Having your bank details linked to your SARS eFiling not only helps the revenue service ensure you remain tax compliant but also makes it easier for you to authorize payments through the platform. Maintaining your bank details is critically important, so you will want to ensure the details reflect correctly on their side. Here’s everything you need to know to activate and maintain bank details on eFiling.

How Do I Activate my Bank Details on eFiling?

In order to prevent fraudulent changes to your eFiling profile, any activation or change of banking details with SARS, whether through eFIling or other channels, will require verification. Do not expect a newly changed or activated bank account to immediately allow transactions. On the eFiling system, this activation or update is done through the RAV01 form within the eFiling interface.

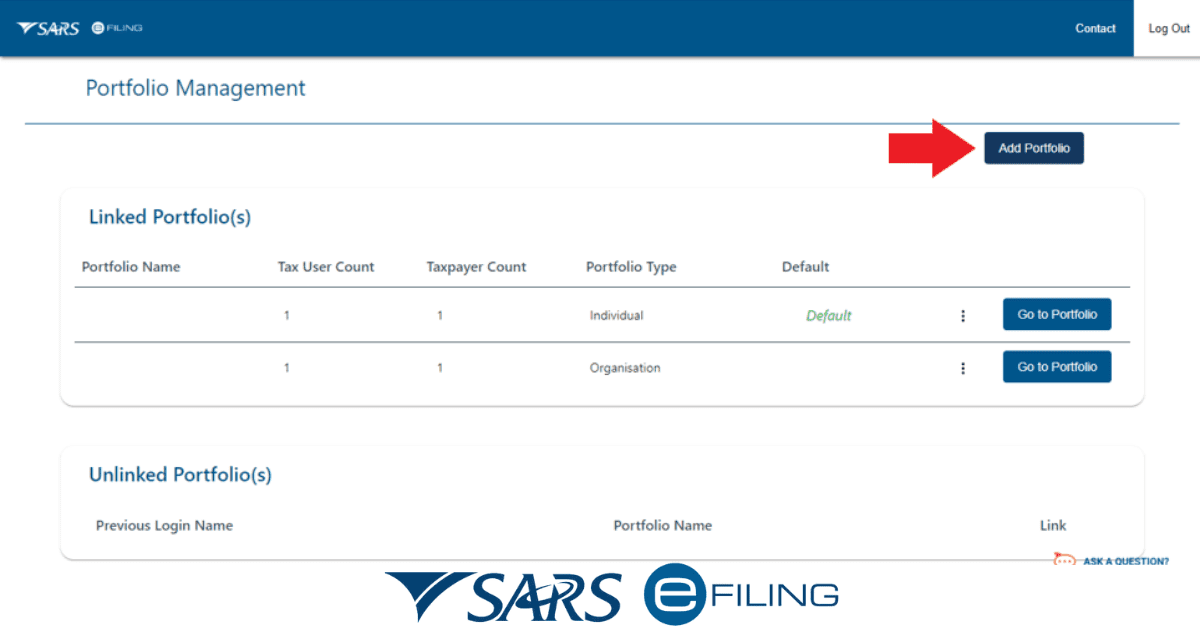

To activate a new bank account, do the following:

- Go to ‘My Registered Particulars” in the left side menu, and select “My bank accounts”

- Select ‘Add a New Bank Account”

- Walk through the on-screen prompts to enter your bank account details

- If you are prompted to upload documents at the time, add them to the on-screen prompt

This will capture your account details for SARS, pending verification. If you are not asked to upload documents at the time, you may find a prompt in the ‘Sars Correspondence” section later to enable you to upload documents. Remember all tax types need a bank account assigned for you to file online.

Once your bank details have been activated on eFiling, you will be able to receive payments from SARS directly to your bank account and initiate push payment if you wish to pay this way. You can update your bank details at any time by following the same steps and entering your updated information. It’s important to keep your bank details up to date to ensure that you receive any payments from SARS in a timely and efficient manner.

What do I Need to Update my Banking Details at SARS?

To update your banking details at SARS, you will need the following information:

- Your bank account number

- Your branch code

- Proof of bank account ownership (such as a recent bank statement or a stamped proof from the bank)

- You can typically generate these proofs within your SA bank account app or internet banking profile, it does not always need a branch visit.

- A Copy of your ID document

- An image of you holding the ID type

- Proof of residence may be requested

- If you hold a joint account, you will need the same documents for the spouse/other person

You can update your banking details by visiting a SARS branch, submitting a request in writing, or by using the eFiling system. If you choose to update your banking details online using eFiling, you can follow the steps outlined in the previous section to activate your bank details on eFiling.

Can I Update my SARS Banking Details Online?

You can update your SARS Banking Details online, but again, they will need to verify the changes to ensure no fraud is taking place on your account.

Follow the steps we outlined in the ‘Activate your Bank Account’ section. You will see there is an option to add a new bank account here (on the online RAV01 form). Enter the new banking details and upload documents (if prompted). They will send an OTP (one-time pin) to the email or cell phone on the system as part of this process, so have them ready.

If your old banking details are the only bank account active on the system, you will need to wait until your new banking details are verified before you can delete the old information or amend tax types with the new banking details.

How do I Upload my Bank Statement on SARS eFiling?

Typically, you will be prompted to upload your bank statement and other supporting documents on eFiling when you add or change your banking details. It is also possible you will receive correspondence from SARS ( in the ‘SARS Correspondence” section of your eFiling profile) which will link you to the correct section to digitally upload documents. Make sure that the picture you take with your ID is clear and follows their standards to avoid problems later.

It’s important to keep your bank details up to date with SARS to ensure that any refunds or payments due to you are paid into the correct bank account and to remain tax compliant. If you need help with updating your bank details, you can contact the SARS Call Centre at 0800 00 7277 for further assistance. Remember, they will not take telephonic or email requests to change bank details to prevent fraudulent changes on your account. Should you need to visit a branch for any reason, be sure to take the required proofs and documents with you to ensure a smooth process.