Credit scores remain a mysterious term in the financial arena and more so to students. This is the same case with South Africa, with most people regarding it as an American thing or something that has less impact on their lives. This is, however, far from the truth. The credit score is one extraordinarily important determinant of one’s financial future, often overlooked in academic curricula. It is a key determinant for getting a mortgage, credit card

How To Build A Credit Score As A Student

Starting your credit score journey as a student in South Africa is like learning a whole new language. It will take discipline and strategy.

Start by understanding your credit score now, as it will be your new beginning, your base. Next, look for your existing accounts, such as a cellphone contract. Regular, timely payments are like the vocabulary of the new language you are learning, in which you show fluency in finances.

A credit card, used judiciously and accompanied by total repayments each time, is tantalizing to forming correct sentences grammatically. It will tell the lender if the borrower can be entrusted with repayments. Similarly, holding a phone contract and paying bills fully enhances your credit score, just like perfecting your pronunciation.

Be very careful about availing yourself of many credit cards after a refusal because that may be looked upon as desperate, like bungling a conversation. More than one overdraft or many credit accounts that are not being used can give red flags to lenders, just like abuse of words in a sentence. After all is said and done, do not use up all the available credit. It is like overusing a phrase; it does not speak well for your literacy.

The above are the steps that, if followed carefully, can result in the students mastering the language of credit.

Why Is My Credit Score So Low As A Student?

As a student, a low score in your credit worth may be due to varied reasons. One of them is that you may not have a lot of credit history; thus, the lender will not have enough information to appraise your credit worth. Another reason could be that you have a missed or late payment

Third, you may have applied for too many credit products in a short space of time, and that would present an impression that you are desperate and probably a risk to the lender. A fourth explanation could be that you use a significant portion of your available credit limit, indicating high credit utilization. This could indicate living beyond your means and struggling to pay off the debt.

How To Improve Your Credit Ratings As A Student

A good loan reading as a learner will thus increase the chances of future financial opportunities such as low-interest rates, high overdraft limits, and better loan terms. Some useful tips that could improve your credit score in South Africa could be as follows:

- Pay your bills on time. It’s a reflection of sound financial management and responsibility. You could use reminders and even automate your payments to avoid skipping the deadlines.

- Check your credit report. It is free and easily accessible from TransUnion, ClearScore, or Investec. Look for errors or misrepresentations and challenge them for rectification as and when required.

- You might want to try a secured card or a student credit card. They’re easier to qualify for than regular cards and can help you start a credit history. Use them with prudence, paying them off in full every month.

- Keep your credit utilization ratio low. This is the percent of your available credit that you use. You should keep it under 35% to not damage your score.

- Apply for new credit carefully. Too many inquiries or accounts applied over a short period could decrease your score and give the impression of desperation. Apply only when really in need and compare attentively the options you have.

How Long Does It Take For A Student To Build Credit?

But as a student, building a credit score can take time. Credit history typically needs three to six months of credit activity. However, it could change depending on how you manage money and debt. The better you pay the bills, the faster and more significant rise of your score can be by using credit cards and avoiding getting in over your head in debt.

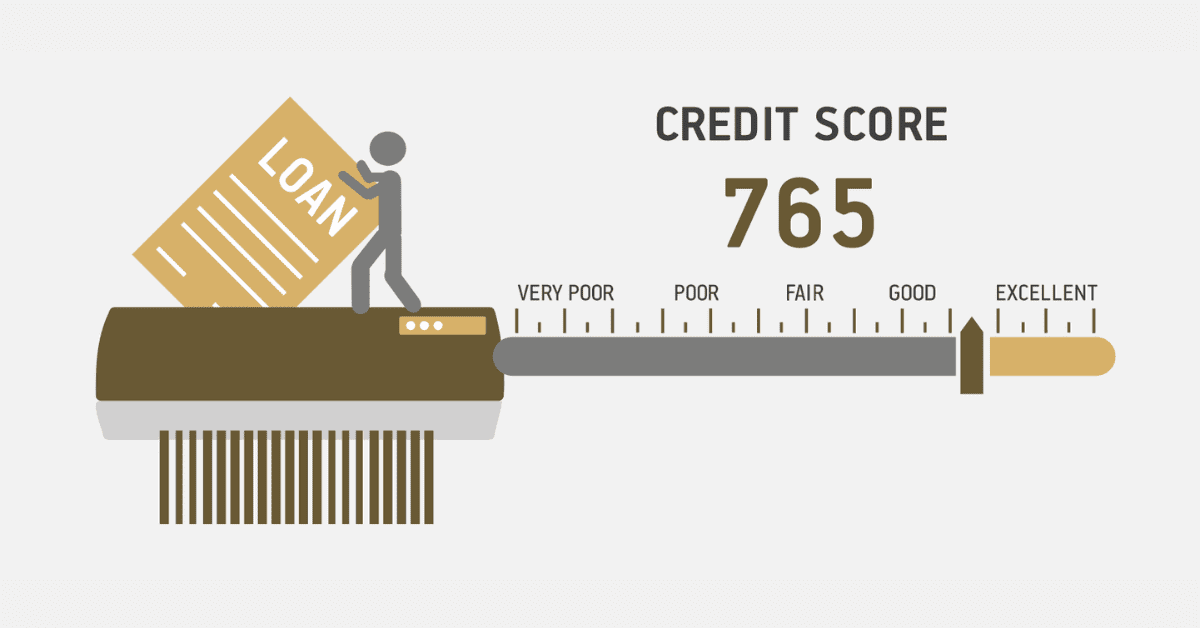

What’s A Good Credit Score For A Student?

A good loan rating for a learner in SA is any reading above 650. This reflects that one has a positive credit history with very low risks of defaulting on debt in the future. The credit bureau establishes a rating out of a few key factors surrounding your credit behavior: how your bill payment habits look, how much debt you have, and how often you apply for new credit. Credit scores range from 0 to 999 or 0 to 1200, depending on the bureau.