When you find yourself as an amateur in the financial space, it becomes problematic to understand the concept of credit score. The financial landscape in South Africa is inclined to credit score, whether business or individual.

These problems of credit score can arise when you have very little knowledge about credit scores.

The whole idea of credit scores is to control purchasing behaviours, reduce printed notes in the system, measure the creditworthiness of people and many more.

These are systems designed by banks, government and credit bureaus to monitor people’s way of spending money. Certainly, your money is your money, but have you thought about the benefits that people can derive from credit scores?

There are so many financial opportunities available for people who are diligent and disciplined with their finances.

But what happens when you know knowing about how a credit score is created? Well, in this blog post, we will give you a deeper insight into how a credit score is created.

To ascertain the information, you will be informed about how you can determine your credit score, what affects your credit score, what generates your credit score and many more.

How is your credit score created?

The creation of a credit score does not just pop up in your name. Credit scores are numbers that represent the financial plans of an individual.

These numbers read a lot of meaning into your financial demeanour.

Upon signing up to get a credit card, your details are captured in the credit bureau. The information you provide at the point of creation is null and void until a transaction is made.

Although your credit score does not start from 0 but rather 300, it is the minimum number you can have on your credit score.

Upon depositing and continuous transactions your credit score starts changing based on your financial behaviour. Once the figures have been reported in your credit history, your credit score creation has been completed.

How Is Your Credit Score Determined?

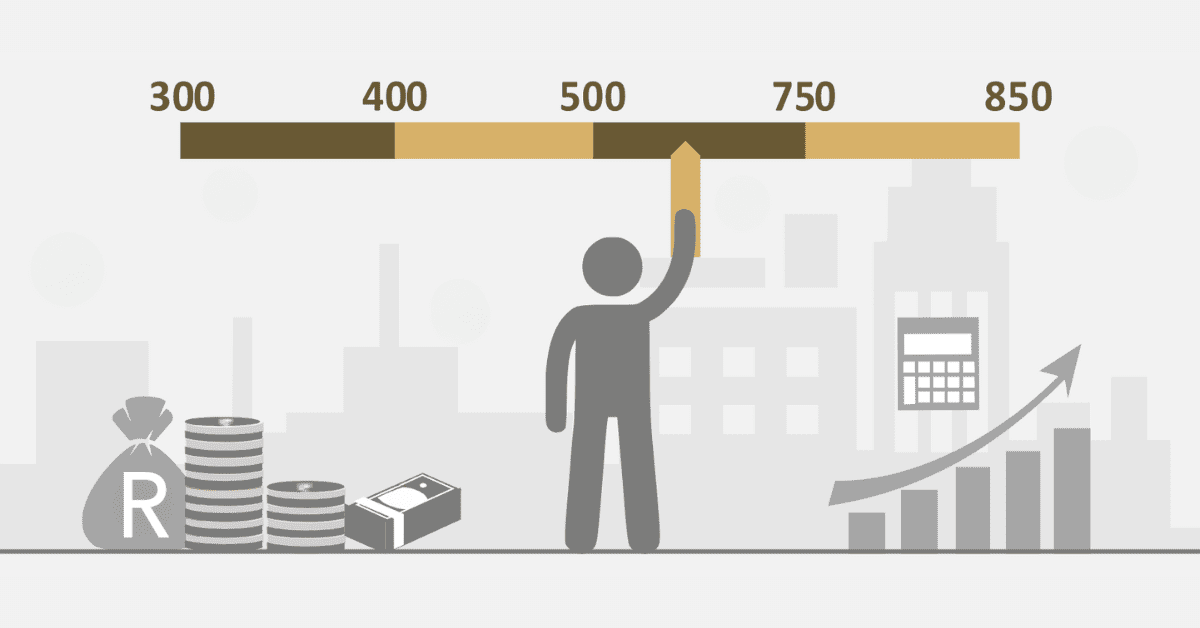

Credit scores, which are numbers that show how creditworthy you are, tell lenders whether you can get good rates and terms on loans. Consumer credit scoring algorithms, such as FICO and others, look at credit report information to come up with numbers between 300 and 850.

Your payment history is the most important part of your credit score. Your score goes down if you are late on payments, especially ones that are over 30 days past due. If you file for bankruptcy, it can hurt your credit score for up to seven years.

Credit scoring models focus on the ratio of credit spending by taking into account the amounts that are due. When you compare present balances to credit limits, you should get a number that is less than 30%. Credit scores go up when utilization rates go down, so paying down debt or raising credit limits can help.

Scoring models look at how old your oldest and newest accounts are, as well as the average age of all your accounts. Good credit handling can raise your credit score.

If you have recently opened a new credit account or done a lot of hard credit inquiries for new applications, this could affect your credit score. Scoring models know that loan shopping can lead to a lot of questions in a short amount of time, so they may remove duplicates to make them less important.

