Many people find tax season stressful, but fortunately, the South African Revenue Service (SARS) has implemented auto assessment to make the process easier. Many taxpayers, however, still need to learn how to accept their auto assessment and what it all means due to this new function.

This article will provide all the details you need about this new system and a step-by-step walkthrough on accepting your SARS auto assessment. Thus, let’s get started and learn everything there is to know about SARS auto assessment!

Should I accept auto-assessment?

It’s important to carefully review your auto-assessment before accepting it. While it may seem convenient to accept it without going through the hassle of submitting your tax return, you run the risk of missing out on deductions and credits that you’re entitled to, resulting in you paying more tax than you need.

Take the time to double-check that all your tax certificates have been received and are up-to-date. Remember to consider additional expenses such as wear and tear, donations to charities, travel expenses, home office, and medical expenses that you paid personally. These deductions won’t appear on your auto-assessment, but they could significantly affect the tax you’re required to pay.

Suppose you’re unsatisfied with your auto-assessment or have any questions about it. In that case, you can access your tax return via eFiling or SARS MobiApp, complete the return, and file it within 40 business days from the date that SARS issued your assessment. This step allows you to correct errors or omissions and claim all the deductions and credits you’re entitled to.

How do I accept my SARS auto assessment?

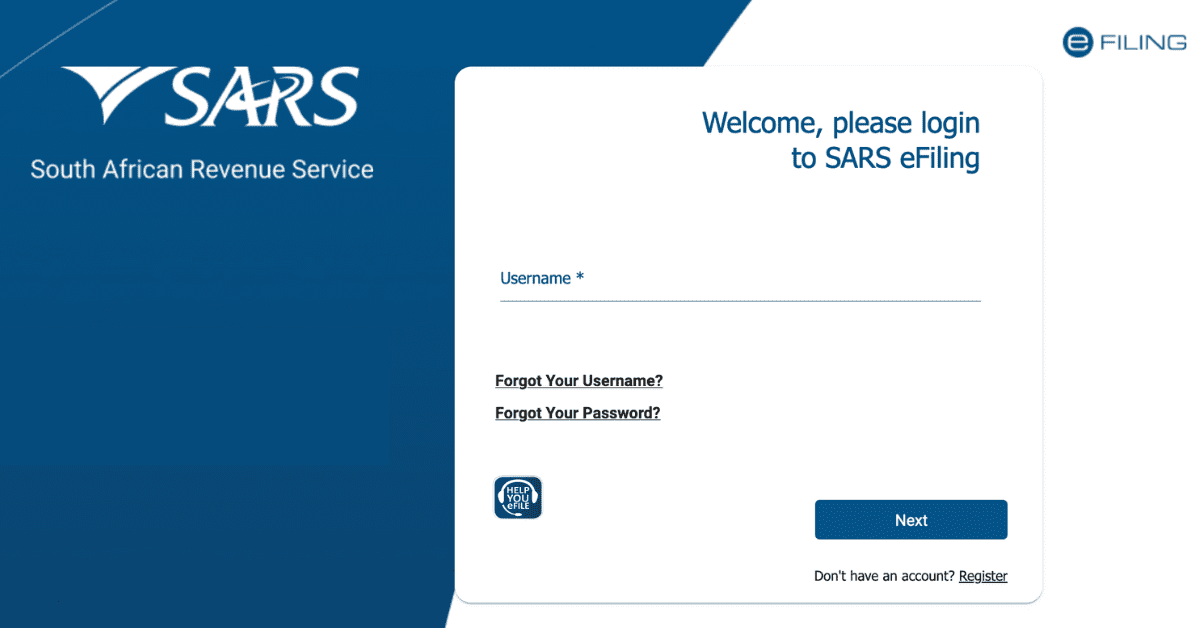

Accepting your SARS auto assessment is a straightforward process, and you can do it online via eFiling or the SARS MobiApp. The first step is to log in to either platform and view your assessment, displaying all the data used to calculate it. If you agree with the assessment and a refund is due to you, you don’t need to do anything else.

You can log out and wait for your refund, which should arrive within approximately 72 hours, provided your banking details with SARS are correct. However, if you owe SARS, you must pay via eFiling or the SARS MobiApp. If you don’t agree with the assessment, you can access your tax return, complete it, and file it within 40 business days from the date that SARS issued your assessment.

How do I accept SARS returns on eFiling?

It’s easy to accept SARS refunds via eFiling. You will receive notice through SMS and email once SARS has processed your return that your assessment is now accessible via eFiling

You can view and approve your evaluation here. If you disagree with it, you can either lodge a challenge or choose to accept the assessment. Simply click the “Accept” option if you accept the assessment.

After accepting your assessment, you can pay SARS or get your refund (if applicable) (if you owe tax). Ensure your profile’s banking information is accurate and current to get your refund. You can use eFiling or the SARS MobiApp to pay any taxes you owe.

It’s crucial to remember that you have 40 business days to contest an assessment or, if you still need to, submit a return. If you don’t meet this deadline, SARS may file a lawsuit to recoup any unpaid fees.

What does it mean when SARS says you have been auto-assessed?

If you receive notification from SARS that you have been auto-assessed, your tax assessment was determined using data from several sources. Using this procedure, they hope to streamline the tax return-filing process. Without you contributing any information, they utilize what they have to determine your tax liability and then send you a copy to approve or reject.

However, remember that the auto-assessment may only account for some of your tax information, especially if you have additional expenses or deductions that SARS didn’t feature in the data they obtained. In this scenario, you may need to file your tax return to claim all the credits and deductions for which you are eligible.

You can take no further action if you obtain an automated evaluation and agree with its findings. You may file a return manually if the assessment is incorrect or doesn’t contain your tax information.

Conclusion

In conclusion, accepting an auto assessment from SARS may seem like the easy way out, but it can come with risks. It’s always a good idea to carefully review your assessment and ensure that all the information is correct. If you disagree with the assessment, filing a return and making corrections to avoid potential penalties is important. With eFiling and the SARS MobiApp, accepting or rejecting an auto assessment is a straightforward process, and SARS provides various channels for you to make changes to your assessment. Always take the time to double-check your tax information and make sure you are paying the correct amount of tax.