpayer types. These are outlined on the SARS website in detail for each entity and tax type.

How Long Does SARS Verification Take?

Once you have gathered all of the necessary information and documents, you can register for tax online using the SARS eFiling system. SARS will review your information and confirm your registration, which may take several days.

The time it takes for SARS to verify your information and complete the registration process will vary depending on several factors, such as the time of year, the volume of applications SARS is processing, and the complexity of your application.

In general, it can take anywhere from a few days to several weeks for SARS to complete the verification process. During busy periods, such as the income tax season, the verification process may take longer, so plan accordingly.

After you have completed the online registration process, you can check the status of your application by logging into the SARS eFiling system and checking the “My Profile” section. If your application has been approved, you will receive a confirmation email from SARS with instructions on how to log into the eFiling system and start using it to manage your tax affairs.

Who Must Register for Tax?

In South Africa, tax registration is mandatory for individuals and businesses that earn income or carry out transactions that are subject to tax. However, below a certain single-source income threshold set each year, individuals are not required to submit a tax return unless they want to utilize deductions they are entitled to (medical aid, pension, and allowed expenses) to recover some of the PAYE they have paid through the year. If you earn from multiple sources, this will not apply even if you are not required to pay any tax due to your earnings level. You will still need to register and declare your earnings as a provisional taxpayer.

- Individual taxpayers: If you are an individual who earns income from employment, business, rental, or other sources, you are required to register for income tax regardless and file an annual tax return if you earn over the income threshold or wish to use deductions.

- Businesses: If you operate a business in South Africa, you are required to register for the appropriate taxes, such as income tax, value-added tax (VAT), and employee taxes. You will also be required to file regular provisional tax returns and make tax payments to SARS. Payroll taxes may also apply, where you submit PAYE on behalf of your staff.

- Trusts: If you operate a trust in South Africa, you are required to register for income tax and file an annual tax return.

- Foreign taxpayers: If you are a foreign individual or business that earns income or carries out transactions in South Africa, you may be required to register for tax and comply with South African tax laws. Your (or your company’s) tax residence will determine this, although there are exceptions.

Tax registration requirements and obligations in South Africa are subject to change, and you should consult with a tax professional or SARS for the most up-to-date information.

Hopefully, you now have a clearer understanding of registering for tax in South Africa through SARS and their eFiling platform. Remember that their contact centre is always available to help you with further queries.