When it comes to credit scores, there are a few important factors that influence how creditworthy an individual is considered to be. Some of the factors that are taken into consideration include the individual’s payment history, how much credit they are utilising, and the length of their credit history. By understanding how these factors impact your credit score, you can make well-informed decisions and take appropriate actions to enhance your financial position.

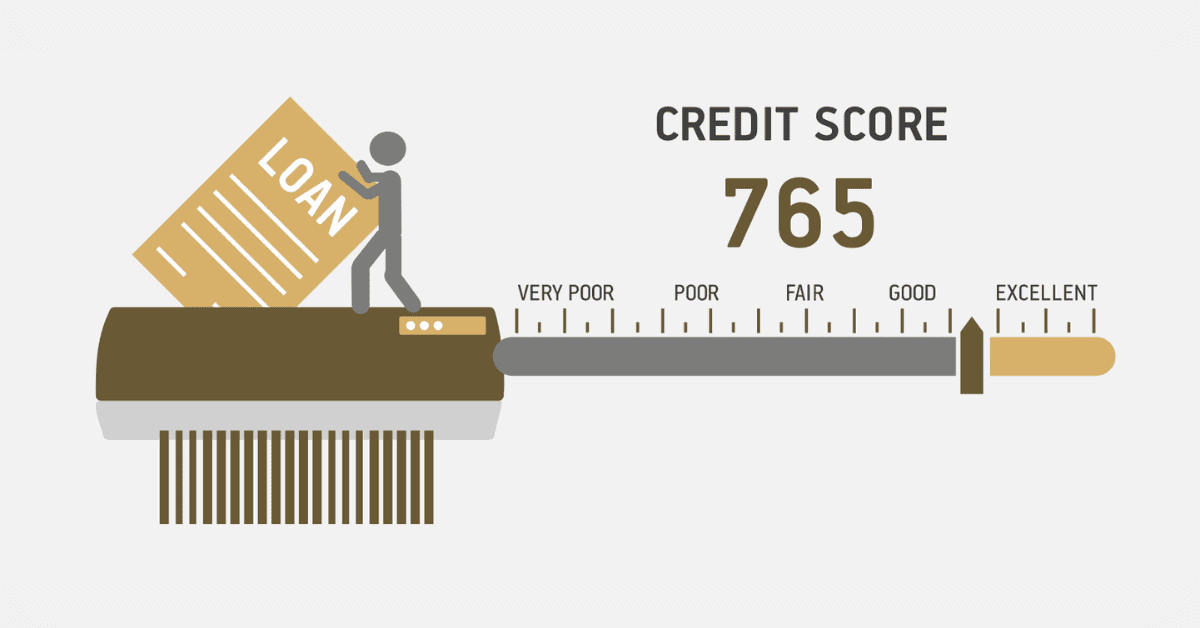

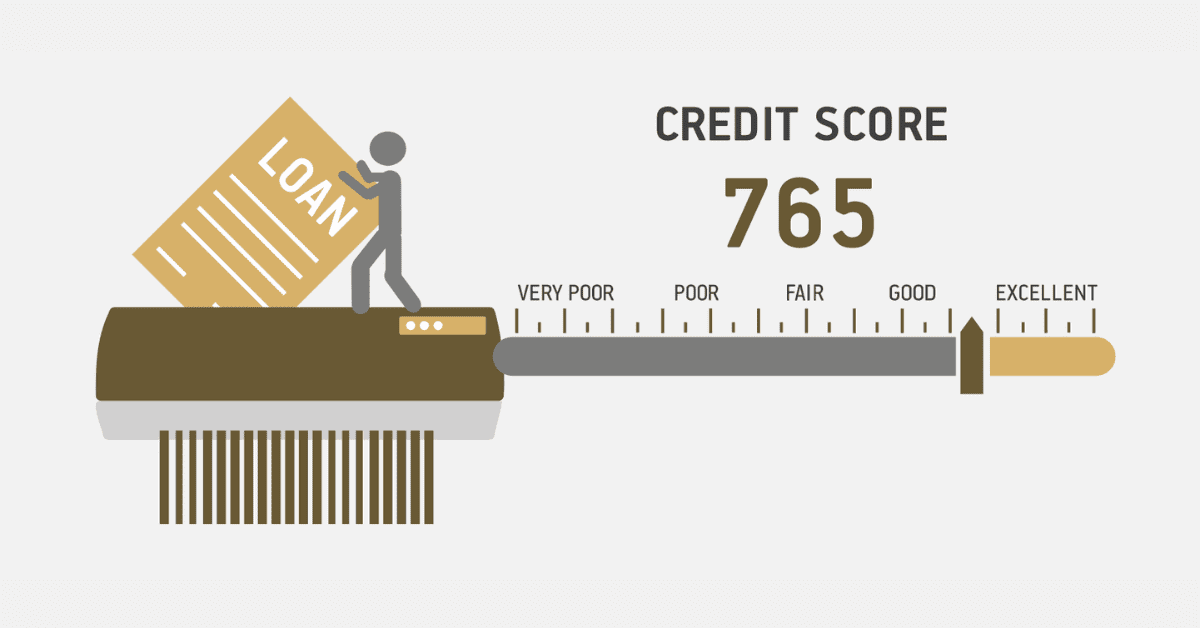

Lenders and financial institutions place significant importance on credit scores when evaluating a person’s creditworthiness. A higher credit score indicates that you have a solid credit history, manage your finances responsibly, and are less likely to miss loan payments or fail to pay off your credit card bills. However, individual’s credit scores are extremely important when it comes to determining their financial opportunities

If you are looking to understand more about credit scores, the first step is to indicate the various input that makes up a credit score. With these clues, you should be able to understand how the credit score is calculated.

How is credit score calculated in South Africa?

The credit bureau calculates your credit score using the information in your credit report. When evaluating your creditworthiness, lenders take into account various factors such as your bill payment history, level of debt, and most importantly, how these factors compare to those of other individuals with active credit.

Every bureau has its own unique method of calculating your score, considering various types of information, such as the data they already have about you or your employment situation.

While your credit score holds significant importance, it is essential to remember that it is just one aspect of your credit report. Your credit report provides valuable information beyond your score, making it a useful resource. A credit report is a comprehensive summary of your financial history, including details about your credit score, financial accounts, profile, and rating.