Last but not least, having both open credit cards and instalment credit accounts can help your credit score. Different scoring systems may give you slightly different results, but keeping an eye on your credit score can help you keep track of your finances and find ways to make them better.

In the end, understanding what affects your credit score will help you handle your money wisely, build a good credit history, and keep your score high. Checking your credit score can help you be more responsible with your money.

What Affects Your Credit Scores?

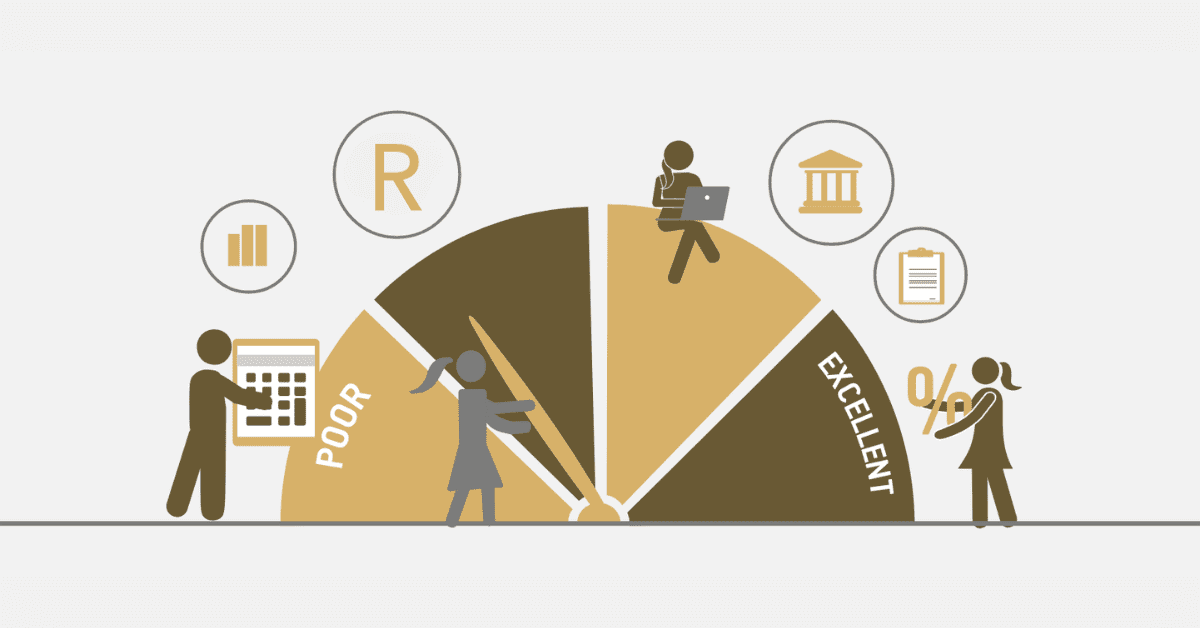

Your credit score could be affected negatively and positively. Mostly most people underrate the credit score system.

The last act which might be seen in the eyes of many negatively affects your credit score especially when you have no idea.

No one is ready to commit to a “negative” score as this can harm your credit score. It takes so many years to get an excellent credit score.

Several factors can impact credit scores. Factors that can have a positive impact on your credit score include making payments on time, keeping your credit card balances low, and having a variety of different types of credit.

Scores are adversely affected by late payments, high credit utilization, and accounts in collections. Additional factors to consider are the duration of credit history, recent credit applications, and the variety of credit being utilized. It is essential to find a middle ground between using credit responsibly and ensuring a strong payment history to maintain a positive credit score. It is important to consistently keep an eye on your credit report and take immediate action to resolve any discrepancies. This will contribute to maintaining a strong credit profile.

What generates your credit score?

Simply put your payment habit generally generates your credit score. For example, if you find yourself paying for some items worth $500 with a 6-month plan of at least $95 at the end of every month; you are expected to pay the required amount and also on time.

These acts contribute to credit score generation. In the case where you missed your payment, a score is generated. Whether you get more points or lose some points, you have to know the credit score generations work over time and factor in your financial behaviour.

Why is my credit score going down when I pay on time?

There are a lot of scenarios that could be built for having your credit drop even when you are paying on time.

There are possible ways this could happen and it becomes your responsibility to look into your credit card every month.

Some of these are using a lot of credit, applying for new credit, closing old accounts, having mistakes on your credit record, or economic factors that affect a lot of consumers. Late payments can also hurt your score, even if they do not happen very often. Keeping an eye on your credit record, being smart about your debt, and fixing mistakes can help you raise and keep your credit score.

In your credit report, someone else’s credit behaviour may be shown as yours at times. Check your credit record to see if someone is using your credit card or applying for new credit in your name if your credit score keeps going down even though you pay your bills on time.