As South Africa has no reliable public transit system, having your own car is on most people’s wish lists. Few of us have the means to buy a car outright in cash, especially a new, reliable one. Getting approved for a car loan, however, requires you to have a good credit score. What can you do if you don’t have that good score? Today we look at everything you need to know about car loans and low credit in South Africa.

How to Get a Car Loan With a Low Credit Score

Trying to make a major big-ticket purchase like a car with a low credit score is going to be very tricky. While some reputable lenders in the market offer ‘bad credit’ car loans, you are going to pay a lot more in interest and have significantly higher premiums.

If you are trying to get a car loan merely to show off, or have your heart set on a fancy, flashy set of wheels, now is the time to reconsider. Strongly. That is a recipe for getting deeply into debt, and that is a dangerous game to play. However, if you have a legitimate need for a vehicle, the very best thing to do would be to hold off a while and try to raise your credit score. Even a reasonably small raise can make for big savings in the long run. If you can’t wait, here are some other things that can help.

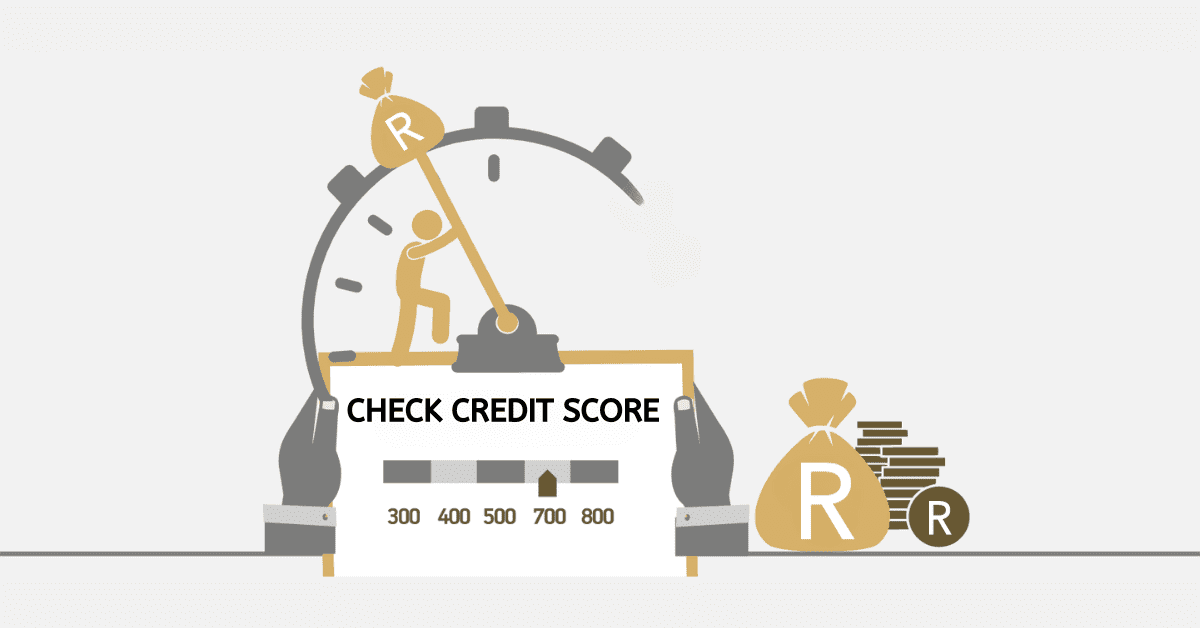

- Check your credit report anyway. You may uncover errors (or even fraud) you can quickly fix. Then, see what is causing the poor credit score, and take steps to improve it.

- Offer to pay a deposit. The highest you can afford. This will lower your installments, may get you better terms on the loan, and will show the vendor you are serious.

- Ensure you can prove at least 3 months of a salary large enough for the loan and your other debts.

- Shop around for the best possible rate from lenders who work with bad credit financing

- Be very careful about your vendor choice, though. Many scamsters and loan sharks are waiting to take advantage of people like you. Stick to reputable vendors, even if it is frustrating.

You can ask your lender of choice for a pre-approval before you start shopping, too. This will give you confidence in what you will be approved for and can be a useful negotiation tool.

If your problem is no credit, not low credit, you have a few more options. This is very common for young, first-time buyers and divorced/widowed people who used to rely on their spouse’s credit. A relative who is willing to co-sign, or stand surety, may help you unlock a better deal or qualify for a loan you otherwise wouldn’t.

What is the Lowest You Can Get a Car Loan For?

On paper, the lowest salary that will qualify for a car loan is R6,500 per month. Realistically, that isn’t going to get you a lot of money, however, as lenders cannot take more than a specific portion of your salary as laid out in the National Credit Act. Most finance companies, especially those focusing on bad credit finance, will want to see at least R7,500 per month.

What Car Company is Easiest to Get Financing?

If you are really struggling to get a car loan, enquire directly with dealerships who offer in-house financing instead. Some of these have less stringent credit checks or are more flexible with your options. Always deal with an NCR-registered company for peace of mind.

Keitzman Vehicle Finance is a well-regarded company that specializes in helping clients get pre-approved for car loans. They may be the easiest way to get financing if you are struggling.

Which Bank is Best for Car Finance?

Standard Bank, Wesbank, and Absa Vehicle Finance are widely seen as the best banks for car financing in South Africa. FNB Vehicle Financing, while technically the same parent company as Wesbank, is a separate division and is also well-regarded. No bank is particularly easy to get a car loan from, however. Especially with a low credit score. They have the most stringent requirements of all lenders.