Your overall credit score consists of various categories. Your credit score is determined by assigning a specific percentage to each category. Determining the precise weight assigned to each category in calculating your overall credit score can be challenging since each credit bureau employs its own methodology and criteria.

The breakdown provided below will give you a clear understanding of the areas you should focus on in order to improve your credit score.

- Your payment history accounts for 35% of your overall credit score. The payment history category is likely the most crucial one. About 35% of your credit score is determined by it. Making payments on time can significantly improve your credit score. Lenders are interested in knowing whether or not you make timely payments.

- This particular category accounts for approximately 30% of your overall credit score. It calculates the amount of debt that you utilise. You have a predetermined amount of debt at your disposal, and this category indicates the extent to which you utilise it.

- Imagine that you possess a credit card, for example. To achieve a high score in this category, it is recommended to utilise less than 30% of the total credit limit on your credit card. This principle applies to all of your other accounts and credit cards too.

- The length of your credit history accounts for 15% of your overall credit score. Your credit score also considers the age of your credit report. It plays a role in determining approximately 15% of your overall credit score. Lenders prefer to observe your consistency and reliability over an extended duration. Older credit reports are generally trusted more by lenders. Whether the score is considered good or bad, having an older record can assist in predicting future patterns.

- Lenders are interested in knowing whether you have recently applied for any credit. This category makes up approximately 10% of your overall credit score. When customers frequently apply for credit, lenders perceive them as being risky. If you avoid applying for additional credit frequently, it will increase your chances of scoring points here.

