Buying a car in South Africa can be challenging if you have a low credit score, but it is not an impossible task. People with less-than-ideal credit scores might encounter increased interest rates and fewer choices when obtaining financing.

While local lenders might have reservations, there are alternative financing options available for individuals seeking car loans. Specialised car dealerships and lenders catering to borrowers with poor credit could potentially provide viable solutions.

In addition, financial institutions may view recent financial improvements and stable income as positive factors.

Even though there may be challenges, individuals with low credit scores can still obtain car financing in the South African market by actively managing their finances and making strategic decisions.

While you are here let us find out more about how to buy a car with a low credit score. Although it is not impossible, the question lies within the process.

What is bad credit?

Having bad credit is not something that occurs suddenly or overnight. Typically, when someone exhibits poor financial behaviour, it indicates that they may struggle to responsibly repay their debts. However, it is important to note that bad credit can be caused by various factors, not just limited to personal actions. In certain cases, it may be a result of circumstances beyond your control.

Having a poor credit score can make it difficult to get approved for a loan or credit card. However, it is possible to rebuild your credit. You do not have to endure a poor credit score for an extended time. By committing to paying your bills on time, cutting down on unnecessary expenses, and making use of credit improvement tools, you can work towards repairing your credit score within approximately a year.

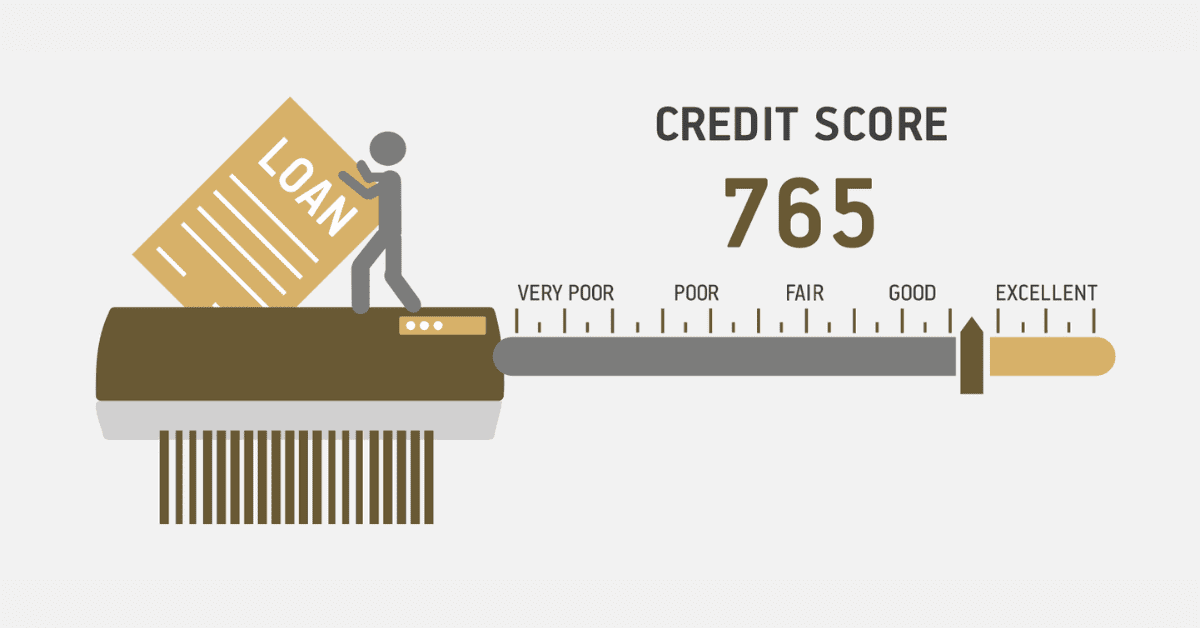

Although credit scores may appear as simple numerical values, they have the potential to significantly influence different aspects of your life. When you apply for a loan or line of credit, the lender will assess your credit score. If your score is low, it can lead to either a very high-interest rate or your application being denied.

How to buy a car with a low credit score

If you need a car loan but your credit does not look good, you might end up paying a significant amount in terms of loan costs. Lenders use credit scores to assess the likelihood of borrowers repaying their loans. The lower your score is, the more they less appealing you look to repay your loan. Lenders frequently increase the interest rate they charge due to the increased risk they assume.