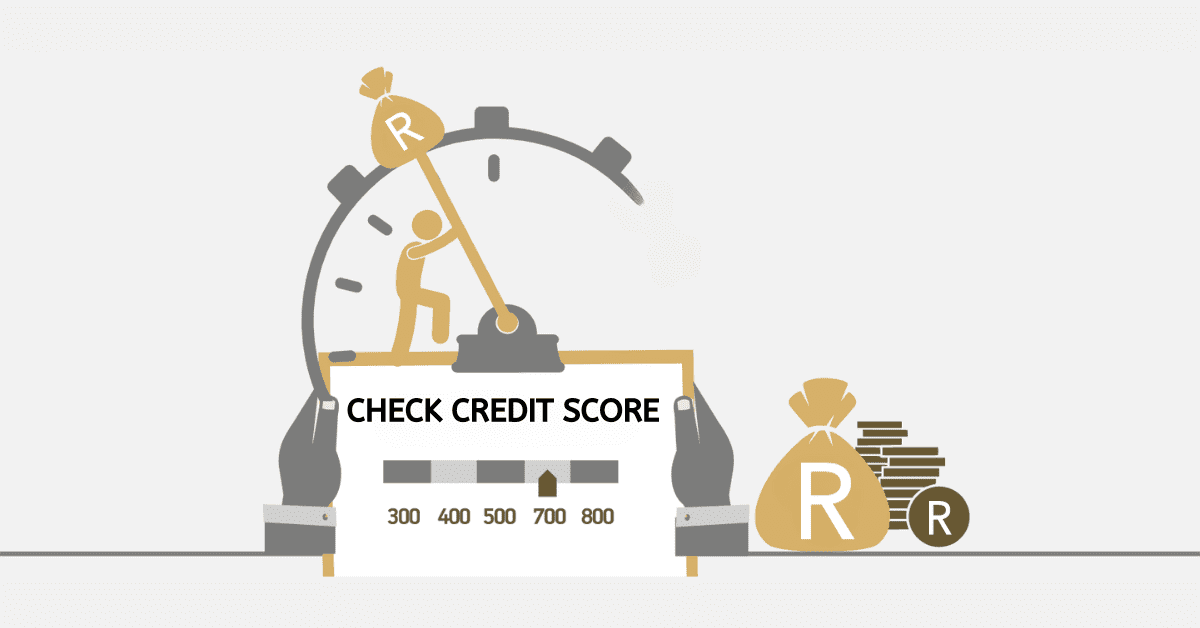

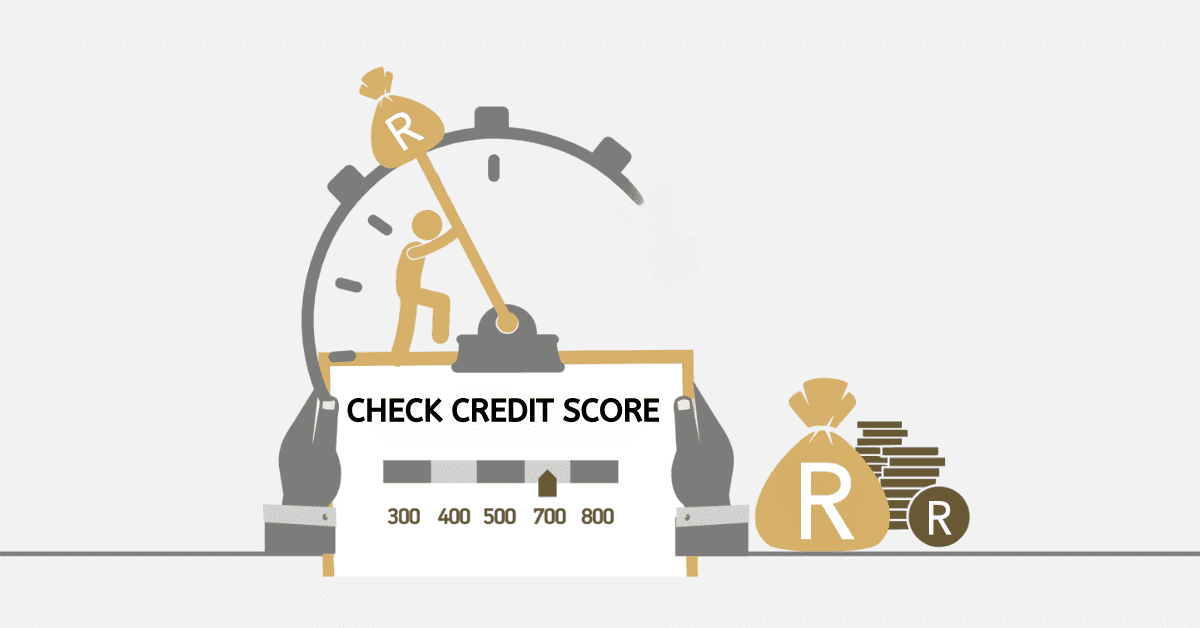

What is the Lowest Credit Score to Buy a Car in South Africa?

You will need a minimum credit score of 660 to qualify for a car loan in South Africa. If you can get that score to 700 or higher, you will unlock more offers and a lower interest rate, too, so it is worth investing some time in your credit score to get the best possible deal. Remember that credit score isn’t the only factor. You will also need a high enough salary and will need to meet some other basic requirements.

Getting a car loan with a low credit score is difficult, but not impossible. You will have to put a lot of effort into it, however. Remember that even small improvements in your credit rating can have a big impact on what is open to you and the interest cost it comes at. Rehabilitating your credit is always worth it.