- The credit mix makes up 10% of your overall credit score. Your credit mix refers to the various types of debt you have in your name. This particular category makes up approximately 10% of your overall credit score. Lenders are interested in understanding your ability to handle multiple types of credit simultaneously. If you have a greater variety of credit, you can earn more points in this regard. Below is a brief list of the various types of accounts and credits that fall under this category.

How is your first credit score calculated?

When it comes to credit scores, every individual has a unique starting point. Credit scores are not the same for everyone. They are individualised and change over time based on a person’s financial history and behaviour. This implies that your credit score is not fixed or manipulated, but rather it evolves gradually as a result of your financial choices and behaviours. Maintaining a credit history is a crucial part of effectively managing your finances and attaining long-term financial stability.

Usually, this data is utilised to determine your credit score, which is a numerical indicator of your creditworthiness.

What is a normal credit score in SA?

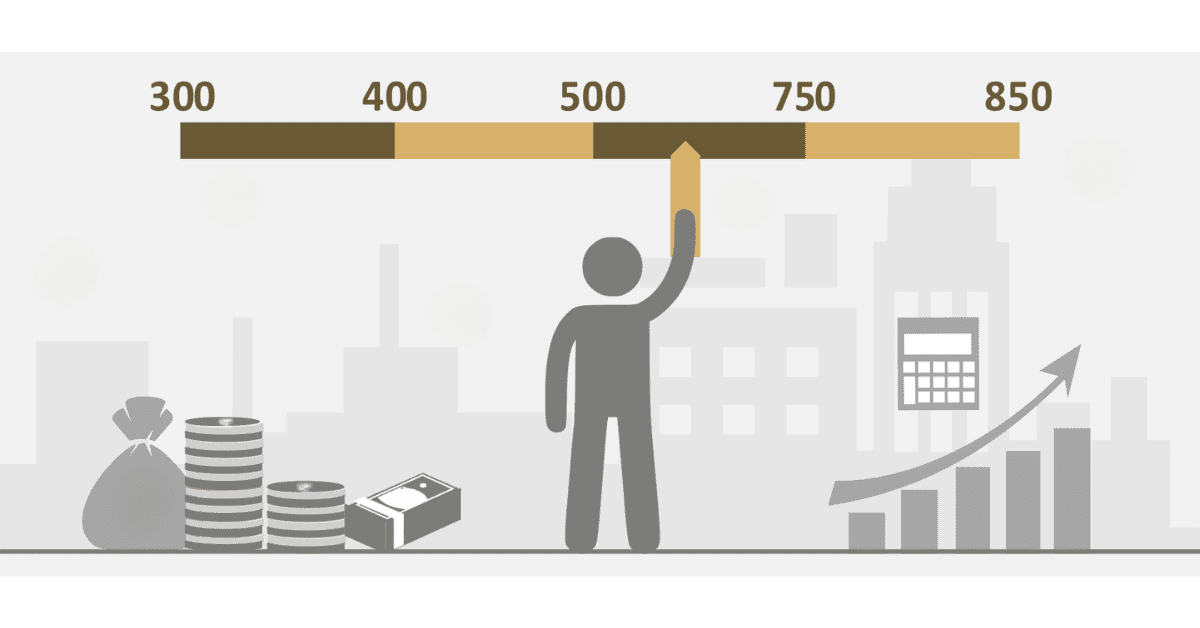

A normal credit in South Africa may be considered as a fair credit score. Based on the categorisation of the credit score. a fair credit score precedes a poor credit score. If you have a normal credit it is considered to be between 670 – 739.

What is the lowest credit score to buy a house?

When it comes to buying a house, lenders take your credit score into account as one of the important factors. The three-digit number, which falls between 300 and 850, gives lenders an idea of your creditworthiness and how likely you are to repay your loan. Although there is no specific credit score that is mandatory to purchase a house, it is generally recommended to have a credit score between 500 and 700.

What does a zero credit score mean?

It is not possible to have a zero credit score. The minimum set standard for a credit score is 300. Should you have a zero credit score it simply means your bank and credit bureaus do not have enough credit information on your account.