It is a good idea to check your credit score before you start searching for a car loan. If you come across any incorrect information on your credit report, it is advisable to analyse and fix all errors. Having errors on your report has the potential to negatively impact your credit score, which in turn can make it more challenging for you to secure a loan.

Before you begin your search for a loan, it is a good idea to check your credit report. This will give you a better understanding of what to anticipate. With other credit score sites, you have the opportunity to access your credit report at no cost. Another option is to check in with your bank platform and get your credit score details and credit report.

Another way to buy a car with a low credit is saving for a down payment. It is a wise decision for some compelling reasons. Starting with a down payment can potentially improve your chances of securing a car loan, particularly if your credit score is less than ideal. If you fail to repay the loan, lenders are at a higher risk of incurring greater financial losses, especially when they have to repossess the car.

Ensure to clear existing debt before planning to get a car. Once all your existing debts are cleared, it makes your credit look worthy enough to secure a car loan. This gives you the upper hand in negotiating the interest rate on the car loan.

Check Your Credit Score and Credit Report

Checking your credit record and score regularly is crucial for maintaining your financial well-being. There are platforms which include your bank that give you access to view your credit score and credit report for free.

Having a higher credit score increases your chances of getting approved for a loan and securing favourable interest rates. Monitoring allows for quick identification and resolution of mistakes, which helps secure your financial capabilities.

It is advantageous to you as an individual who seeks to better your credit score to always check your credit report. Doing these necessary checks puts you in a higher spot to secure loans and other benefits. A good credit score signifies a lot and informs lenders about your financial habits.

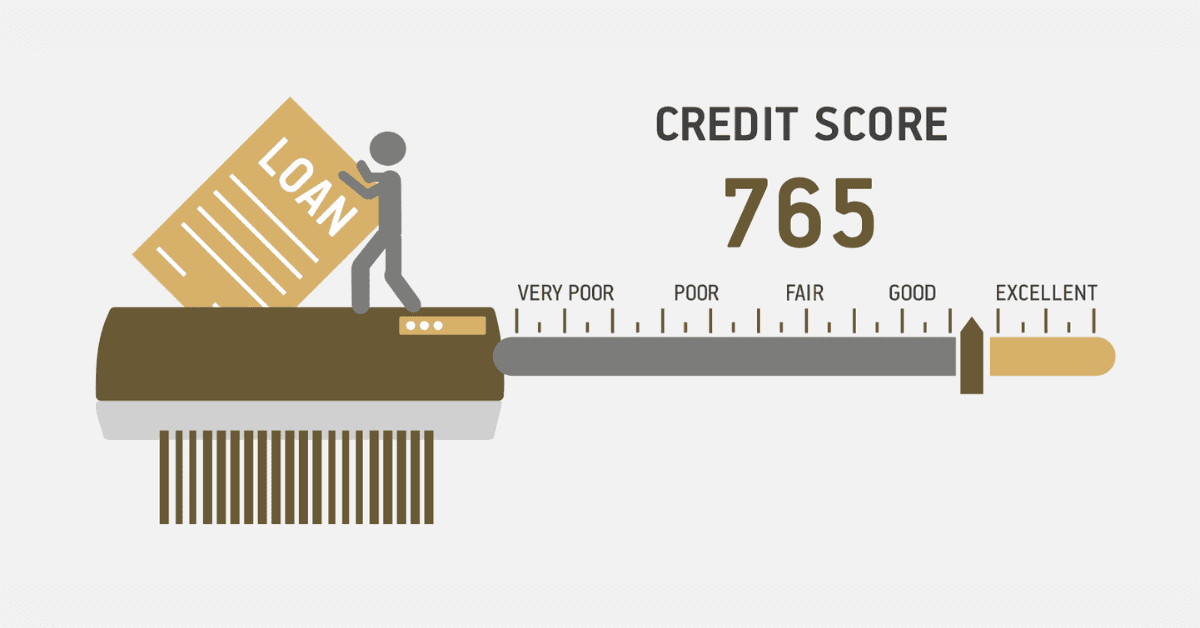

What is the minimum credit score for car finance?

By meeting this minimum standard, you demonstrate to lenders that you are responsible for your finances, increasing the likelihood of getting approved for your car loan. To increase your likelihood of securing the car loan you are required to have a minimum of 600 as your credit score. This demonstrates that you are conscientious about managing your finances, which can enhance your credibility with lenders.