The South African Revenue Service’s long-term goal is to become a forward-thinking revenue and customs agency that promotes economic growth and social development while reducing the amount of administrative work taxpayers must do to comply with tax laws.

Through education, service, and enforcement, the SARS hopes to foster a culture of compliance. At the same time, the agency plans to leverage technology to improve its efficiency and efficacy.

The ability of SARS to identify taxpayers and keep track of their tax obligations is one reason why having a tax number is important. This helps ensure that everyone earning an income contributes their fair share toward building a better South Africa.

It also helps ensure that everyone earning an income contributes their fair share. Individuals and businesses must obtain a tax identification number before registering for tax obligations, submitting tax returns, or paying taxes.

Additionally, it is essential to complete specific tasks, such as opening a bank account or submitting a loan application.

In this article, we will learn something interesting about SARS and its taxation, how to get your SARS number, processing for tax and other related topics.

How do I apply for a sars tax number?

Getting a SARS tax number in South Africa is a simple and straightforward process. Here’s what you need to do:

- You must have certain documents ready before applying for a SARS tax number. These include an official copy of your driver’s license or passport, proof of where you live, and proof of your bank account information.

- You can fill out the tax registration form online at the SARS eFiling website or get a paper form from the SARS branch closest to you. You must give information about yourself on the form, such as your name, contact information, employment status, and income.

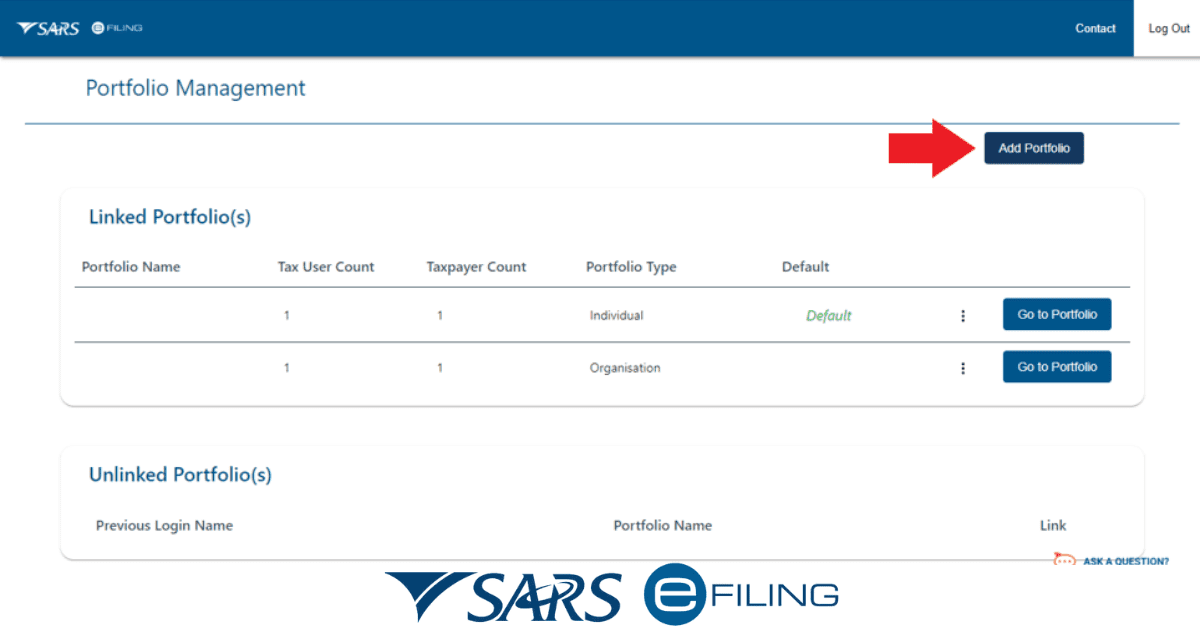

- Once you have filled out the registration form, you can submit it online through the SARS eFiling website or in person at a SARS branch. To submit the form online, create an eFiling profile and log in to your account.

- After you send in your registration form, SARS will let you know they received your application. Then, SARS will review your application and send you a tax number by email or text.

- You can register for eFiling if you want to file your tax returns online and use other SARS services. To do this, go to the SARS eFiling website and follow the steps for registering.

What documents do I need to get a tax number at SARS?

To obtain a tax number in South Africa from the South African Revenue Service (SARS), you typically need to provide the following documents:

- Your South African ID or passport

- Your proof of address (such as a utility bill or bank statement)

- Your banking details (such as a bank statement or cancelled cheque)

- Any relevant supporting documents related to your source of income (such as payslips, rental agreements, or business registration documents)

Does SARS number expire?

The reference number from the South African Revenue Service has no expiration date. Once it has been issued, it does not change throughout the taxpayer’s lifetime. On the other hand, it is possible for it to become dormant if the taxpayer does not submit a tax return for an extended period of time. (that is, if they pass away)

How long does it take to get a tax number from SARS?

The South African Revenue Service (SARS) tax identification number application process can take minutes to weeks. If you apply for a tax ID number by mail, it may take up to 21 business days to arrive; applying in person at a SARS office may take up to 48 hours.

How can I get my tax number without eFiling?

Without eFiling, you can get a tax ID in South Africa by visiting your local South African Revenue Service (SARS) office. Visit the SARS website for a complete directory of locations.

Your application will be handled by the nearest SARS employee, who can issue you a tax identification number.

Can I be taxed without a tax number?

No one can be taxed in South Africa without obtaining a tax identification number. Tax numbers are issued by the South African Revenue Service and are required for filing taxes in that country. (SARS). A tax identification number (TIN) is a number used for tax reporting and other administrative purposes.