If you live in South Africa and owe taxes, you should stay on top of your paperwork and always have the most recent versions of any necessary forms handy. The South African Revenue Service’s ITA34 form is one example of such a document (SARS). To get a full picture of your tax situation, including assessments, payments, and refunds, you can use Form ITA-34.

How to get an ITA34 from SARS

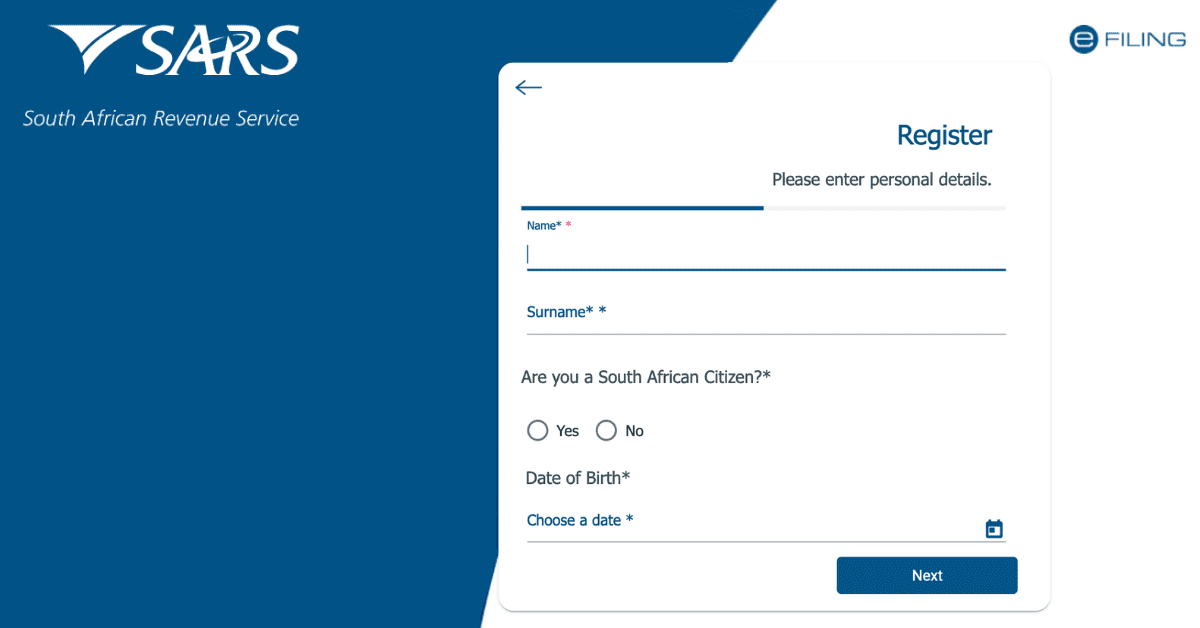

You can obtain an ITA34 form hassle-free from SARS. You can request a copy of the form through your eFiling account once you have registered with SARS. Therefore, sign up for eFiling, the SARS-provided online portal for taxpayers to manage their tax data if you haven’t already. As long as you have an eFiling account, requesting an ITA34 is hassle-free.

What is an IT34 from SARS?

South African companies, corporations, and trusts need the ITA34 Form. You can organize your taxes and pay SARS the right amount by completing and submitting it annually. The form will calculate your taxable income and tax liability. Thus, accurate and current information is crucial. eFiling lets you complete the ITA34 Form online without visiting the SARS office. Therefore, complete the ITA34 Form to organize your tax affairs and avoid SARS issues.

How can I get my ITA34 form online?

Getting your ITA34 form from SARS is now hassle-free! You can access it from the comfort of your own home. All you need is an internet connection and a SARS eFiling account.

Log in to your account, go to the ‘Forms’ section, select ITA34 from the drop-down list, or simply search for it using the search box. Fill in your personal information and provide any necessary supporting documents, then hit the ‘Submit’ button. But don’t get too excited just yet – completing the form doesn’t guarantee payment from SARS.

The processing time varies depending on the complexity of your transaction, but typically it can take anywhere from a few days to a few weeks. If you have yet to receive payment after a reasonable time, contact SARS for an update.

What is an ITA34 by SARS?

The ITA34 Form is crucial for all companies, close corporations, and trusts in South Africa. It is a means to report your income and taxes and ensure that you pay the correct amount. This form must be completed annually, providing SARS with a complete picture of your financials, including your income, expenses, and capital gains. Therefore, the ITA34 Form allows you to declare your taxes accurately and get the credit and deductions you deserve.

You can complete the form online through the SARS eFiling system or print it and fill it out by hand. Just remember accuracy is key when filling out the ITA34 Form, so double-check all the information before submitting it to SARS!

What happens after ITA34 is issued?

After SARS processes the ITA34 Form, it’s time to sit back and relax as the tax experts handle the next steps. Once the audit is complete, SARS has a speedy 21-day turnaround to issue a Letter of Completion. This letter will inform you if your refund amount has changed or stayed the same.

And the good news is you can expect your hard-earned money to hit your bank account within 7 business days of receiving the letter! It’s that simple! So, keep an eye on your mail for that all-important Letter of Completion from SARS.

How do I know if SARS owes me a refund?

Log into your eFiling account and click the Statement of Account (ITSA) icon at the top to see if SARS owes you a refund. Clicking on it will show your account status, including any outstanding debt. Your ITSA statement will show the refund amount and date. Therefore, check your ITSA regularly to manage your taxes.

How long does an ITA34 take?

The time it takes to receive your ITA34 form will depend on various factors, such as the volume of requests SARS receives, the accuracy of the information you provide, and the complexity of your tax matter. It may take a few days to several weeks to receive your ITA34 form.

How do I view ITA34 on the app?

You can easily access your ITA34 from the comfort of your own home with the SARS MobiApp. All you need is your smartphone or tablet and an internet connection. Here’s how you can view your ITA34 on the app:

- Download the SARS MobiApp from the App Store or Google Play Store.

- Log in using your eFiling credentials.

- Once logged in, navigate to the “Notice of Assessment” tab.

- You will find a list of all the Notice of Assessments (ITA34) issued to you by SARS.

- Click on the ITA34 form you would like to view.

- The ITA34 form will open, and you can view the details of your assessment and any refund or due payment.

It is important to regularly check your ITA34 to ensure that SARS has the correct information about you and your tax situation and to avoid any potential fines or penalties for incorrect tax submissions.

Conclusion

In conclusion, the ITA34 form from SARS is an essential document for all taxpayers in South Africa. It outlines the details of your tax assessment, including any refund or payment due to SARS.

Getting your ITA34 form is quick and easy through either eFiling or the SARS MobiApp. You can also visit a SARS branch or call the Contact Centre to request a copy. Regularly checking your ITA34 will ensure that SARS has accurate information about you and your tax situation and will help you avoid potential fines or penalties.

If you believe that you have overpaid on your taxes and are owed a refund, you can check your ITA34 or reach out to SARS directly to confirm the status of your refund.