In a digital world where we maintain many passwords, it’s relatively common to forget the specific password we use for each site. Especially regarding SARS eFiling, as many individuals only use the site once a year for their income tax return. However, it is important you use a solid and secure password for your SARS eFiling, as it provides an important layer of security to prevent cybercriminals and unauthorized parties from accessing your private or business tax information. If you have forgotten your login password or need to amend or change other details, we’ve created this guide to help.

How to Recover eFiling password

If you forget your eFiling password;

- You should head to the front page of the login for eFiling.

- You will see a small blue hyperlink for “Forgot Password” under the login box. There’s also an option to recover your username if you have forgotten that.

- Simply follow the on-screen prompts, and a password reset option will be sent to your registered security contact details.

- You will not ‘recover’ the password per se; instead, you will be allowed to reset it to a new password once they can verify it is a legitimate request. For this reason, it’s important to keep your email and phone contact details up-to-date with SARS.

You can also recover this password from the SARS MobiApp, or use two-factor authentication for a passwordless login that instead sends a push notification to your registered mobile device.

How do I get my tax number if I forgot my username and password?

The easiest way to get your tax number if you cannot access eFiling is by looking at any piece of SARS correspondence you may have saved, either via mail or downloaded documents. These will always display your tax number. Remember to make sure it is your tax number and not a PAYE or VAT registration number. An old tax return is your best bet.

If you cannot find your tax number this way, go to the www.sars.gov.za website and select their “contact us” number. Send them your details (typically ID number for a non-business entity, contact details, and a landline telephone number) and request your tax number in the drop-down menu.

If you cannot do either of these, then your best option is to contact the SARS contact center or request a call back. Call backs can take up to 2 days. Failing this, you may have to go to a branch to resolve the matter.

How can I reset my income tax password without email ID?

If you have forgotten your username and password, start by requesting help with the lost username via the steps we outline above, and then proceed to set a new password once your recover your username.

This will be a tricky process if you no longer have access to the email you provided to SARS for use on the system, as that is where these requests will be sent. There is a mandatory cell phone field when recovering username, and if you still have access to this number, you can use that instead.

If you are locked out of both of these options, you will need to go into a branch or contact the SARS call center to assist you in restoring eFiling access. Be prepared to prove your identity when doing this.

What is your eFiling username?

Your eFiling username is not an official SARS identifier, and they do not issue it to you. Instead, it is the username you selected when you first created your eFiling account. It could be anything you chose- try a combination of capital and lowercase letters and numbers for the best security. If you have forgotten your username, follow the steps we outlined above to recover it.

Where do I find my eFiling user ID?

You will not find your eFiling username on any official SARS documentation, as they do not issue it to you. You chose it when you first registered for eFiling. If you have forgotten it, it can be recovered via the ‘Lost Username’ option on the frontpage of the eFiling login.

How long does it take to reset your tax password?

If you still have access to the mobile number and email you used on the eFiling site, resetting your password is a very quick process. Simply use the ‘Lost Password’ option on the frontpage of the eFiling site, provide the requested details, and a link to reset the password will be sent to you. Typically this will take under 10 minutes.

If you no longer have access to those communication channels, you will need to contact the SARS Contact Center for assistance, and it may take a while to restore your eFiling access.

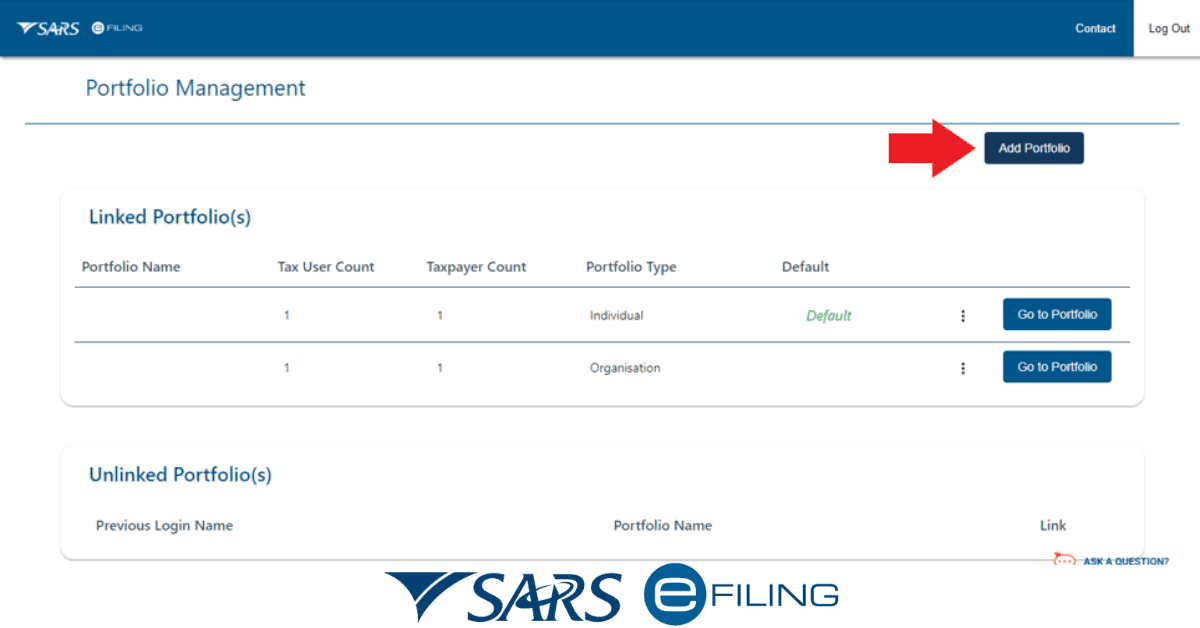

How do I change my SARS eFiling username?

Once you login to eFiling, you can click the blue ‘Profile’ button on the top left of the screen. Then click ‘Profile and Preference Setup’ in the left-hand menu and scroll to the “Your Login Details” to make changes to your username.

With these handy details, you should feel fully confident in recovering your eFiling password and making changes to your username and other details. Remember, if you cannot do it via the offered online prompts, you will need to call the SARS Contact Center for further assistance.