An Individual Income Tax Return Form 6 (IRP6) must be filled out to report income that does not come from wages, such as interest, dividends, rental income, company profits, and more. Two provisional tax returns (IRP6) and the necessary payment must be submitted by taxpayers who are considered provisional throughout the tax year. You must submit your initial provisional tax return during the first six months of the tariff year. However, your second provisional tax

It is standard procedure in South Africa to include the expected taxable income and tax liability for the relevant period on the IRP6. Filling out and submitting the IRP6 online is made easy using E-Filing. It’s the most used choice since it is a quicker, hassle-free, and shielded path to address tax challenges. This post will let you master each stuff you should know about the eFiling IRP6 exercise, including how to register an IRP6 SARS, who has to sign up for one, and where to locate one. All the info you need is given here.

How do I complete IRP6 on eFiling?

The steps to complete IRP6 on eFiling are as follows:

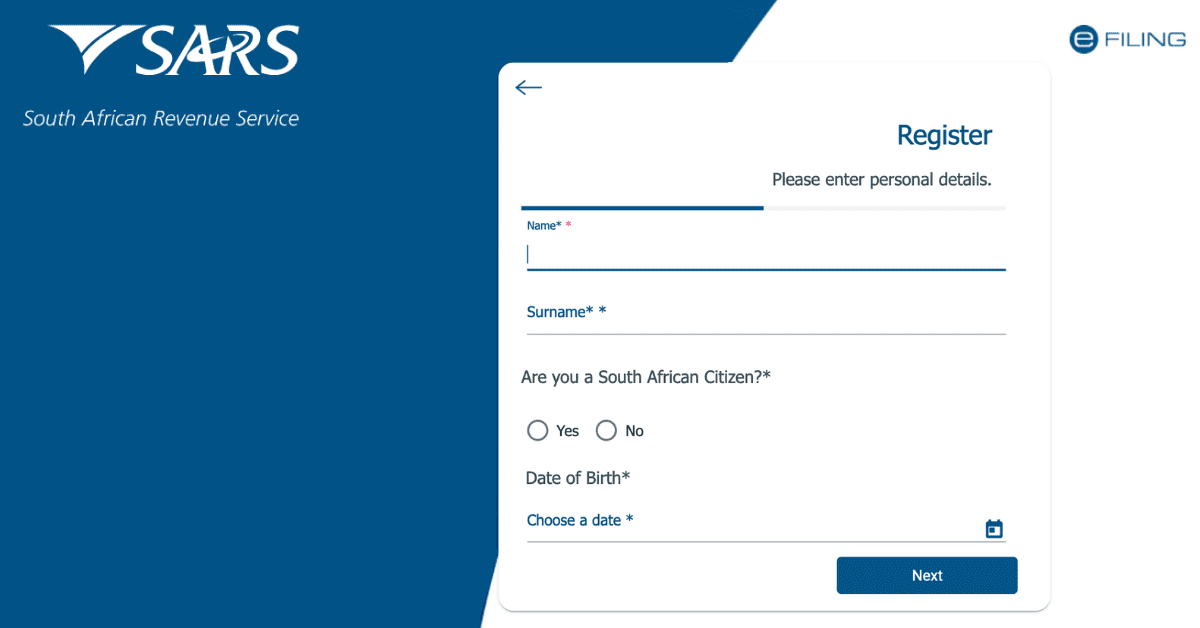

- Log in to your eFiling profile and ensure that the “Provisional Tax (IRP6)” tax type is activated.

- Press on the “Returns” icon and then hit on “Returns Issued”.

- Click “Provisional Tax (IRP6)” and select the provisional tax period from the drop-down menu in the top right corner.

- Click on “Request Return,” and the Provisional Tax Work Page will be displayed.

- Fill in the required fields with the relevant information, such as your personal details, estimated taxable income, tax calculation, payment details, etc.

- Verify the details and click “Calculate” to see the amount of tax payable for the period.

- Click “Save” to save your return, and click “File” to submit your return to SARS.

- Print the confirmation display and store it for your reference.

What is an IRP6 SARS?

An IRP6 SARS is a return for provisional tax payment issued by the South African Revenue Service (SARS) to provisional taxpayers. An IRP6 SARS contains the following information:

- The tax reference number and the provisional tax period of the taxpayer.

- The estimated taxable income and the tax calculation for the period.

- The payment reference number (PRN) and the payment due date for the period.

- The declaration and signature of the taxpayer or the representative.

An IRP6 SARS reconciles the provisional tax payments with the normal tax liability for the applicable assessment year. On assessment, the provisional discharges will be offset against the liability for standard tax for the concerned year of assessment.

Who must submit IRP6?

According to the Income Tax Act, No.58 of 1962, a provisional taxpayer is any person who receives income (or to whom income accrues) other than remuneration or from an employer not registered for employees’ tax. Provisional taxpayers are individuals or companies earning income from interest, dividends, rental, business, etc. Note that most salary earners are not provisional taxpayers if they have no other sources of income.

A provisional taxpayer must submit two provisional tax returns (IRP6) during the tax year and make the applicable payment thereon. The first provisional tariff return must be forwarded within the first six months of the tariff year. On the other hand, the second provisional tax return must be forwarded at the end of the tariff assessment year. A third payment is optional after the end of the tax year but before the issuing of the assessment by SARS.

There are some exceptions to the definition of a provisional taxpayer, such as approved public benefit organizations, recreational clubs, body corporates, share block companies, certain associations of persons, non-resident owners or charterers of ships or aircraft, natural persons who do not earn any income from carrying on any business or whose taxable income is below the tax threshold or R30 000, small business funding entities, deceased estates, and certain associations approved by the Commissioner.

Where do I get my IRP6?

An IRP6 can be obtained from the following sources:

- eFiling: The eFiling facility allows you to request an IRP6 return and make your submission and payments online. Using the client information system, you can register once for all different tax types. If you are already an eFiler, simply add the provisional tax to your profile to access and file your IRP6 return online.

- SARS Contact Centre: You can call the SARS Contact Centre on 0800 00 SARS (7277) to request an IRP6 return or get more info and updates about the provisional tax process.

- SARS Branch: You can visit the nearest branch and request an IRP6 return. The SARS staff will help you to complete and submit your IRP6 electronically.